Since bottoming at $17,700 on June 18, Bitcoin has been trading within a relatively tight band, with $25,100 marking the upper limit of this channel.

Although the past week or so saw BTC print six consecutive daily green closes, higher-than-expected CPI inflation data, released on September 13, ended the upward momentum. On that day, BTC swung 13% to the downside to bottom at $19,800.

Price uncertainty is the dominant narrative as macro pressures continue to weigh heavy on the market leader. According to the Options 25 Delta Skew and Options Volume Put/Call Ratio, this has played out as a willingness to go long, even on minor signs of price recovery. However, the overall sentiment is bearish.

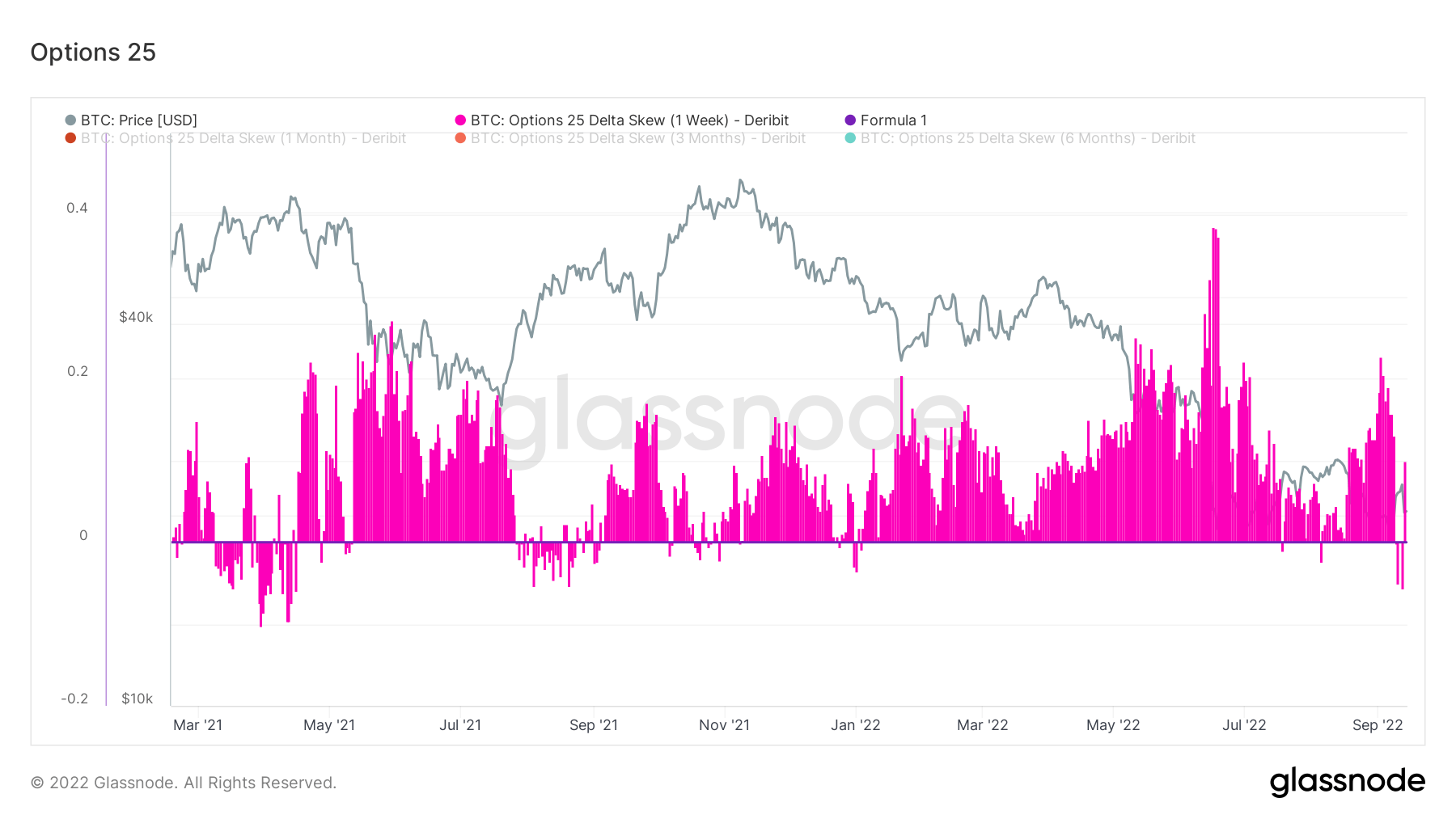

Options 25 Delta Skew

The Options 25 Delta Skew metric looks at the ratio of put vs. call options expressed in terms of Implied Volatility (IV). Puts being the right to sell a contract at a specific price and calls being the right to buy.

For options with a specific expiration date, 25 Delta Skew refers to puts with a delta of -25% and calls with a delta of +25%, netted off to arrive at a data point. In other words, this is a measure of the option’s price sensitivity given a change in the spot Bitcoin price.

The individual periods refer to option contracts expiring 1 week, 1 month, 3 months, and 6 months from now, respectively.

Below 0 indicates calls are pricer than puts. This situation has occurred only six times this year. During Bitcoin’s recent bottoming, traders scrambled for puts and then reverted to calls at the local top.

This changeable behavior can be explained by a long, drawn-out bear market prompting traders to react quickly, even on minor indications of price recovery.

In recent weeks, as Bitcoin flitted above and below $20,000, traders have struck for calls, to go long, on four occasions, only for the market to move against them. Consecutive back-to-back calls have not happened since the end of last year.

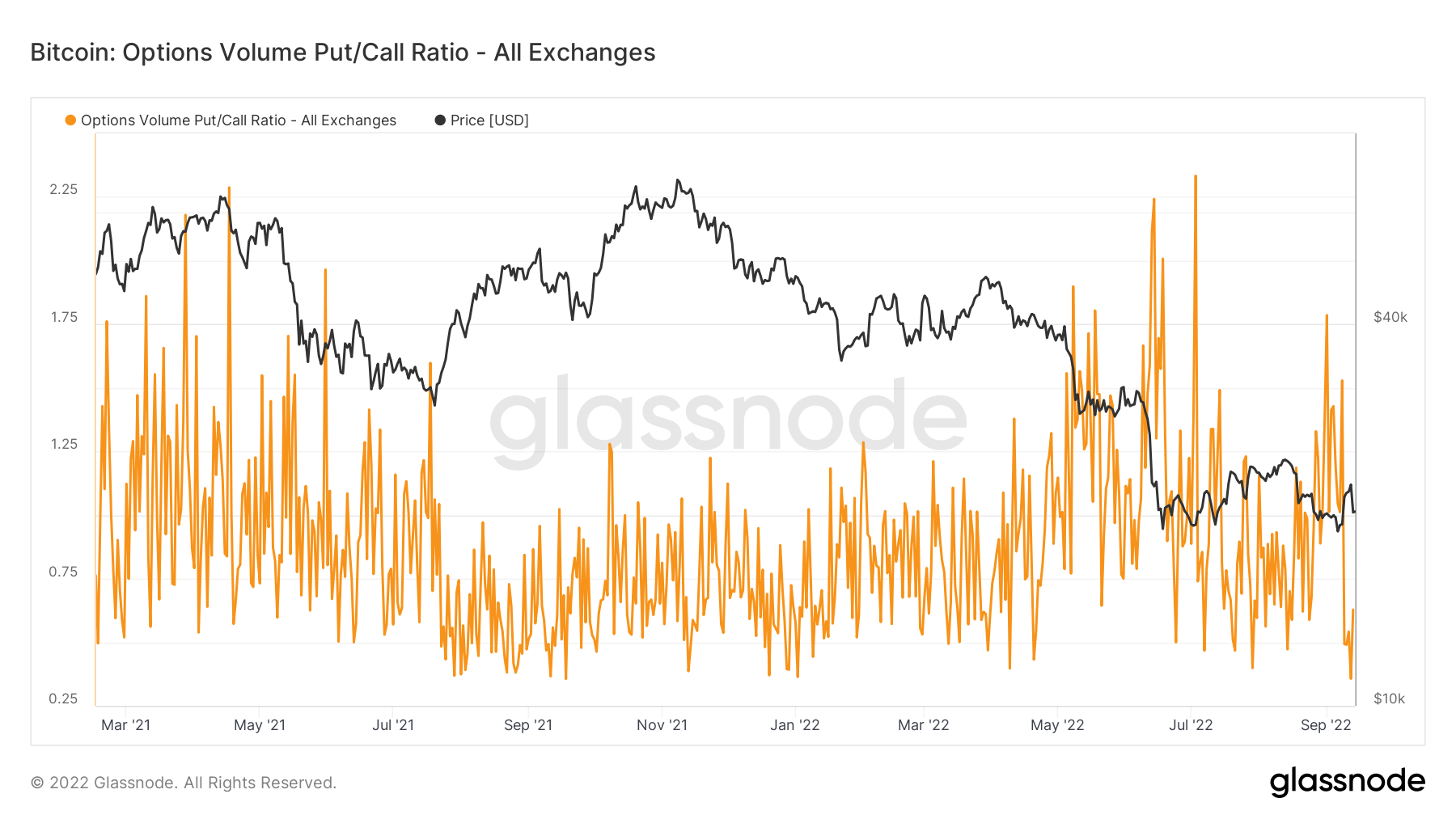

Options Volume Put/Call ratio

The Options Volume Put/Call Ratio shows the put volume divided by the call volume traded in options contracts in the last 24 hours. It is used to gauge the general mood of the market.

The chart below shows a heavy skew towards puts, as evidenced by sharp increases in the ratio during instances of price bottoming.

This suggests bearish sentiment is firmly embedded. But similar to the Options 25 Delta Skew data, traders will go long on signs of price recovery.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Toncoin

Toncoin  Sui

Sui  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Polkadot

Polkadot  Litecoin

Litecoin  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Official Trump

Official Trump  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Internet Computer

Internet Computer  Aptos

Aptos  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  OKB

OKB