The below is an excerpt from a recent edition of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

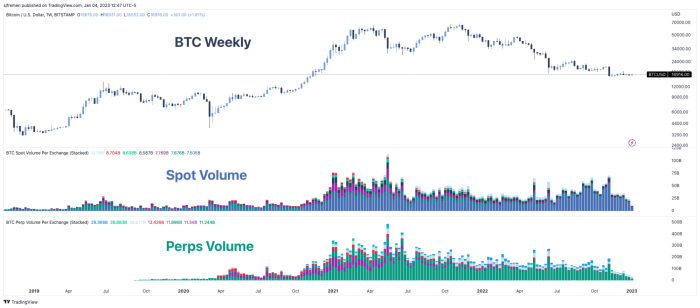

As we head into 2023, we want to highlight the latest state of bitcoin’s volume and volatility after a recent wave of capitulation. Last time we touched on these dynamics was in “The Bitcoin Ghost Town” in October, where we highlighted that an extremely low volume and low volatility period in bitcoin price, GBTC and the options market was a concerning sign for the next leg lower. This played out in early November.

Fast forward and the trends of declining volume and low volatility are back once again. Although this could be indicative of another leg lower to come in the market, it’s more likely indicative of a complacent and decimated market that few participants want to touch.

Even during the November 2021 capitulation period, there was a historically low period of volatility. Sometimes the most market pain can be felt when having to wait for a clear change in trends. The bitcoin price is providing that pain as we’ve yet to see the type of explosion in market volatility that has defined market pivots and major directional moves in the past.

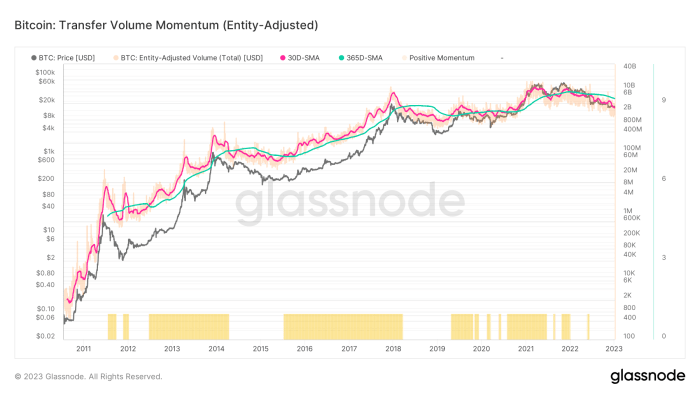

While there are many different ways to define, classify and estimate bitcoin volume in the market, they all show the same thing: September and November 2021 were the peak months of action. Since then, volume in both the spot and perpetual futures markets have been in steady decline.

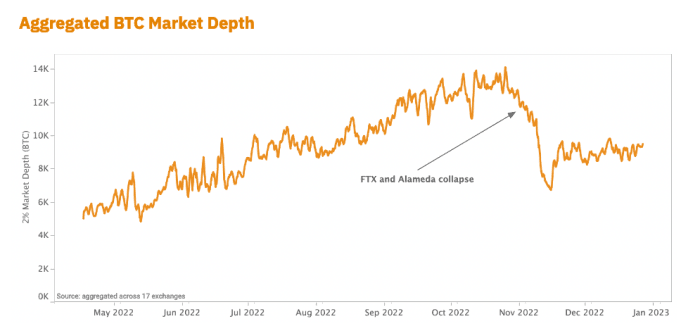

Overall market depth and liquidity has also taken a major hit after the collapse of FTX and Alameda. Their destruction has led to a large liquidity hole, which is yet to be filled due to the lack of market makers currently in the space.

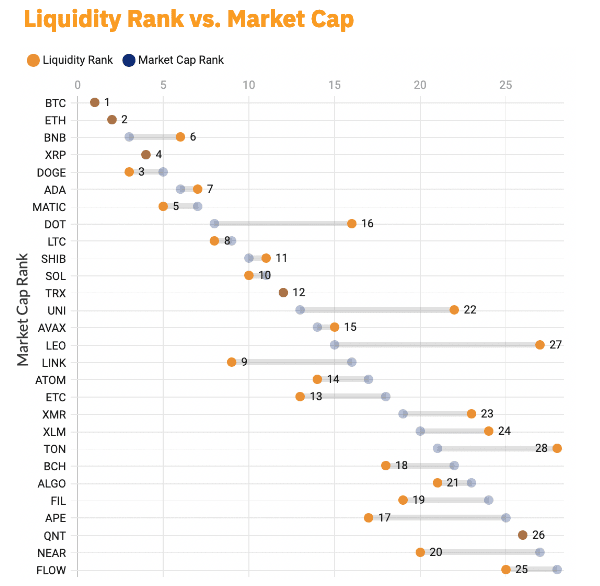

By far, bitcoin is still the most liquid market of any other cryptocurrency or “token,” but it’s still relatively illiquid compared to other capital markets since the whole industry has been crushed over the last few months. Lower market depth and liquidity means assets are prone to more volatile shocks as single, relatively large orders can have a greater impact on market price.

On-Chain Apathy

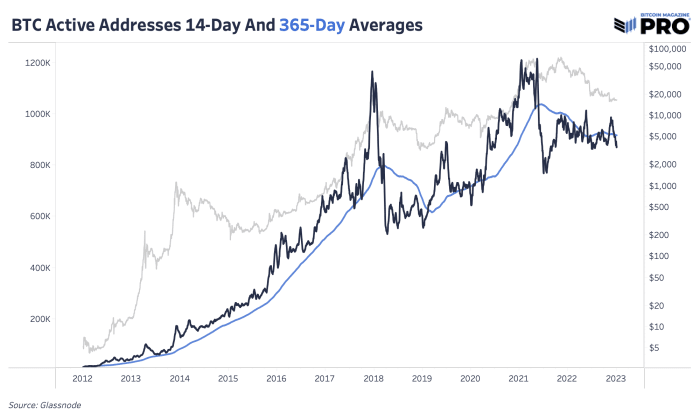

As expected in the current environment, we’re also seeing more market complacency when looking at on-chain data. Although continuing to rise over time, the number of active addresses — unique addresses active as either a sender or receiver — remain fairly stagnant over the last few months. The chart below highlights the 14-day moving average of active addresses falling below the running average over the last year. In previous bull market conditions, we’ve seen growth in active addresses outpace the existing trend fairly significantly.

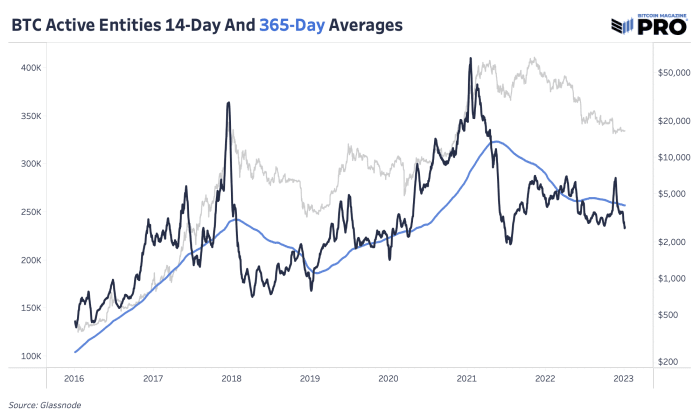

Since address data has its flaws, looking at Glassnode’s data for active entities shows us the same trend. Overall, bear markets reversing are the result of many factors, including growth in new users and an increase in on-chain activity.

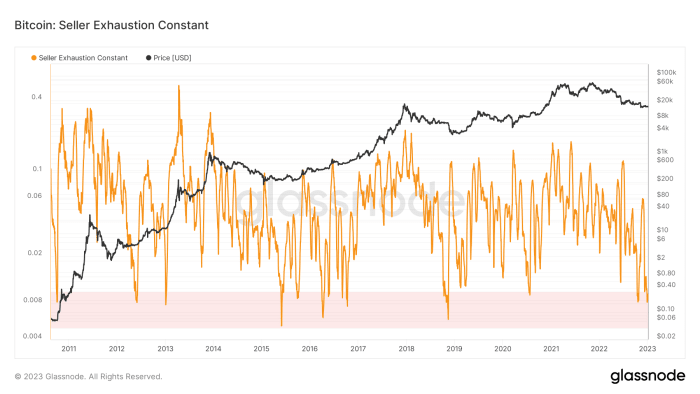

In our July 11 release “When Will The Bear Market End?”, we made the case that the brunt of the price-based capitulation had already been felt, while the real pain ahead was in the form of a time-based capitulation.

“A look at previous bitcoin bear market cycles shows two distinct phases of capitulation:

“The first is a price-based capitulation, through a series of sharp selloffs and liquidations, as the asset draws down anywhere from 70 to 90% below previous all-time-high levels.

“The second phase, and the one that is spoken of far less often, is the time-based capitulation, where the market finally begins to find an equilibrium of supply and demand in a deep trough.” — Bitcoin Magazine PRO

We believe time-based capitulation is where we stand today. While exchange rate pressures can certainly intensify over the short term — given the macroeconomic headwinds that remain — the conditions that look likely to persist over the short and medium term look to be a sustained period of chop with extremely low levels of volatility that leave both traders and HODLers questioning when volatility and exchange rate appreciation will return.

Like this content? Subscribe now to receive PRO articles directly in your inbox.

Relevant Past Articles:

Credit: Source link

Huobi BTC

Huobi BTC  Morpheus Network

Morpheus Network  Thales

Thales  ASSAI

ASSAI  Clayton

Clayton  WEMIX Dollar

WEMIX Dollar  MOE

MOE  Defi.money

Defi.money  Shido

Shido  Sei fastUSD

Sei fastUSD  Koto

Koto  Keep3rV1

Keep3rV1  Observer

Observer  zkExchange

zkExchange  Mettalex

Mettalex  888

888  Arthera

Arthera  Primate

Primate  cUNI

cUNI  Moontax

Moontax  Penpie

Penpie  StakeWise

StakeWise  gAInzy

gAInzy  QORPO WORLD

QORPO WORLD  stake.link

stake.link  Cerebrum DAO

Cerebrum DAO  Financie Token

Financie Token  imgnAI

imgnAI  Bucket Token

Bucket Token  dogi

dogi  Music by Virtuals

Music by Virtuals  Polaris Share

Polaris Share  Jesus Coin

Jesus Coin  Rally

Rally  GameGPT

GameGPT  Fren Pet

Fren Pet  Soil

Soil  Muse DAO

Muse DAO  Deep Worm

Deep Worm  Carbon Browser

Carbon Browser  LEOX

LEOX  Beeper Coin

Beeper Coin  VNX Swiss Franc

VNX Swiss Franc  EarnBet

EarnBet  King Protocol

King Protocol