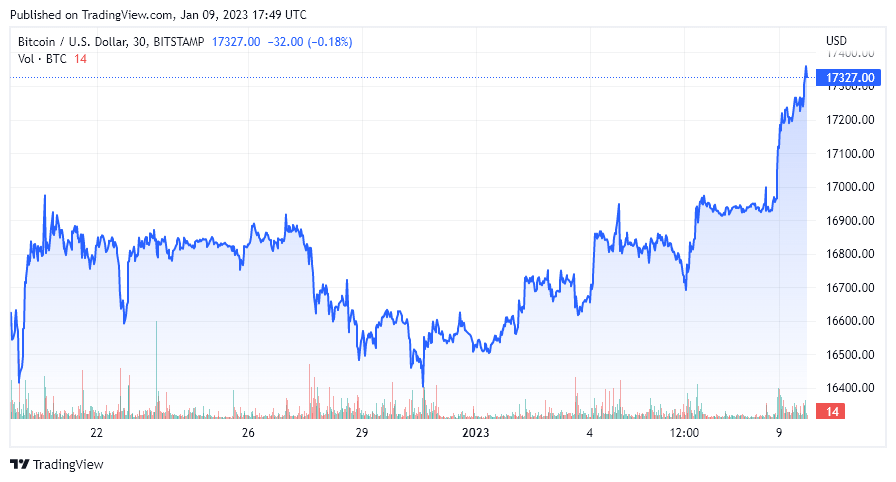

Crypto’s benchmark cryptocurrency, Bitcoin, has pushed past $17,000 for the first time in 2023 after being range bound for several weeks between $16,380 and $16,975.

Bitcoin has now been on a positive trend since the start of January when it opened the year at $16,482. Bitcoin is up 3.72% over the last seven days and 2.33% in the previous 24 hours, according to CryptoSlate data.

Why is Bitcoin pumping?

With a lack of significant on-chain developments within the Bitcoin ecosystem, the rally appears unlinked to any news related to the network. Further, noteworthy developments within the crypto space at large to which Bitcoin could react have been scarce.

However, as the dust begins to settle on the FTX news cycle, the use case for Bitcoin in self-custody is stronger than ever. A global financial crisis is looming with continually steep inflation, no end in sight for the war in Ukraine, and growing tensions between China and the West. In addition, the concern over which asset class will act as the best store of value in 2023 may be strengthening investors’ resolve in Bitcoin.

While Bitcoin acted as a risk-on asset throughout the majority of 2022, eyes now move to whether Bitcoin will repeat its strong performance when the Ukraine war started as we move further into 2023.

The next Bitcoin halving event is roughly 18 months away, so historical metrics suggest the bull market is not yet around the corner. However, plenty of investors have fled crypto after the tumultuous events of 2022. The collapse of major exchanges, projects, hedge funds, and lending platforms shook out plenty of investors while removing bad actors from the space.

Forbes recently discussed potential Bitcoin price predictions for 2023 with Alistair Milne, founder of Altana Digital Currency Fund, suggesting it could reach as high as $300,000 by 2024. Others had more conservative estimates predicting prices between $30,000 and $50,000, such as the Professor of Finance at Sussex University, Carol Alexander.

Eric Wall, the CIO of Arcane Assets, also stated the bottom is in for Bitcoin, and it will now race toward a $30,000 price target in 2023.

Potential bear trap

The biggest elephant in the room, however, is the fate of Digital Currency Group and, therefore, Genesis and the Grayscale Trust. A recent CryptoSlate market report showcased the predicament facing DCG and the potential havoc it could wreak on the crypto industry should it be forced to liquidate assets to avoid bankruptcy.

CryptoSlate is keeping a keen eye on developments at DCG as there have been no further updates following the Winklevoss Twin‘s ultimatum regarding Genesis Earn funds. The Winklevoss brothers set a deadline of Jan. 8 for DCG to respond to an open letter, a date which has now passed without a word.

The Forbes article mentioned above also highlighted several traditional finance companies that predicted Bitcoin would fall below $10,000 this year. Most notably, Eric Robertsen, the Global Head of Research for Standard Chartered, called for $5,000 as “crypto firms and exchanges find themselves with insufficient liquidity, leading to further bankruptcies and a collapse in investor confidence in digital assets.”

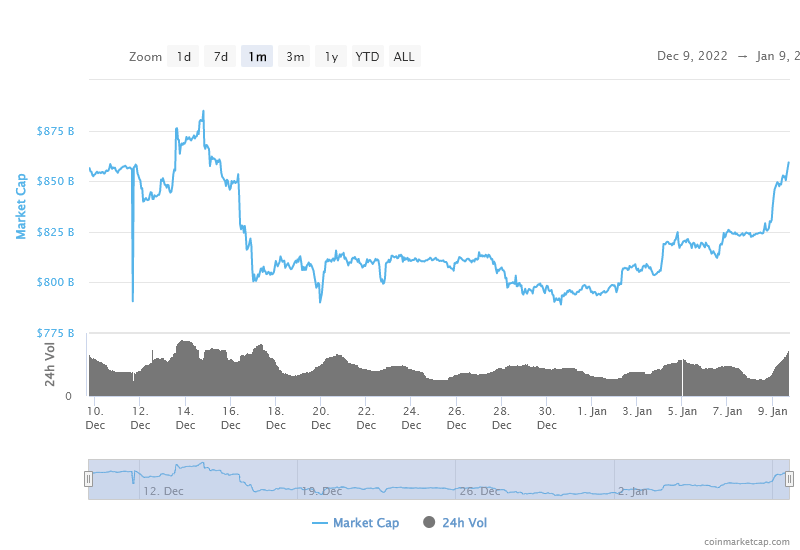

Yet, as the chart below indicates, the overall crypto market cap has been rallying since 2023. Over the past nine days, over $50 billion has been injected into the crypto markets. As we welcomed in the new year, the total market cap was $795 billion but has since hit $859 billion, according to CoinMarketCap.

The global crypto market cap with Bitcoin removed stood at $477 billion on Jan. 1. It has steadily grown to $525 billion, an increase of $58 billion. Thus, while Bitcoin is performing well in 2023, the broader crypto market is outperforming the flagship crypto network. Only $18 billion has been injected into Bitcoin, a mere 4.7% increase in market cap compared to the rest of the total market (minus Bitcoin), which rose by 10%.

Nothing has changed regarding Bitcoin’s fundamentals, and 2023 is set to be a year where either the FIAT system solves the inflation problem, or the events of 2008 come back to bite central banks harder than ever.

The FIAT problem

A world where the FIAT system is on its last legs is a world where Bitcoin has the potential to reign supreme. Time will tell whether the U.S. Federal Reserve, Bank of England, European Central Bank, and Bank of Japan can regain economic control.

While Bitcoin has remained flat before starting to rise in value, the Dollar has been downward since late September. The chart below shows the peak strength of the Dollar being reached on Sept. 22, 2022. Since then, it has fallen over 10%, roughly the same decline seen on the Bitcoin chart for the same period.

Bitcoin’s volatility has been at some of the lowest levels in its history between November and January, moving around 12% in both directions during the period.

Today’s price action in Bitcoin mirrors the Dollar’s poor performance over the last 24 hours. Since Jan. 6, the DXY has declined by 2.49%, while Bitcoin has risen by 2.9%. Of course, neither of these moves is unprecedented. However, should the DXY continue to fall throughout 2023, it could give Bitcoin the strength it needs to return to levels last seen before the bad actors caused a market-wide sell-off during 2022.

Bitcoin is clearly positioning itself as a flight from FIAT in a world where global currencies are potentially in serious jeopardy. Of course, there are multiple moving parts, some historically correlated and some not, but 2023 is undoubtedly set to be an interesting experiment in how Bitcoin performs amid further global economic uncertainty.

At the time of press, Bitcoin is ranked #1 by market cap and the BTC price is up 2.39% over the past 24 hours. BTC has a market capitalization of $333.95 billion with a 24-hour trading volume of $18.01 billion. Learn more ›

BTCUSD Chart by TradingView

Market summary

At the time of press, the global cryptocurrency market is valued at at $855.35 billion with a 24-hour volume of $46.14 billion. Bitcoin dominance is currently at 39.05%. Learn more ›

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  WETH

WETH  Polkadot

Polkadot  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC