Bitcoin miners appear to have paused their liquidations, according to CryptoQuant data on Feb. 5.

Per streams, bitcoin miners’ reserve trend has been flat at around 1.837m BTC from Jan. 19. This marked the day when bitcoin miners held off from selling their coins.

The shift in the trend of BTC reserve coincided with the revival of Bitcoin prices from mid-January 2022.

From Jan. 19, BTC prices have rallied from $21,081 to $23,063 on Jan. 25. Reserves remained flat at around 1.837m.

Traders track the number of coins held by bitcoin miners. The bitcoin miner reserve data follows the number of coins in addresses affiliated with miners. However, the tracker doesn’t show the number of coins held by individual mining pools or farms.

Miners are tasked with confirming transaction blocks and securing the network. They must invest in modern gear and cater to operation costs, including paying electricity bills and salaries. Presently, the Bitcoin network rewards 6.25 BTC to every successful miner.

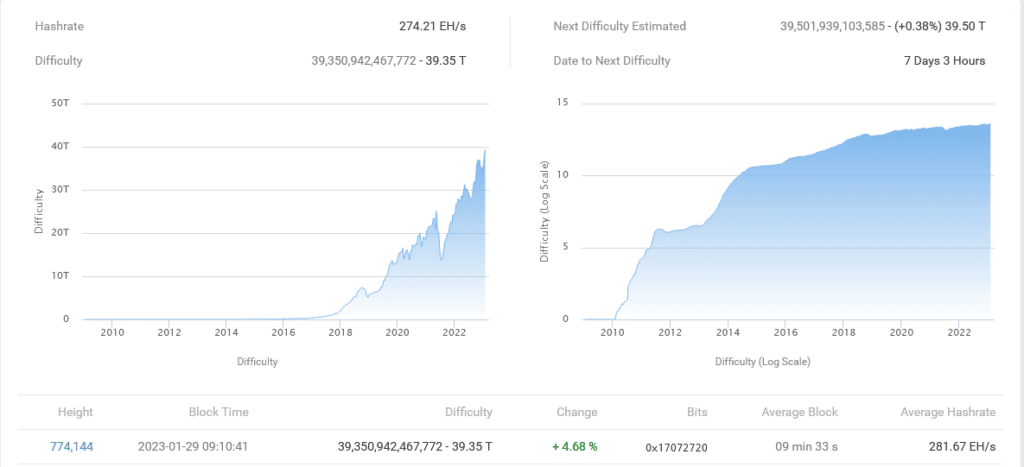

Coins are distributed every 10 minutes, regardless of the overall difficulty. Difficulty levels have increased in recent weeks, rising by 4.68% in the last adjustment in response to rising BTC prices.

Typically, miners’ reserves increase when they pause the selling of coins in centralized exchanges such as Coinbase or Binance, or on over-the-counter (OTC) desks. This expansion in their reserves could indicate confidence in the markets and their expectations of more price gains in the months ahead. Conversely, when reserves are fast-falling, they may fear the markets could post more losses in coming sessions.

Since BTC reserves are increasing, moving in sync with spot prices, there could be more upsides going forward. In January, prices bottomed up after dropping to as low as $15,300 in Q4 2022.

The bankruptcy of FTX, a cryptocurrency exchange, and several CeFi platforms, mostly lending platforms filing for bankruptcy, accelerated the sell-off. Bitcoin prices fell from $20,000 to register 200 lows.

Trackers show that BTC is trading at $23,135, up 37% in the last month.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)