- Bitcoin rose to $26,820 on Wednesday, trading in the opposite direction to stocks as the Dollar Index hit a 10-month high.

- An easing for the DXY could see Bitcoin price strengthen above the $26k base.

Bitcoin (BTC) defied a surge for the Dollar Index (DXY) on Wednesday, spiking to above $26,820 in early US trading hours. The gains for the benchmark cryptocurrency buoyed the altcoin market, with several tokens seeing decent moves to push the total market cap up by about 1.5%.

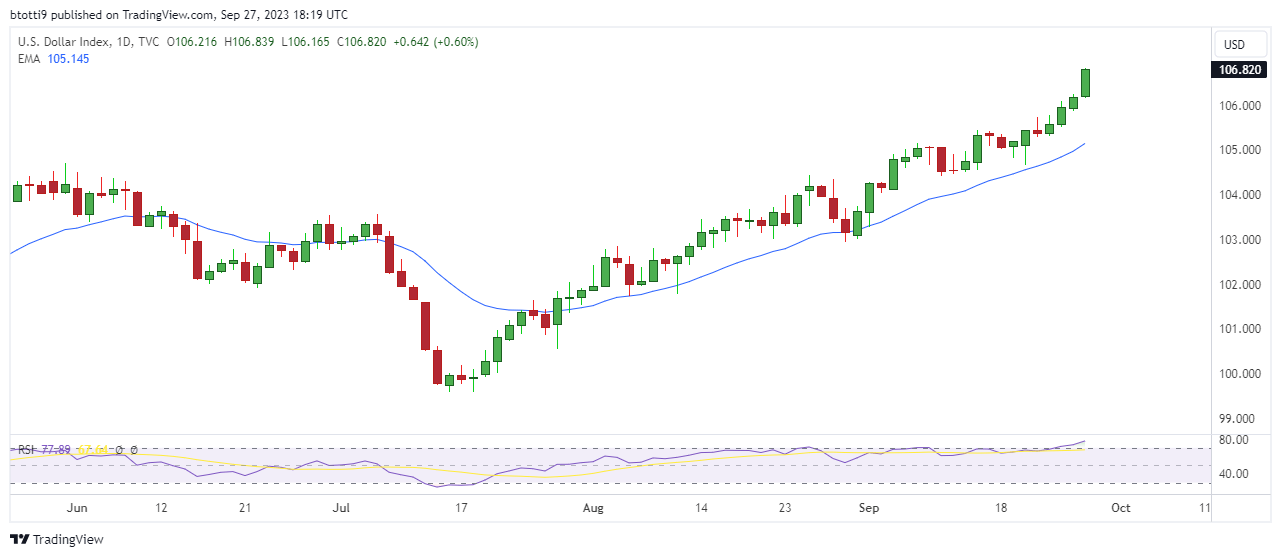

But as the DXY, which measures the greenback’s strength against a basket of other major currencies, hit highs of 106.83 for its highest level since November 2022, stocks moved lower. Alongside the dollar’s strength has been rising yields, with the benchmark 10-year US Treasury yield soaring to a 16-year high of 4.64%. The two-year US yield rose to 5.15%

It’s a scenario that sees the stock market compound weakness seen over the past week, including Tuesday’s Dow slump that was the biggest in a single day since March.

BTC price outlook

The US dollar index’s upside has historically signaled a bearish outlook for stocks and other risk assets, including crypto. Market intelligence platform says the negative correlation between the dollar index and Bitcoin and S&P 500 has particularly been evident since 2021.

That should be the perspective, though Bitcoin is showing a resilience above $26k. According to crypto investor Scott Melker, Bitcoin’s performance shows it “has its own life.”

$BTC is currently COMPLETELY uncorrelated from every other market.

Bitcoin is up, the dollar is WAY up, stocks are down, gold is down.

Bitcoin has a life of its own.

— The Wolf Of All Streets (@scottmelker) September 27, 2023

Meanwhile, Santiment analysts say BTC could see a breakout if the DXY begins to cool off.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)