The Bitcoin price trajectory has once again taken a sharp upward turn, marking its ascent past the $28,000 landmark for the first time since its notable surge on August 29. This prior leap had been attributed to Grayscale’s triumph over the US Securities and Exchange Commission (SEC) in their legal battle regarding the Bitcoin Trust (GBTC) conversion to a spot ETF.

In a striking demonstration of Bitcoin’s infamous volatility, the BTC experienced a price escalation of over $800 within a minuscule 5-minute window on Sunday evening, rocketing from $27,250 to a peak of $28,053 between 6:15 and 6:20 pm ET.

Why Is Bitcoin Price Up Today?

One primary catalyst behind this dramatic price movement, as pinpointed by the esteemed crypto analyst Byzantine General, is the phenomenon known as a “short squeeze.” In the realm of futures trading, a short squeeze is characterized by a rapid price increase, forcing traders who had bet against the asset’s price (short sellers) to buy it to prevent further losses. This reactive buying can intensify the asset’s price jump.

During yesterday’s surge, a staggering $392 million in Bitcoin short positions, or about 7.7% of the total open interest in the market, were swiftly liquidated. Byzantine General further elaborated on the market’s resilience, observing that the Bitcoin open interest bounced back swiftly with an increment of $350 million, humorously suggesting the market’s willingness to embrace such a volatile maneuver again: “The whole market was actually like ‘I’ll fucking do it again.”

Crypto analyst Fabian D. deepened the analysis by pointing out the intricate interplay between short sellers being ousted and the potential for further Bitcoin appreciation. He indicated that the upward trajectory of Bitcoin from this point hinges on two primary factors: the entry of spot buyers driven by the fear of missing out (FOMO) and whether short sellers decide to re-establish their positions.

Fabian also alluded to the absence of institutional buying activity in the week preceding this surge but underscored the importance of monitoring premium rates on platforms like Coinbase and CME upon market opening today. Adding to the complexity of the market landscape, Fabian flagged two impending events: the anticipation surrounding the Ethereum Future ETF inflows, and the court hearing concerning the Celsius platform, which might potentially refocus attention on its creditor distributions.

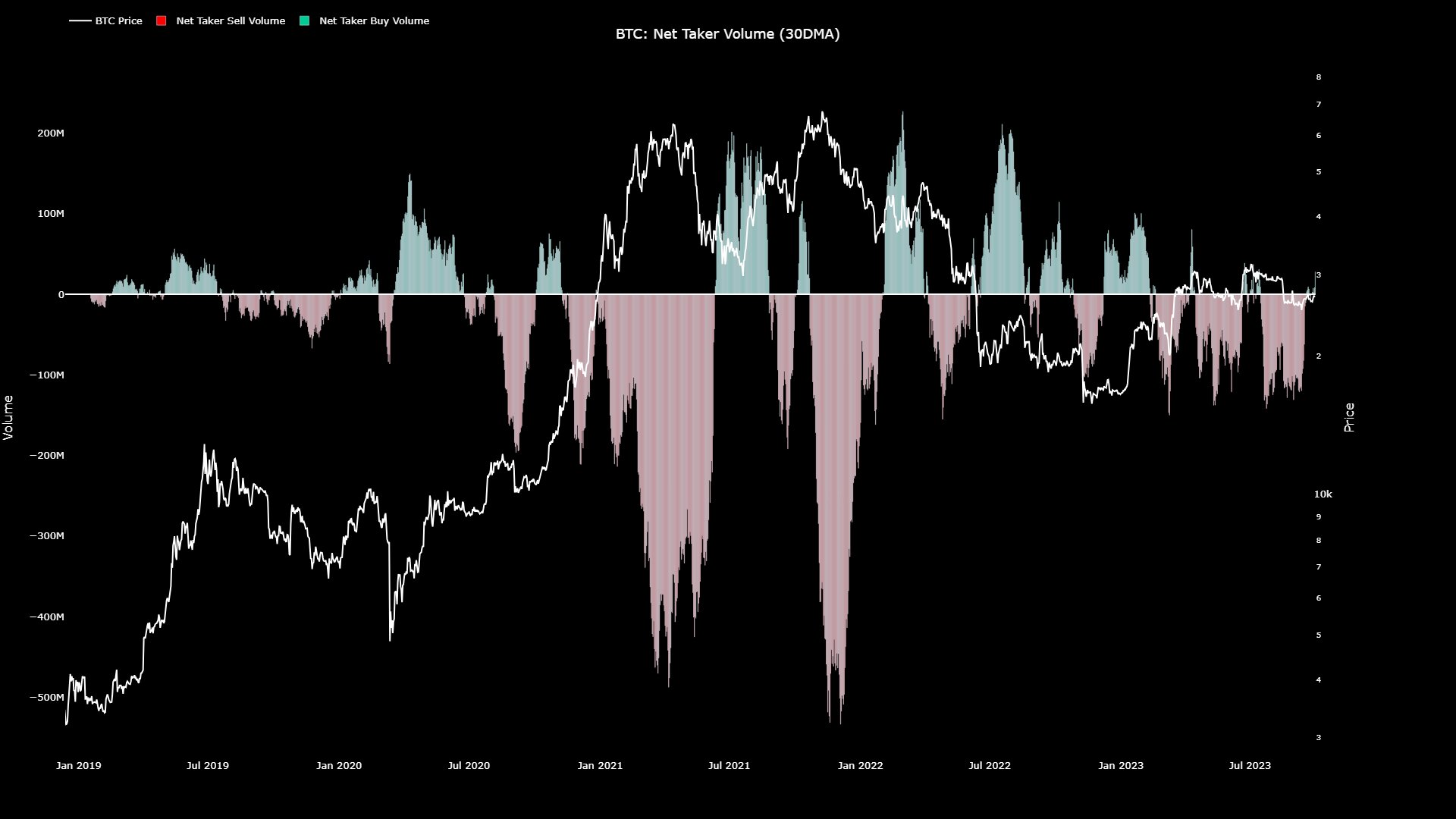

Drawing insights from on-chain data, analyst Maartunn introduced another layer of optimism, noting that “Net Taker Volume has crossed into the green zone, indicating that buyers are in control. The last time was four months ago.”

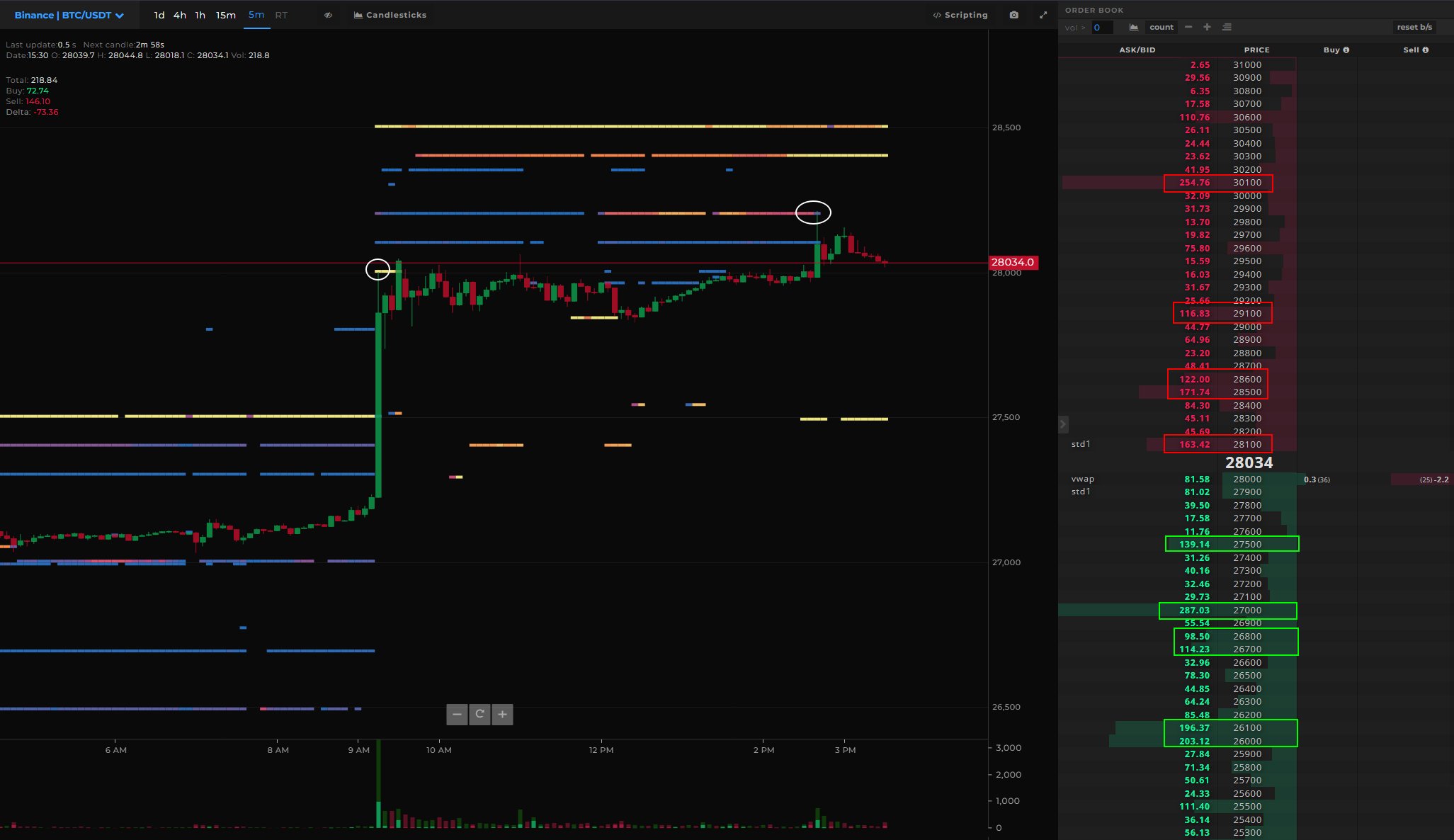

Diving into granular analytics, quant trader Skew shed light on the dynamics at play on platforms like Binance and Bybit. He emphasized that the recent price upswing wasn’t entirely unforeseen, particularly given the noticeable shift away from short positions and the robust perpetual bid leading up to the spike.

Looking at the Bitcoin aggregate CVDs & delta, he further noted: “Mostly seeing sell pressure just in perps for now. Price decline with Perp CVD decline & Perp sell delta picking up. Next move that decides the fate of this entire move is spot.”

Highlighting the evolving market dynamics, Skew pointed out that the BTC Binance Spot exhibited a notably broad order book with a significant amount of available and resting liquidity. He inferred that such a setup could lead to more pronounced price reactions.

Highlighting the evolving market dynamics, Skew remarked that the BTC Binance spot market exhibits a notably broad order book with a significant amount of available and resting liquidity. He inferred that such a setup could lead to another pronounced price reaction. “Increasing ask liquidity on spot order books; implies greater volume needed by spot takers to clear $28K – $29K (Market structure shift),” he warned.

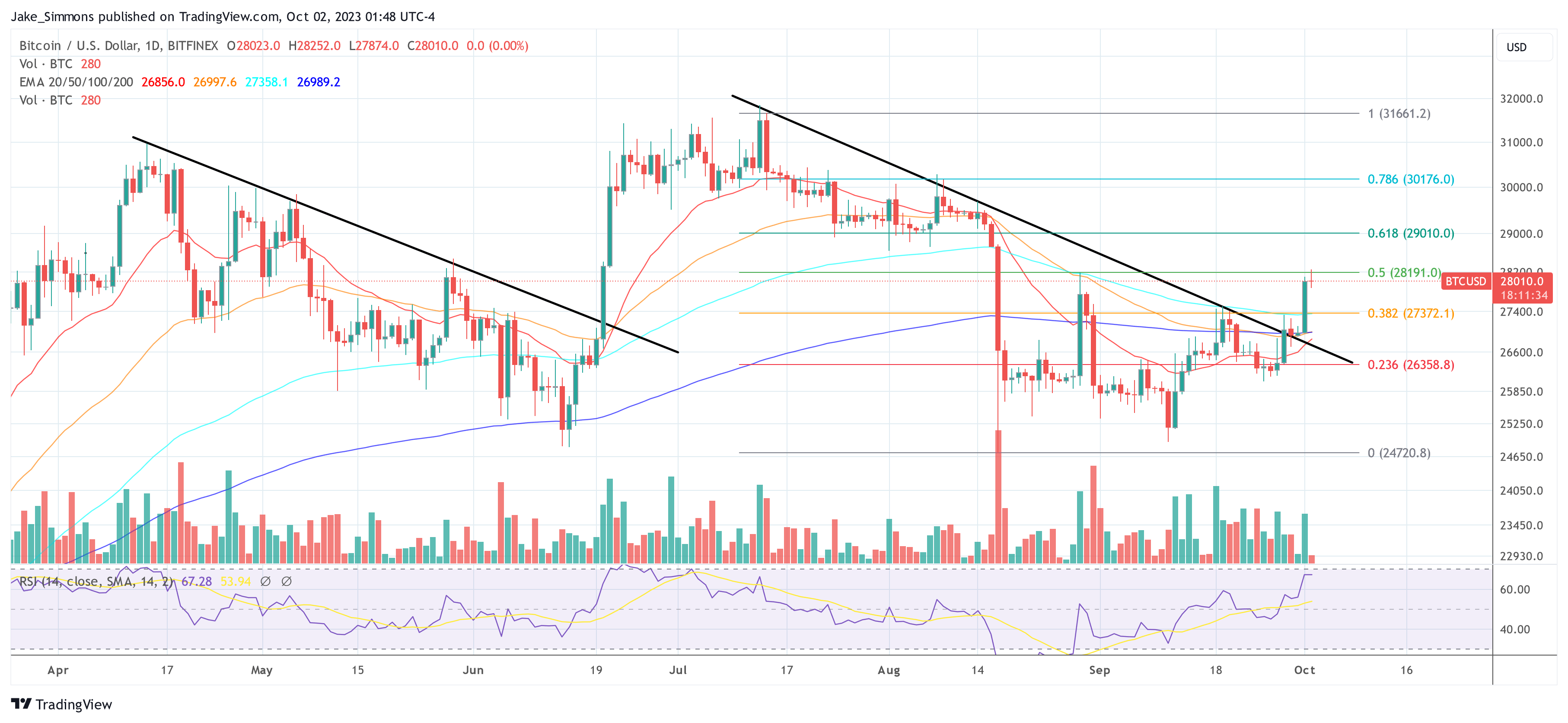

It is also interesting to note that the price movement was already evident in the 1-day chart. As explained in the last Bitcoin price analyses, the price broke through the (black) downtrend line established in mid-July last Thursday. While the successful re-test of the trendline took place on Friday and Saturday, confirming the bullish momentum, the expected bounce occurred yesterday.

Featured image from Shutterstock, chart from TradingView.com

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hyperliquid

Hyperliquid  USDS

USDS  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  WhiteBIT Coin

WhiteBIT Coin  Pepe

Pepe  Bittensor

Bittensor  Aave

Aave  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)