Bitcoin has risen over 110% in 2023 at the time of writing, where the price of the asset started the year off at $16,677 on January 1, has now pumped to above $35,000 only 10 months later. With more room to run this year as hype builds in the market around the potential approval of a spot Bitcoin ETF by the SEC and the upcoming halving event, many are now questioning if this is the end of this cycle’s eventful bear market.

Since the few disastrous incidents that happened in the bear market causing the price drop, things are now looking more optimistic. As some of the worlds largest asset managers, including Fidelity, VanEck and WisdomTree, have filed in hopes to be the first in the United States to get approval for a spot Bitcoin ETF. One name in particular though is making more headlines than the rest, and that is the worlds largest asset manger BlackRock, who manages about $10 trillion.

BlackRock CEO Larry Fink recently made an appearance on Fox Business stating that their clients around the world are interested in getting exposure to Bitcoin, saying the recent price rally has been a “flight to quality.” Earlier this month, Bloomberg ETF analysts Eric Balchunas and James Seyffart raised their approval odds for a spot Bitcoin ETF by the SEC to 90% by January 10, 2024.

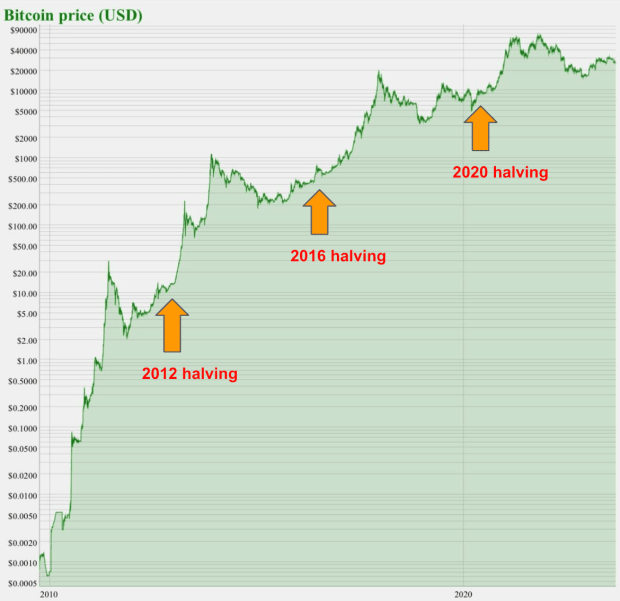

The next Bitcoin having is expected to take place in roughly 180 days in late April, 2024. The event will see the Bitcoin block reward drop from 6.25 BTC per block to only 3.125 BTC. This will be the fourth halving in Bitcoin’s history, with the first happening in November 2012, the second happened in July 2016, and the third happened in May 2020. Historically, a year leading up to and after the halving, the price of BTC goes up substantially.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Polkadot

Polkadot  Litecoin

Litecoin  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Internet Computer

Internet Computer  Aptos

Aptos  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  OKB

OKB