Quick Take

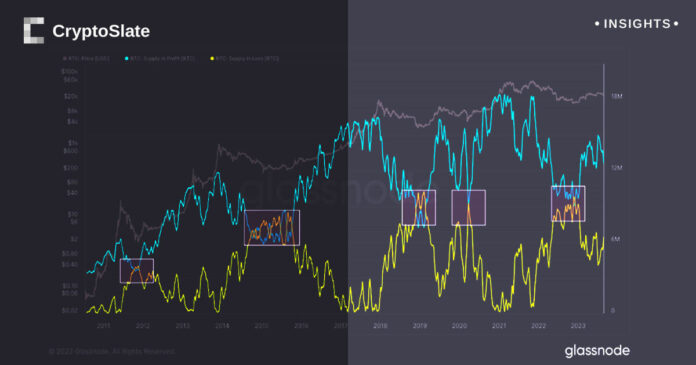

Several key metrics in the Bitcoin market suggest a local bottom, an inflection point indicating a potential reversal from the recent downward trend.

Open interest, a metric that tracks the total number of outstanding derivatives contracts, has been reset, indicating that players are repositioning themselves for a potential market shift. Meanwhile, the perpetual funding rate has remained negative for three consecutive days, suggesting a contraction of leveraged positions in the market.

Moreover, the miner capitulation phase, a period where smaller or inefficient miners sell their holdings due to unfavorable market conditions, appears to have passed. This is reinforced by the continuous offloading of coins from cryptocurrency exchanges. Short-term holders (STHs) reportedly capitulated and sold at a loss last Thursday, often a sign of market bottoming.

However, one indicator is still absent from this potential bottoming scenario – the supply in profit/loss. This metric swings towards a ‘bottom’ when more Bitcoin is at a loss than profit. This indicator shows a discrepancy of 6 million, suggesting that the market has not yet reached the bottom according to this specific metric.

The post Bitcoin market signals local bottom as key indicators suggest potential reversal appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Toncoin

Toncoin  Sui

Sui  Wrapped Bitcoin

Wrapped Bitcoin  Shiba Inu

Shiba Inu  Hyperliquid

Hyperliquid  Stellar

Stellar  Polkadot

Polkadot  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  USDS

USDS  Aptos

Aptos  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Render

Render  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Filecoin

Filecoin