An on-chain analyst has pointed out that the Realized HODL (RHODL) Ratio indicator is on the way down, a sign that may not be positive for Bitcoin.

Bitcoin RHODL Has Been Losing Momentum Recently

In a new post on X, analyst Checkmate has discussed about the latest trend in the RHODL Ratio of Bitcoin. The “Realized HODL (RHODL) Ratio” is an on-chain metric that calculates the ratio between any two given RHODL wave bands.

HODL wave bands keep track of the percentage of the total BTC supply that was last moved inside a given age range. The RHODL wave bands are a modified form of these, adding an additional weighting factor: the Realized Value.

Put simply, the Realized Value is the spot price at which a given token of the cryptocurrency was last transacted on the blockchain. That is, it’s the coin’s current cost basis.

As the RHODL wave band multiplies this metric with the amount of supply present within a given band, it tells us about the sum of cost bases of coins in that band. When the value of the indicator goes up for any particular band, it means the amount of capital invested into coins falling in the age range is rising.

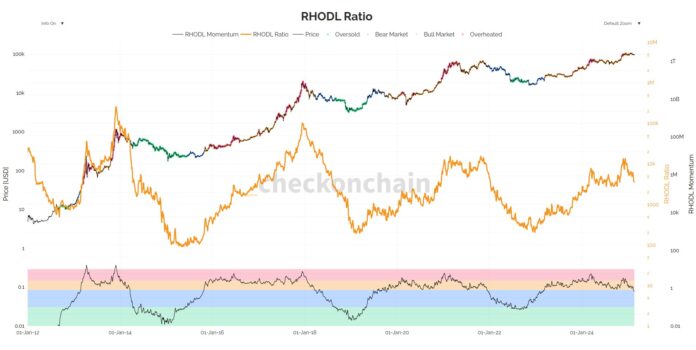

In the context of the current topic, the RHODL Ratio of the 1 week and 1 to 2 years bands is of relevance. Below is the chart shared by the analyst, that shows the trend in this RHODL Ratio over the history of Bitcoin.

As displayed in the above graph, the Bitcoin RHODL Ratio for these wave bands shot up to a high level during the rally beyond $100,000 that took place last year. Such a trend implies the 1 week wave band, which corresponds to the fresh capital coming into the sector, grew large relative to the veteran 1 year to 2 years band.

From the chart, it’s apparent that an extreme rotation of capital into the 1 week wave band has historically coincided with bull run tops for the cryptocurrency’s price.

Since last year’s peak, the metric has been on the way down, which suggests the new demand for the asset is now slowing down. This is also visible in the momentum oscillator for the indicator attached by the analyst on the bottom, which just dipped into a zone that has played the role of the transition region between bullish and bearish trends in the past.

Considering the historical pattern, this development in the RHODL Ratio is certainly not the best for Bitcoin. It now remains to be seen whether the metric would continue its decline in the coming days, potentially signaling a transition away from a bull market, or if it will bounce back up.

BTC Price

Bitcoin made a retest of the $98,000 mark earlier today, but it appears the coin ended up finding rejection as its price is now down to $97,000.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  LEO Token

LEO Token  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hyperliquid

Hyperliquid  USDS

USDS  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  WhiteBIT Coin

WhiteBIT Coin  Pepe

Pepe  Bittensor

Bittensor  Aave

Aave  Ondo

Ondo  Aptos

Aptos  Dai

Dai  Internet Computer

Internet Computer  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)