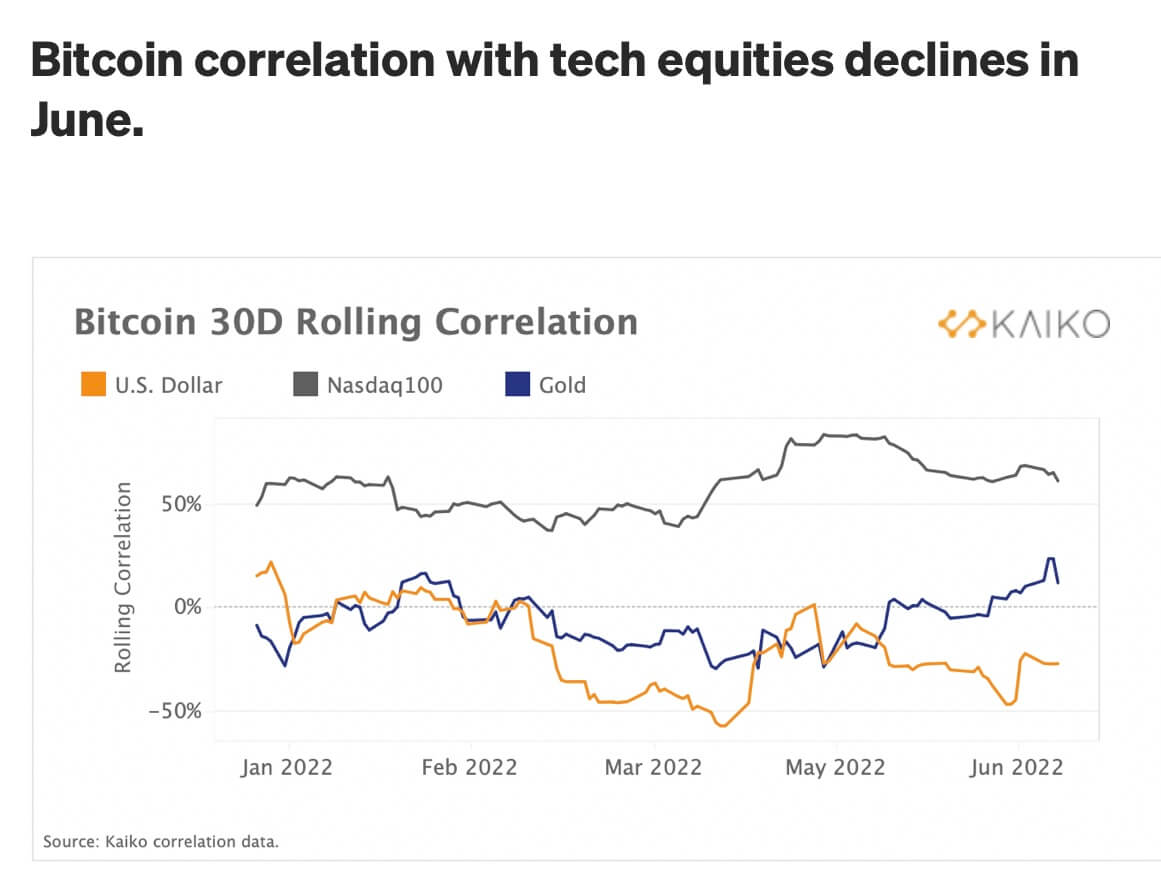

The correlation between Bitcoin (BTC) and Nasdaq 100 reduced this month after reaching a record of .8 last month, according to a new Kaiko report.

While Nasdaq closed the week on a positive note of over 7%, Bitcoin continues to trade in the $21,000 range. But Bitcoin remains mostly uncorrelated to the asset it has been compared with on multiple occasions, gold.

The correlation between Bitcoin and the precious metal asset is at over 50% presently. But its correlation with the US dollars has been alternating throughout the year between 0 and a negative .6.

Bitcoin and Nasdaq 100 have had their performance correlating for some time due to the increased interest of institutional investors in crypto. But the recent hike in interests rate and fears of recessions appears to have affected Bitcoin more than tech equities.

Bitcoin sell-off was spot driven

According to Kaiko, on-chain data reveals that the current crypto sell-off was caused by the spot traders rather than the derivatives market.

Per the report, Ethereum (ETH) and Bitcoin trading volume have declined since the start of the year. After peaking in May 2021, volatility also started reducing in September 2021.

But the weekly trading volume and price action have been relatively stable and on the same levels since then.

According to the report, this shows that there has been a calculated effort by investors to de-risk their position. Thus, the decline is not due to a futures market sell-off.

Additionally, the funding rates on Bitcoin’s derivatives markets show that the futures market wasn’t responsible for the sell-off. The funding rates on BTC perpetual futures have maintained a stable trend despite the sharp price decline.

Funding rates are currently at 0.005% above neutral. If the futures market were responsible for the sell-off, it would be negative, similar to Terra’s failure last month.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC