It would be too early to predict the cryptocurrency market recovery, but there is a change in trends over the past two weeks that suggest investors’ trust was once again on the rise. As another week wrapped up with the price scale remaining low, the investors viewed this as a good opportunity to buy the largest digital asset Bitcoin, and get rid of Ethereum.

Bitcoin’s price chart indicated that the asset’s value has been fluctuating between $38,946 and $32,950. However, there was a high volume of trades carried out between $38,946 and $36,247. This suggested that most buyers bought the digital asset between the abovementioned price range and continued to maintain this range as the week progressed.

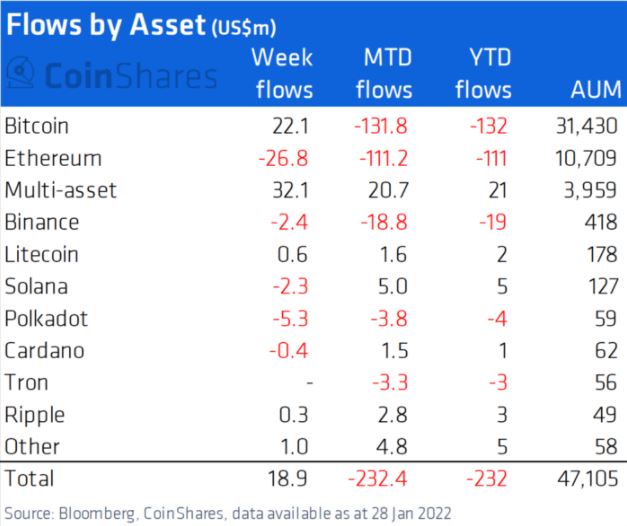

As per the CoinShares report, inflows in Bitcoin totaled $22 million over the last week.

Despite the price being restricted under $40,000, this was the second consecutive week for investors to buy more Bitcoin. In fact, we can witness an increased price sensitivity to monetary policy statements. The recent Federal Open Market Committee [FOMC] meeting had an immediate intraday price response.

The chart under will highlight this change in the crypto asset flows turning positive.

The above chart noted that even though there were inflows, it was limited to a low value of $19 million. Nevertheless, it was an indicator of investors cautiously adding positions at these low price levels.

While Bitcoin once again gained investors’ favor, Ethereum failed to convey confidence. The altcoin continued to suffer from negative sentiment as it witnessed outflows of $27 million. This was its eighth consecutive week of outflows bringing the total outflows for the digital asset to $272 million. This represents 2.4% of AuM.

Meanwhile, other altcoins like Polkadot, Solana, and Cardano were also witnessing heavy outflows suggesting the investors were currently keeping their distance with altcoins. However, their multi-asset funds, which was a combination of coins, saw inflows of $32 million. This was the highest since June 2021, meaning that investors were adopting a diversified investment approach.

As the investors are looking towards more investment opportunities, it would be a good time for a nominal recovery of the market. This could boost more confidence among holders and traders and offer a window of relief to the depressing price movement.

As we close in on yet another weary week, will the investors keep up with the momentum? The current price movement of Bitcoin revealed the asset was starting to recover after a jolt of selling pressure at $38,770 resistance.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  MANTRA

MANTRA  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC