Bitcoin is in focus, especially now that the broader market is in the red and some sectors, mostly meme coins, are sliding. Even as BTC comes under immense selling pressure, on-chain data points to strength.

Over 1 Million Bitcoin Wholecoiners

While the price struggles for traction, the number of wholecoiners, or addresses with at least 1BTC, is trending higher, currently at record highs. Data from IntoTheBlock shows that over 1 million unique addresses are now holding more than one BTC.

This spike is a huge milestone that underscores the growing number of individuals aiming for the wholecoiner status. Of importance, however, it means that more people are net bullish on the coin and willing to accumulate it and become wholecoiners.

At press time, Bitcoin remains choppy, though the overall trend from a top-down preview is bullish. As it is, BTC is being influenced by a range of fundamental factors. Most of them include the current economic uncertainty, with analysts closely monitoring data from the United States.

Although the United States Federal Reserve will slash interest rates this year, their decision to reduce it once this year, not twice or thrice as expected, is seen as bearish for BTC. Economists said the central bank would turn dovish, reversing its position from 2022 to 2023 by reducing interest rates from current record highs.

Since the last meeting earlier this month, BTC prices have been edging lower as the USD strengthens. The slide has been made worse by Mt. Gox trustees’ decision to compensate victims in July, not October as initially planned. At the same time, the German and United States governments have been unloading the coin.

BTC Remains Choppy, Over $265 Billion Must Be Injected For Prices To Break All-Time Highs

One analyst notes that if BTC continues to drop, bulls, most of whom are leveraged, will be liquidated should prices breach $60,000.

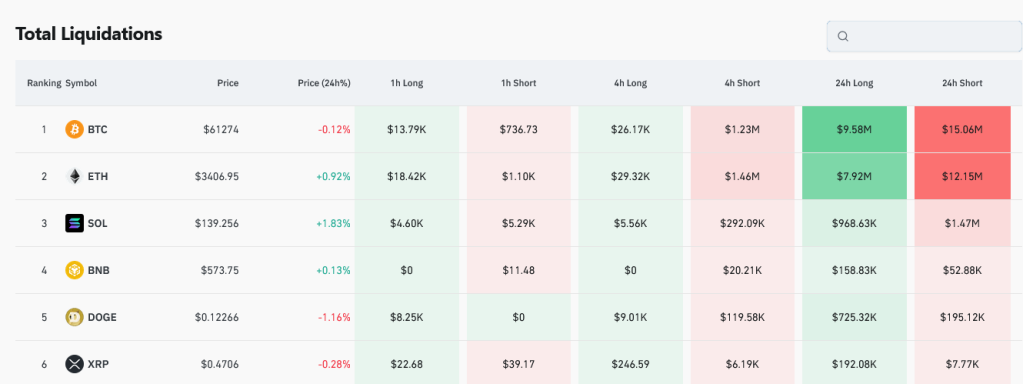

According to Coinglass, as of June 27, over $9.5 million worth of leveraged longs were liquidated in the past 24 hours. At the same time, more than $15 million of shorts were forcefully closed.

Whether the current sideways movement will continue in the short term remains to be seen. Technically, though prices are within a broad range, capped at around $74,000 on the upper end and $56,000 on the lower end, the uptrend remains. Taking to X, one analyst said that for BTC to surge and break $74,000, over $265 billion must be injected into the market.

Feature image from Canva, chart from TradingView

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC