Bitcoin sets new transaction record with more than 568,300 processed in a single day, surpassing the previous peak during the 2017 bull run.

Data from Glassnode, the on-chain market intelligence platform, suggests this increase is in part due to the 307,000 Ordinals transactions that made up over 50% of bitcoin’s daily transactions.

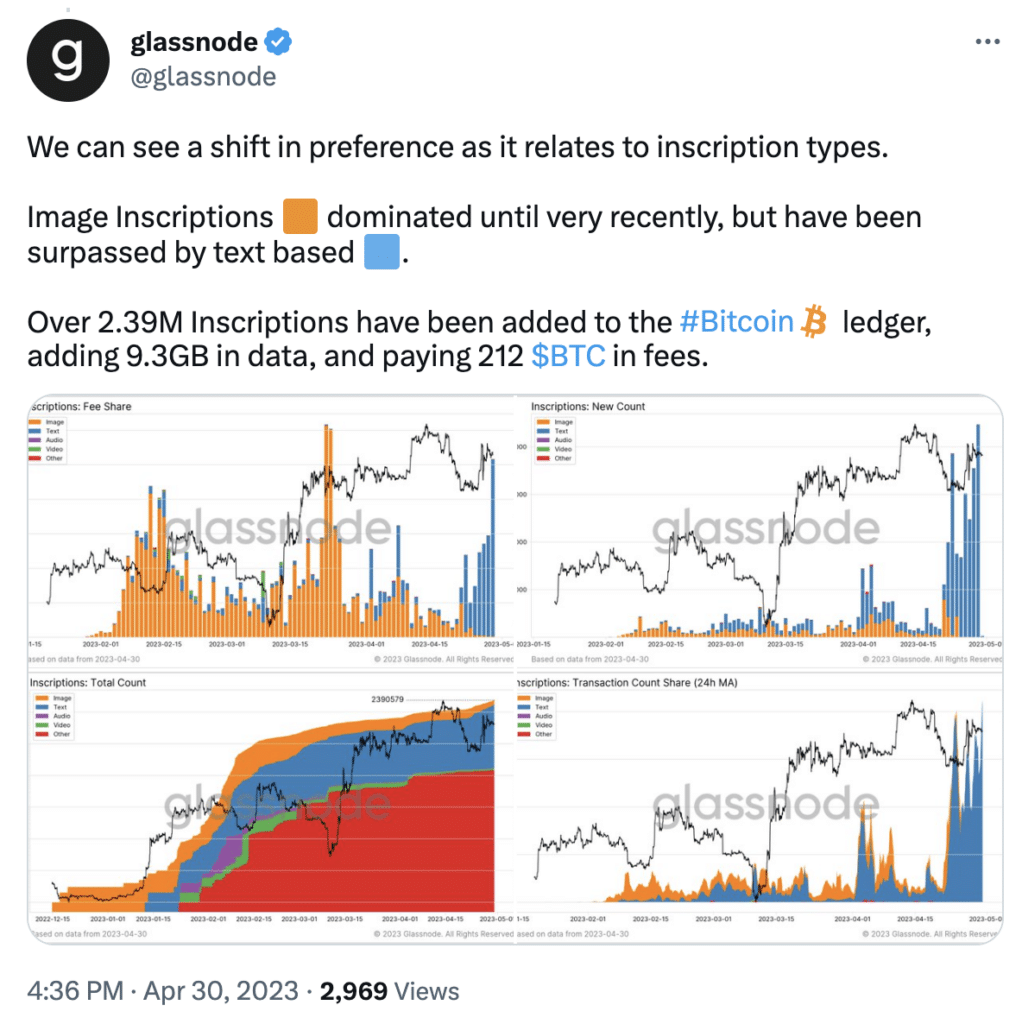

Glassnode reported that since its launch in January, more than 2.39 million Ordinals have been inscribed, allowing for data like audio, art, or even video games to be attached to individual satoshis.

A satoshi is the smallest unit of bitcoin, and this system creates a unique digital asset similar to an Ethereum-based NFT, but with the relevant data stored entirely on the bitcoin blockchain.

As a result, a significant shift in the character of bitcoin mempools this year has become evident, which store unconfirmed bitcoin transactions.

Glassnode reported that, apart from ordinals, the majority of current bitcoin transactions are related to monetary activities, frequently initiated by cryptocurrency exchanges.

Bitcoin is also used for remittances, or sending money across borders, particularly in developing countries where traditional banking services may be limited or expensive. Low transaction fees and fast settlement times make it an attractive alternative to traditional remittance services, which can be slow and expensive.

The impact of these monetary transactions on the price of bitcoin can be significant. When a large number of transactions are conducted through cryptocurrency exchanges, it can create a demand for bitcoin, which may increase the price of the cryptocurrency.

Until these new uses for bitcoin came along, it was not generally used for anything but digital transactions.

One of the main advantages of bitcoin is its speed and low transaction fees compared to traditional payment methods, which has made it a popular choice for online transactions. Bitcoin can be used to purchase a wide range of goods and services, and is not connected to any government.

In addition, bitcoin is also used as a store of value, similar to gold or assets that exist outside of the fiat financial system.

Because bitcoin has a limited supply and cannot be easily manipulated by central banks or governments, some people see it as a hedge against inflation or economic uncertainty. As a result, many people hold bitcoin as a long-term investment.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  WETH

WETH  Polkadot

Polkadot  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC