On May 1, U.S. regulators seized and sold First Republic Bank (FRB) and its assets to JPMorgan in what has now become the largest bank failure since 2008. FRB is the fifth bank to fail in less than two months, following on from Silvergate, Silicon Valley Bank, Signature Bank, and Credit Suisse.

Despite the rising number of struggling banks, regulators continue to assure the public that these failures aren’t part of a global banking crisis — blaming short-term turmoil among local lenders for the fallout.

A source close to Treasury Secretary Janet Yellen told CNN that First Republic was an outlier in the regional banking sector. First-quarter results showed that almost all midsize and regional banks were “well-capitalized” and that deposit flows have stabilized, the source argued.

Jamie Dimon — the CEO of JPMorgan — echoed the statement, assuring participants of a recent investor call that the banking sector was “stable.”

“No crystal ball is perfect, but yes, I think the banking system is very stable. This part of the crisis is over.”

Bending the banking system

However, the failure of First Republic, Signature, and Silicon Valley Bank is already bigger than the 25 banks that failed in 2008.

Data from The New York Times showed that the three had over $530 billion in assets — while Washington Mutual and the 24 other banks that crumbled in 2008 managed around $524 billion, adjusting the data for inflation.

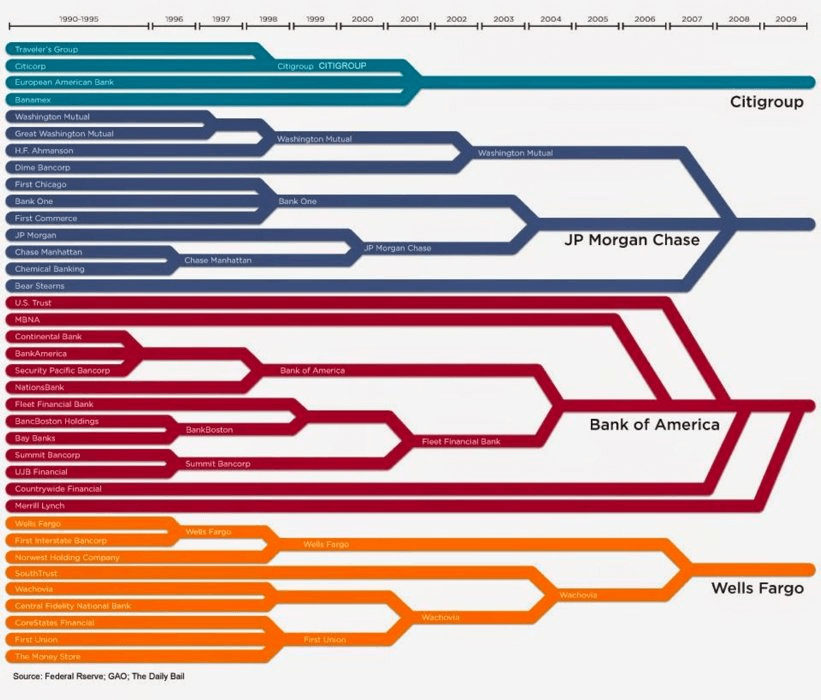

JPMorgan’s acquisition of First Republic was lauded by U.S. regulators as a heroic move that saved the taxpayers from fronting the bill for its failure. However, it sets a dangerous precedent that could see the U.S. market become dangerously centralized and government-dependent.

While there’s no explicit law prohibiting banks from controlling any percentage of the country’s total deposits, there are safeguards in place that prevent systemic banking issues. The Dodd-Frank Act — passed in 2010 in response to the 2008 financial crisis — enables regulators to block mergers and acquisitions that would result in a bank becoming “too big to fail.”

Numerous economists and analysts warned that JPMorgan’s acquisition of First Republic should never have been allowed. The controversial $10 billion deal saw JPMorgan acquire the substantial majority of FRB’s assets and assume its deposits — both insured and uninsured — from the FDIC.

This pushed JPMorgan’s total assets over $3.2 trillion, cementing its position as the largest bank in the U.S.

As part of the deal, JPMorgan acquired $173 billion of loans and $30 billion worth of securities from FRB. It also assumed around $92 billion of deposits, including $30 billion of large bank deposits, all of which will be repaid after the deal closes. The FDIC will share JPMorgan’s loss on $13 billion worth of residential mortgage loans and commercial loans, as well as provide JPMorgan with $50 billion of financing.

Bitcoin

On the opposite side of the financial spectrum stands Bitcoin, which seems to have used the ongoing banking crisis to lay a strong foundation for the rest of the year.

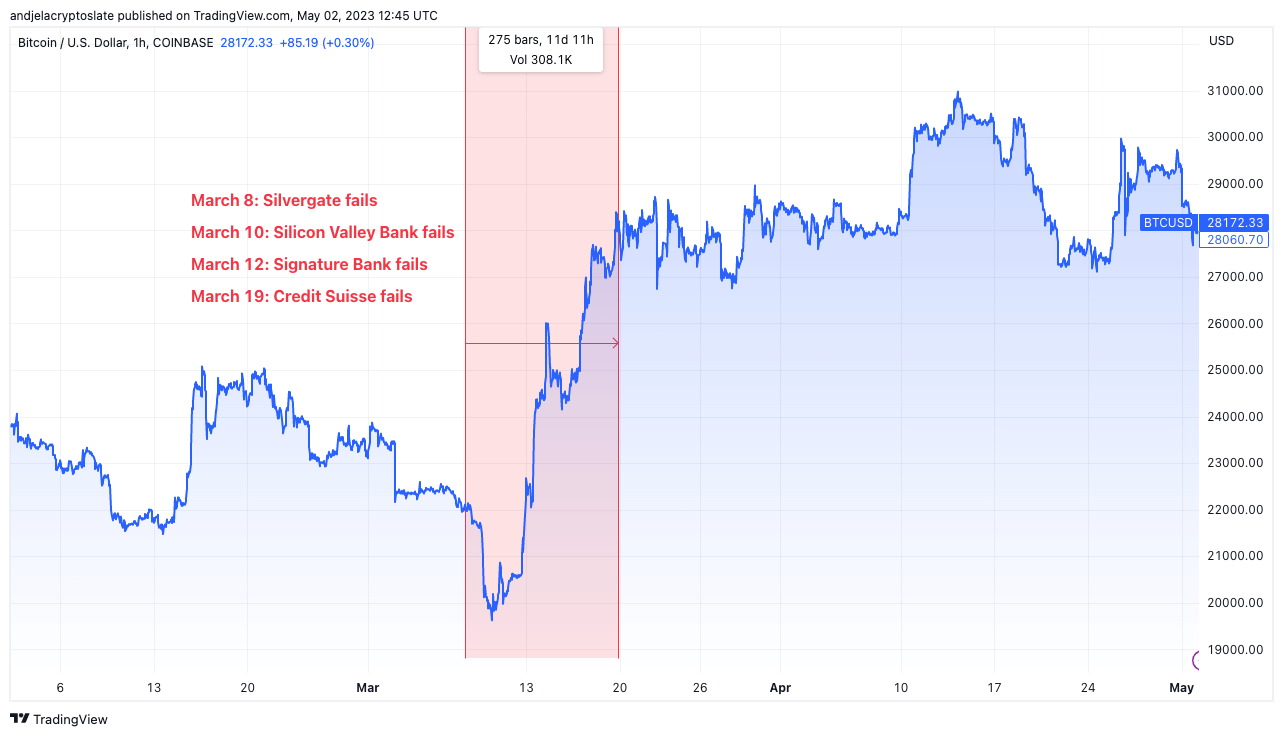

The four consecutive bank failures that took place between March 8 and March 18 this year affected Bitcoin’s price — wiping out nearly 17% of its market cap. However, the effect was short-lived and Bitcoin quickly began recovering from the initial shock regaining the 17% loss in less than three days.

Since then, Bitcoin’s price has been going up, with BTC trading at just over $28,000 at press time. The volatility BTC experienced when crossing $30,000 and its consistent correction at around $27,000 could mean that strong resistance was formed.

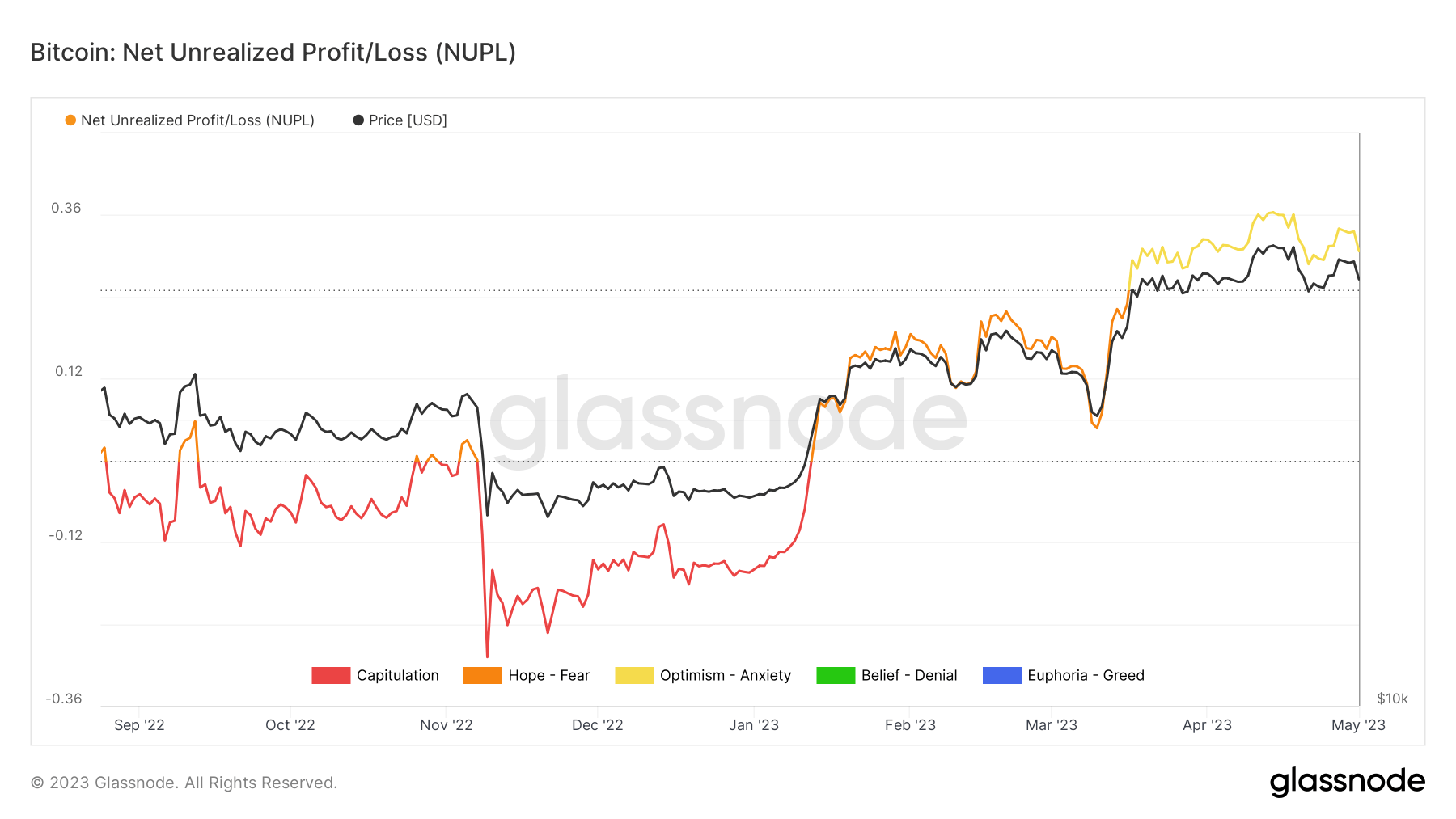

Bank failures also seem to have injected the crypto market with a long-awaited optimism. The Net Unrealized Profit/Loss (NUPL) is an indicator used to determine whether the network as a whole is in a state of profit or loss. The higher the NUPL score is, the more unrealized profits there are in the network and the more optimistic the network is overall about upcoming price action.

Looking at Bitcoin’s NUPL score shows that any semblance of fear brought on by the failure of Silvergate, Signature, and Silicon Valley Bank was quickly wiped out.

The post Bitcoin rises amidst string of bank failures: is this the start of a new financial era? appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC