Quick Take

CryptoSlate’s recent data analysis reveals intriguing patterns in Bitcoin profit-taking behaviors amid volatile market conditions. The analysis showed that the Bitcoin price level of $35,000 has acted as a short-term resistance, with a surge in profit-taking around this point.

Specifically, on Oct. 24, over $1.5 billion of realized profit was reported, marking the second-highest profit-taking event this year. The only other higher instance occurred on May 7, coinciding with Bitcoin’s significant drop from $30,000 to $25,000.

The data further showed that a majority of this profit-taking was led by short-term holders, specifically those who purchased Bitcoin within the last 155 days when the price rose from $25,000 to $34,000.

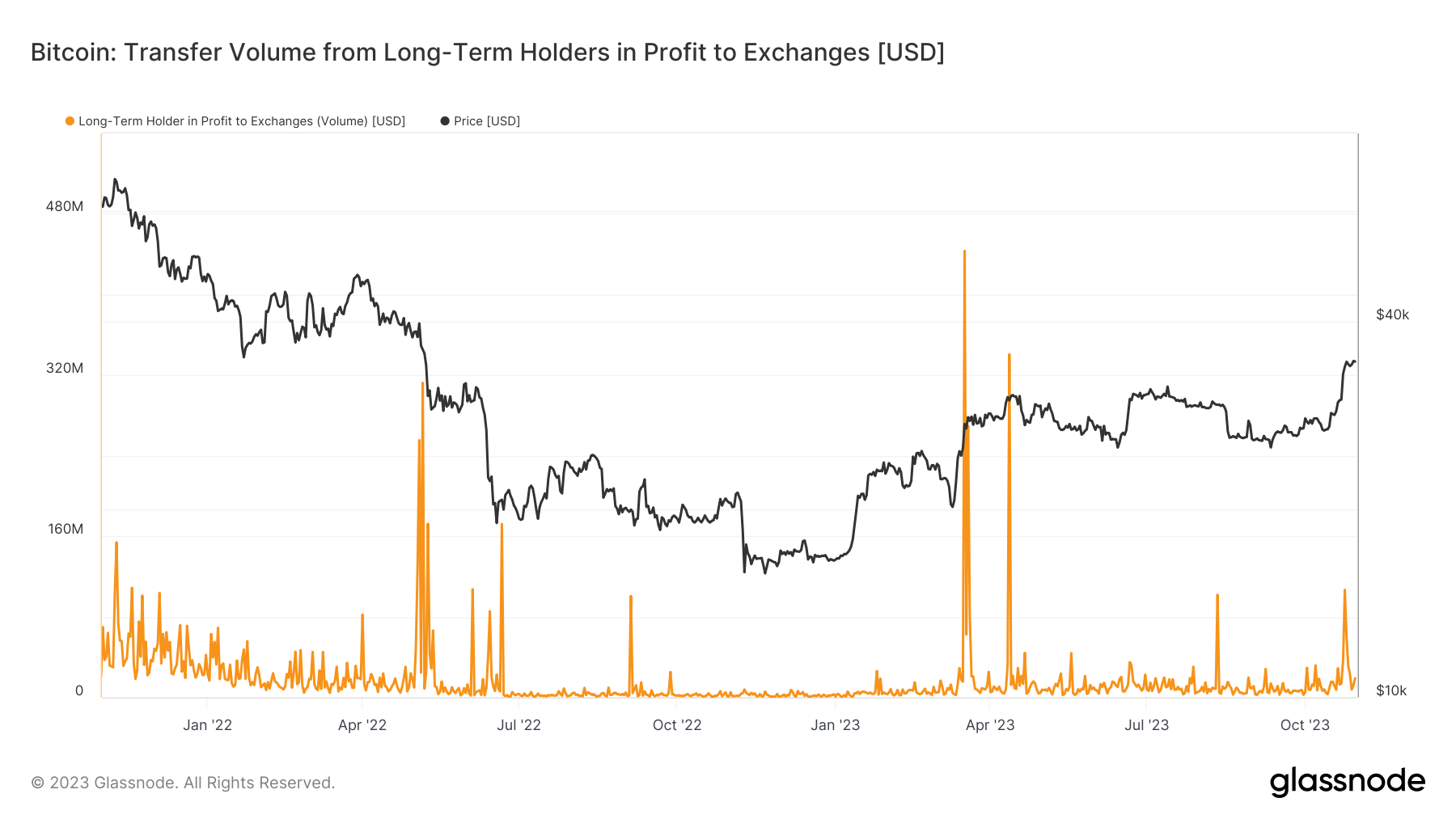

Interestingly, profit-taking among long-term holders appeared to be minimal, accounting for a mere $100 million. This indicates a level of steadiness in the market amid shorter-term turbulence.

The post Bitcoin price surge to $35,000 triggers over $1.5B in profit-taking appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  Polkadot

Polkadot  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Uniswap

Uniswap  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Official Trump

Official Trump  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Bittensor

Bittensor  Cronos

Cronos  Dai

Dai  POL (ex-MATIC)

POL (ex-MATIC)  OKB

OKB