Understanding Bitcoin’s (BTC) valuation against various currencies isn’t merely a matter of numbers — it’s about grasping global economic tides, gauging investor sentiment, and pinpointing geopolitical fluctuations. By juxtaposing Bitcoin against different fiat currency trading pairs, we gain insights into regional economic health, investor behavior, and potential macroeconomic shifts.

Recent market trends point to a significant variance in the trajectory of the BTCUSD and BTCGBP trading pairs. Over the past 30 days, while both pairs have seen growth, the BTCGBP pair has consistently outperformed its USD counterpart.

This divergence might not just be a result of increased Bitcoin demand in the UK, but also an indicator of the pound’s relative weakness against both the USD and Bitcoin. Several factors might be driving this heightened interest in Bitcoin among GBP users. The declining GBP could be propelling investors towards Bitcoin as an alternative store of value, hedging against further depreciation. Also, with the current global economic outlook, Bitcoin increasingly appears as a refuge against traditional currency fluctuations.

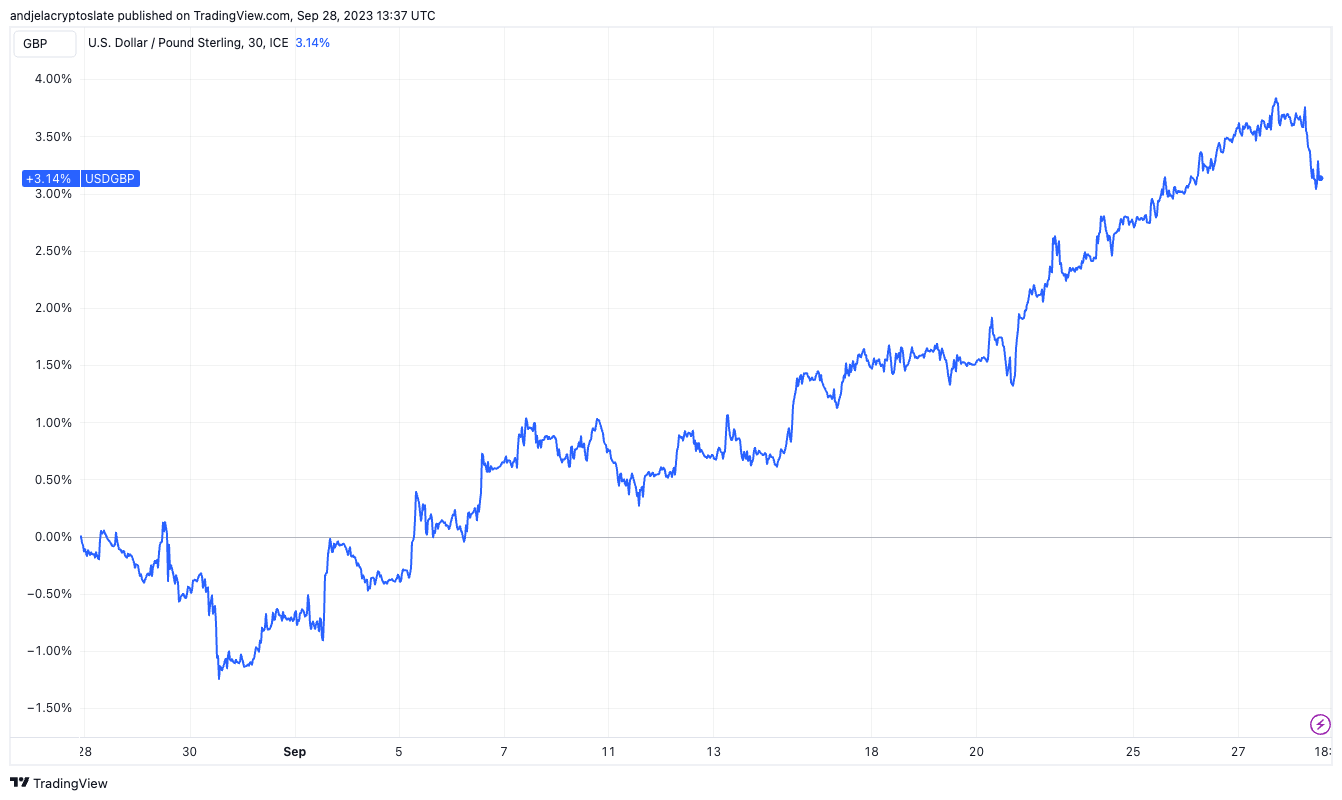

Diving deeper into the currency charts, USDGBP shows a pronounced increase of 3.08% over the last month, signifying the US dollar’s strengthening against the British pound. Conversely, the GBPUSD trend indicates a depreciation of the pound against the dollar. This isn’t just a month’s aberration but seems to be symptomatic of deeper economic undercurrents.

The pound is currently experiencing one of its most significant monthly decreases against the dollar. Its vulnerability in the market has been evident, especially as it seeks stability amidst widespread financial turbulence. Moreover, the dollar’s ascent to a notable high against major currencies, including the pound, further underscores the challenges faced by the GBP.

Several underlying factors contribute to the pound’s current decline. There’s a discernible trend of investors moving away from riskier assets, and the pound hasn’t been spared. Additionally, the UK grapples with escalating inflation rates, prompting speculations about the Bank of England’s prospective measures. Warnings about the potential stagnation of the UK’s economy have emerged, and there are evident signs of renewed economic stress, suggesting a possibly tumultuous financial future for the nation.

A weakening GBP typically signals concerns about the UK’s economic health. Investors, wary of market turbulence, might increasingly turn to cryptocurrencies like Bitcoin as alternative investment avenues. The shifting dynamics in the GBP’s performance against major currencies and Bitcoin might indicate a broader trend: cryptocurrencies are not just speculative assets but are steadily becoming integral to global financial strategies.

As the GBP faces headwinds, Bitcoin’s allure in the UK seems to be increasing.

The post Bitcoin sees rising demand in the UK as British pound struggles appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Litecoin

Litecoin  Polkadot

Polkadot  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Aptos

Aptos  Internet Computer

Internet Computer  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  OKB

OKB