Quick Take

A deep dive into Bitcoin’s issuance reveals a fascinating trend as the next Bitcoin halving event approaches.

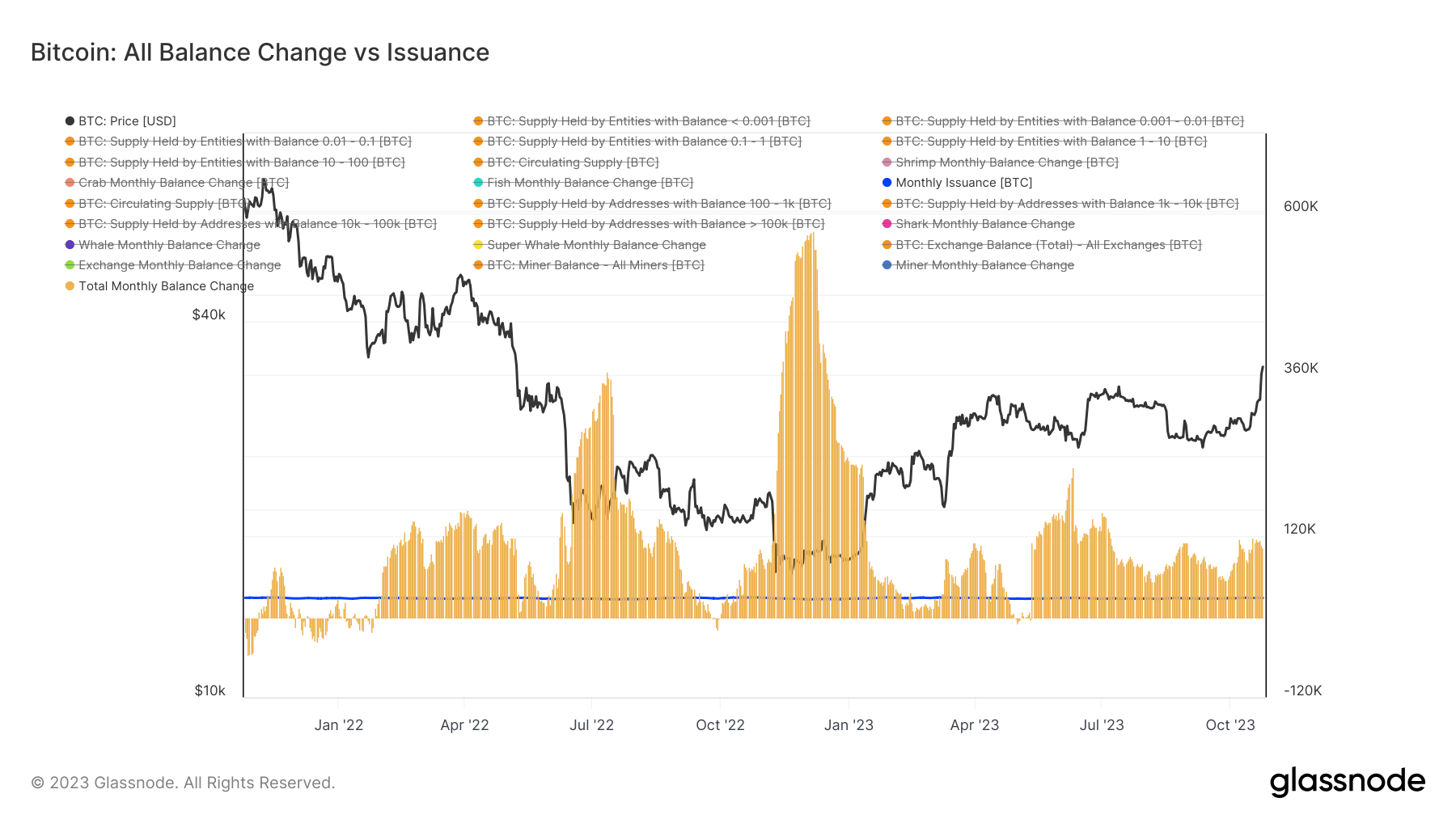

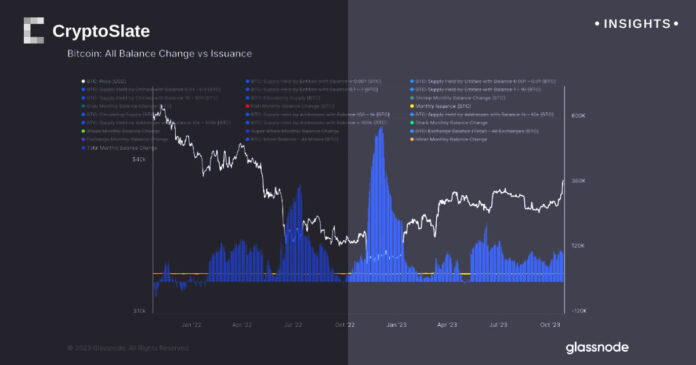

The current monthly issuance of Bitcoin stands at 27,000 BTC, calculated from 900 Bitcoin mined each day over 30 days. An analysis of various cohorts, along with exchanges and miners, unveils a significant absorption of this supply.

Indeed, the balance of the 27,000 BTC is being consumed overwhelmingly. The past month’s data shows ‘Shrimps’ accumulating 25,000 BTC and ‘Crabs’ by 2,265 BTC,

‘Fish’ decreased by 3,000 BTC, ‘Sharks’ by 37,000 BTC, ‘Whales’ by 18,800 BTC, and ‘Super Whales’ by 11,140 BTC.

Meanwhile, exchanges saw a balance decrease of 9,136 BTC, seen as a bullish sign, and miners increased their balance by 3,075 BTC. In total, these cohorts absorbed roughly 103,000 BTC.

With the impending halving event, the monthly Bitcoin supply will drop to 13,500 BTC. Assuming constant demand, this reduction in supply could trigger a bullish turn in the market—an event that may not yet be fully priced in.

The post Bitcoin supply absorption by various cohorts suggests impending halving event not fully priced in appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  WETH

WETH  Polkadot

Polkadot  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC