Bitcoin price held steady above the crucial psychological level of $60,000 as crypto analysts predicted further upside in the coming weeks.

Bitcoin (BTC) was trading at $60,200, its highest level since Aug. 27 as investors moved back to risk assets ahead of the Federal Reserve decision.

Analysts are upbeat

Gold has jumped to a record high while American indices like the Dow Jones and Nasdaq 100 indices had their best week in months,

Notably, Bitcoin seems to have avoided forming a death cross pattern, which happens when the 200-day and 50-day moving averages cross each other. Instead, it has moved slightly above the two averages, which is a positive sign.

Meanwhile, some of the most notable crypto analysts are bullish on the coin. In an X post, pseudonymous crypto analyst Titan noted that the coin may have a breakout to $92,000.

His theory is that Bitcoin tends to move by at least 40% whenever it flips the 50-day simple moving average. He expects that the coin will jump by 71% in the coming months.

In a separate post, he noted that Bitcoin had reclaimed the Tenkan Kijun and moved above the Kumo cloud of the Ichimoku cloud indicator. Also, the Relative Strength Index broke above the multi-month trendline, pointing to more upside.

In another X post, Michael van de Poppe, a popular analyst with over 724,000 followers, noted that Bitcoin may remain in a consolidation phase and then have a bullish breakout at the end of the month or early October.

Santiment, the popular crypto analytics firm, also identified potential bullish catalysts for Bitcoin.

In a post, it noted that Bitcoin was seeing more accumulation by whales and sharks at a time when supply on exchanges was falling.

Bitcoin volume in exchanges is falling

Data by CoinGlass shows that the volume of coins in exchanges dropped to 2.34 million, down from the year-to-date high of over 2.72 million.

That is a sign that many Bitcoin holders have no intention to sell their coins any time soon. Instead, some big holders like MicroStrategy have continued to accumulate.

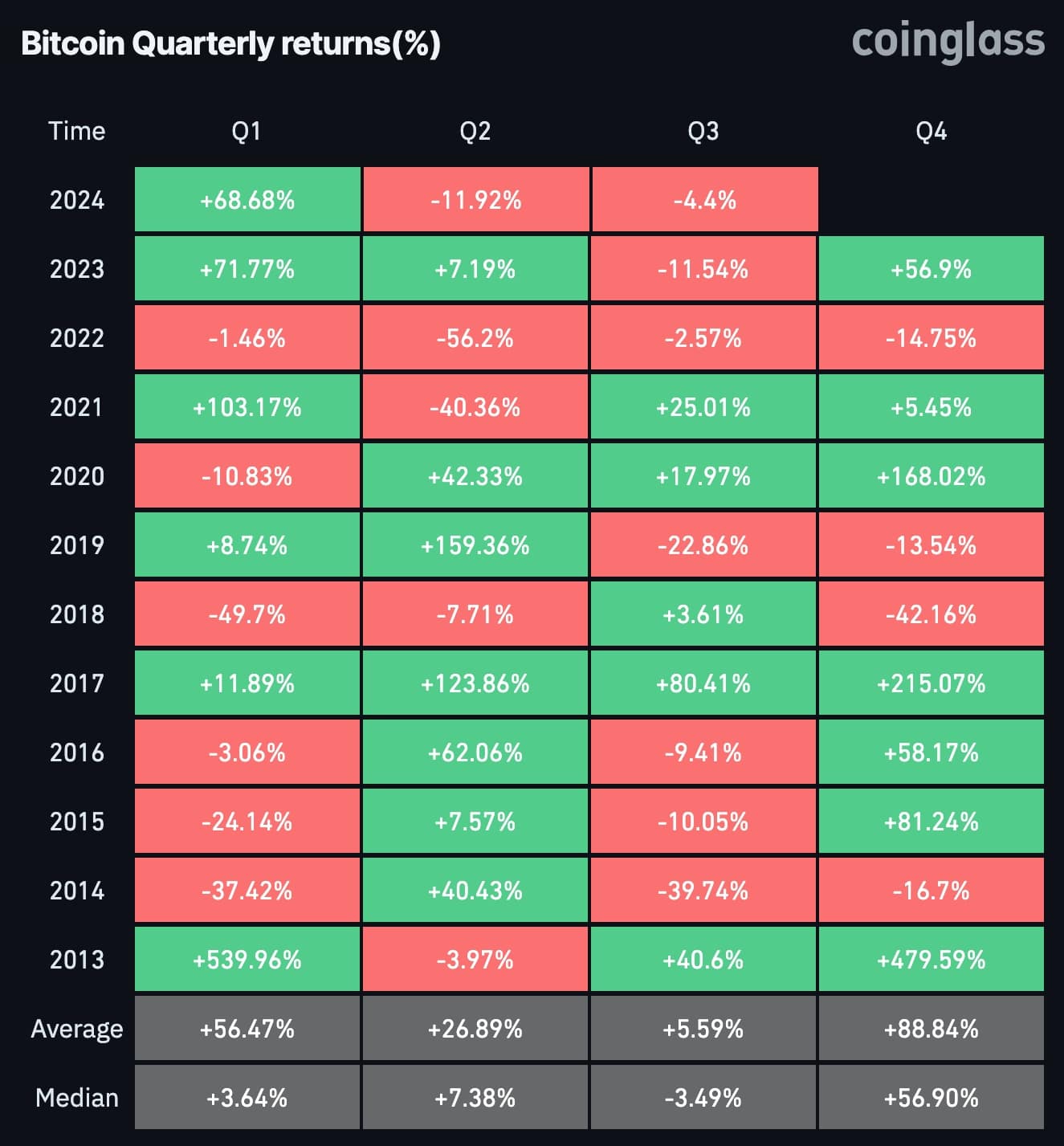

There is also a seasonality case for Bitcoin. According to CoinGlass, Bitcoin tends to have negative returns in the third quarter and then rebound in the fourth quarter.

It has dropped in seven third quarters since 2013 and risen in five quarters.

The average third-quarter return is 5.59% while the average Q4 returns are 88%. September is usually the worst month for Bitcoin while October and November are the best.

Another catalyst, as we wrote on Sept. 14, is that stablecoin holdings by smart money investors have continued moving downwards this year.

After peaking at 35.17% after the FTX collapse in November 2022, it has dropped to just 3.92%. That is a sign that most smart money investors are fully invested in coins like Bitcoin and Ethereum (ETH).

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  Hyperliquid

Hyperliquid  USDS

USDS  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC