The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

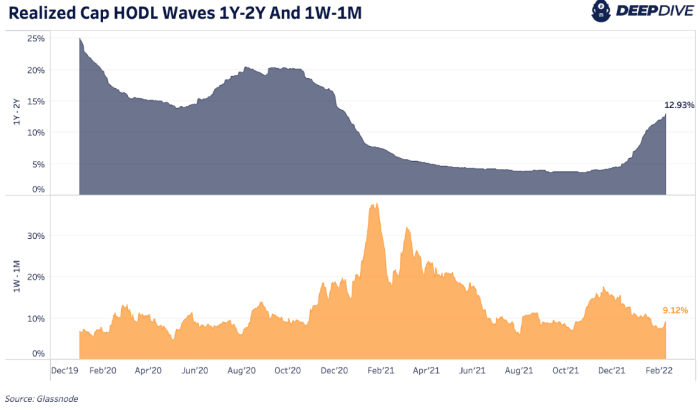

A key on-chain metric that we’ve discussed before, and that we will cover today, is the Realized HODL (RHODL) Ratio. The ratio uses realized cap HODL waves, which takes the original HODL Wave metric and weights the UTXOs in each age band by their realized price. Specifically the Realized HODL Ratio uses the one-week and the one-to-two-years Realized Cap HODL Age bands.

For a more in-depth overview of this metric, check out The Daily Dive: HODL Waves And Realized HODL Ratio.

By using this metric, we can better understand what’s happening with younger coins versus older coins. As younger coins become more dominant and the ratio rises, long-term holders hold less of the realized market value. As the ratio falls, long-term holders hold more market-realized value compared to younger coins. An overheated market would show much higher younger coin dominance.

In the previous bitcoin tops in 2021, we didn’t see the rise of younger coins relative to older coins like previous cycles. We saw the RHODL Ratio rise throughout the year, but it never became heated or overheated like the 2016 cycle. This can be due to a changing cycle, a more maturing market or the fact that we didn’t see the significant wave of new demand, younger coin buying, seen in past cycles.

Over the last month, we’ve seen a significant increase in the HODL Waves and Realized Cap HODL Waves one-to-two-years age bands. More coins are aging into this band and are taking up more economic weight in the RHODL Ratio calculation as more long-term held supply comes into the market. As a result, the RHODL Ratio is right around its 50th percentile inbetween a neutral and cooled state.

Historically, we’ve seen the one-to-two-years age band peak around 50% of supply, while it’s currently at 12.93%. We look to be headed into a trend of increased holder accumulation post a local bitcoin price top. As accumulation continues and older coins age in, the RHODL Ratio falls and makes bitcoin a more attractive historical buy.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)