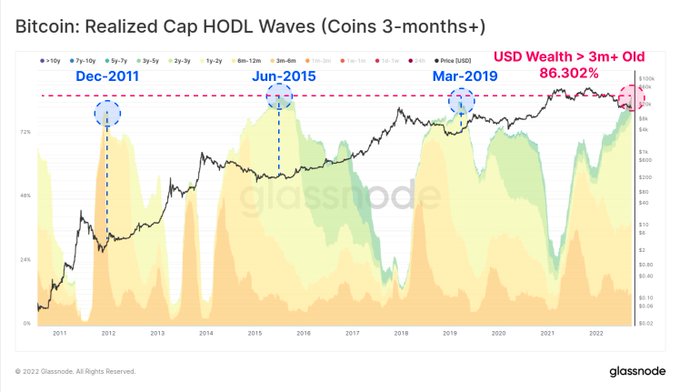

Bitcoin lacked a significant upward momentum, but this has not dampened the spirits of hodlers because coins aged at least 3 months hit an ATH of 86.3%, according to Glassnode.

Based on BTC Realized Cap HODL Wave, the market insight provider pointed out:

“Coins aged 3m+ now account for an ATH of 86.3% of all USD wealth held by the BTC supply. Bitcoin hodlers appear to be steadfast and unwavering in their conviction.”

Source: Glassnode

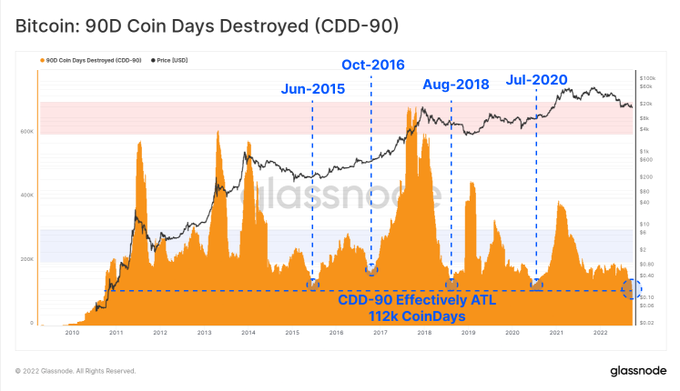

Glassnode added:

“The total volume of Bitcoin coin-days destroyed in the last 90-days has, effectively, reached an all-time-low. This indicates that coins which have been hodled for several months to years are the most dormant they have ever been.”

Source: Glassnode

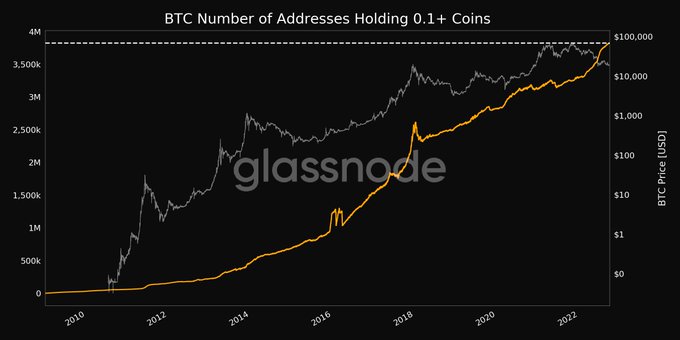

Hodling is among the favoured strategies in the crypto scene because coins are held for future purposes other than speculation. Glassnode stated:

“Number of BTC addresses holding 0.1+ Coins just reached an ATH of 3,824,449. Previous ATH of 3,824,379 was observed on 25 September 2022.”

Source: Glassnode

Therefore, BTC hodlers are not relenting in their conviction despite the top cryptocurrency trading on shaky grounds based on factors like tightened macroeconomic conditions.

Bitcoin was hovering around $18,895 during intraday trading, according to CoinMarketCap.

Meanwhile, Michael Saylor, the co-founder of MicroStrategy, recently opined that Bitcoin was 100x better than gold despite the market drawdown. He, therefore, expected BTC to emerge as the next big store of value.

“I think that the next logical step for Bitcoin is to replace gold as a non-sovereign store of value asset, and gold is a $10 trillion asset as we speak. Bitcoin is digital gold; it’s 100x better than gold,” Saylor said.

Image source: Shutterstock

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  WETH

WETH  Polkadot

Polkadot  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC