The biggest news in the crypto-verse for Dec. 2 includes Bitcoin’s negative 1.4% reaction to the U.S. payroll data, FTX Japan’s efforts to bring liquidity back, and Binance’s $3 million freezing as a precaution after the Ankr protocol got exploited.

CryptoSlate Top Stories

Bitcoin drops 1.4% on better-than-expected U.S. payroll data

The U.S. Bureau of Labor Statistics’ recent payroll data revealed that 263,000 jobs were added during the month of November. Bitcoin (BTC) reacted to this news by falling 1.4% to be traded at $16.780.

FTX Japan to Unfreeze Withdrawals of Client Funds

FTX’s Japanese subsidiary has been working on a financial plan to allow users to withdraw funds.

On Dec. 2, the subsidiary announced that the related authorities approved its plans and that the users would be able to withdraw soon.

Binance freezes $3M from Ankr exploit.

An attacker exploited a bug in Ankr Protocol’s (ANKR) code and minted six quadrillions of aBNBc tokens. The exploiter converted a part into a $5 million Coin (USDC).

Possible hacks on Ankr and Hay. Initial analysis is developer private key was hacked, and the hacker updated the smart contract to a more malicious one. Binance paused withdrawals a few hrs ago. Also froze about $3m that hackers move to our CEX.

— CZ 🔶 Binance (@cz_binance) December 2, 2022

Binance’s CEO Changpeng Zhao said that the exchange froze around $3 million of its funds in response to the exploit.

Over 8% of Bitcoin supply was bought between $15.5K and $17K

According to the UTXO Realized Price Distribution (URDP) metric, 8% of the total Bitcoin supply was purchased when the price was between $15,000 and $17,000.

While the 8% volume signals that further redistribution is likely, Bitcoin consolidation remains high, which suggests long-term holders are in control.

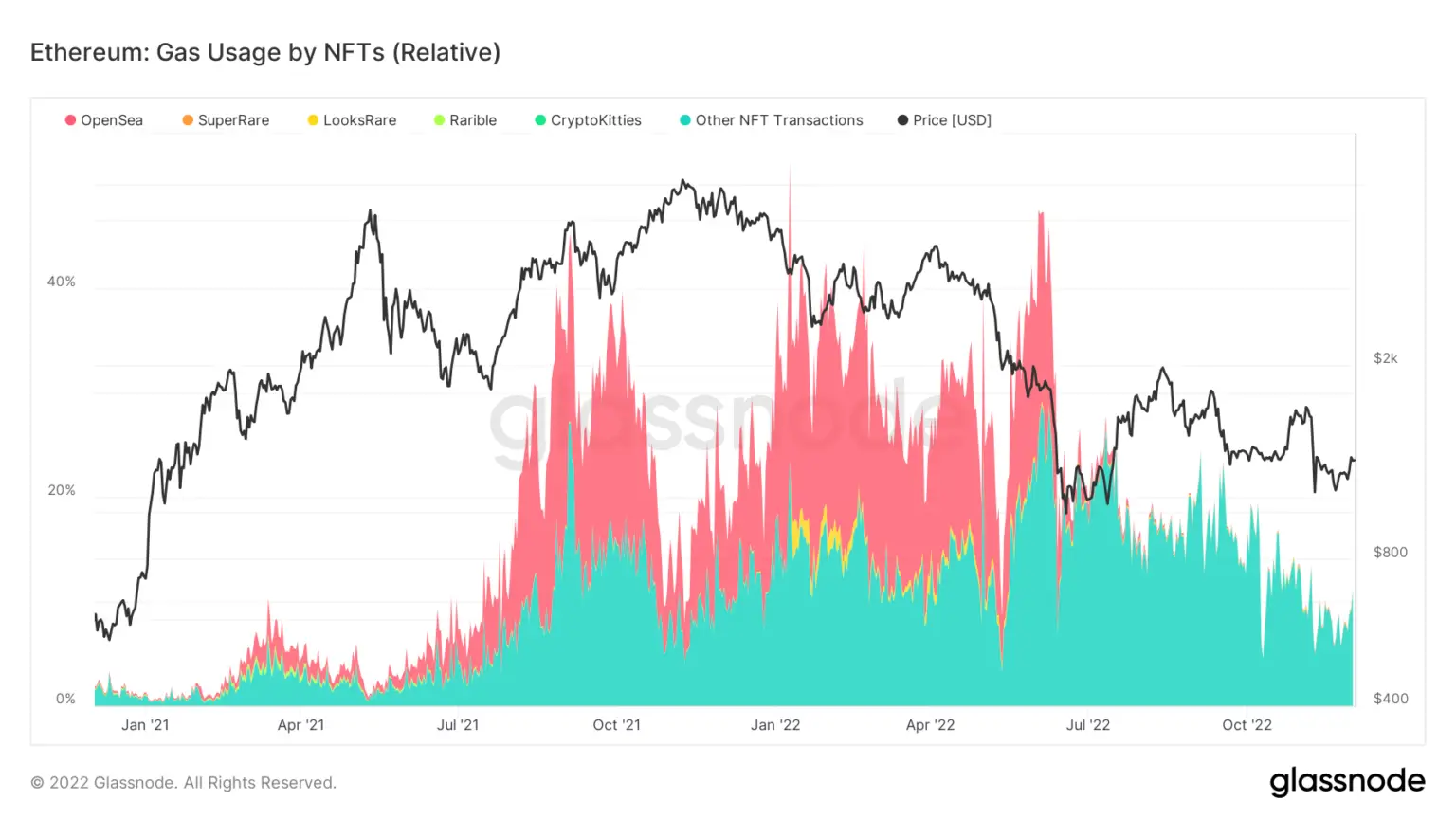

OpenSea’s Ethereum gas usage has declined to almost zero

NFT marketplace OpenSea’s Ethereum (ETH) gas usage has been declining for the last five months.

According to the data from Dune Analytics, gas fees in ERCC721 and ERC1155 token standards that took place in major NFT marketplaces spiked between Oct. 2021 and January 2022, and OpenSea accounted for around 20% of this volume.

However, for the past five months, OpenSea’s percentage shrunk, allowing Optimism and Arbitrum to grow.

Galaxy Digital wins bid for GK8 in Celsius bankruptcy asset auction

Galaxy Digital announced acquiring GK8 without disclosing the sum. GK8 is a self-custody program and was acquired by Celsius in Nov. 2021, which went bankrupt after the Terra collapse.

Galaxy’s CEO said acquiring the self-custody platform is a “crucial cornerstone” in establishing a full-service financial platform.

U.S. lawmakers question private firms’ role in the development of a CBDC

In response to the allegations that private firms are being involved in designing the “hypothetical” U.S. Central Bank Digital Currency (CBDC), the U.S. lawmakers composed a joint letter to send to the Federal Reserve Bank of Boston.

The lawmakers claimed that some private firms involved in the CBDC project might be participating in leveraging the project as research and developing and scaling other CBDC products to sell to commercial banks in the future.

CBDCs: India’s digital Rupee falls flat as low volumes blight trial run

Despite their negative attitude towards the crypto market, Indian lawmakers have always found CBDCs helpful.

India’s digital Rupee has been up and running as a pilot program since the beginning of November. It finally went live on Dec. 1, but the news outlets reported that it failed to catch on.

Research Highlight

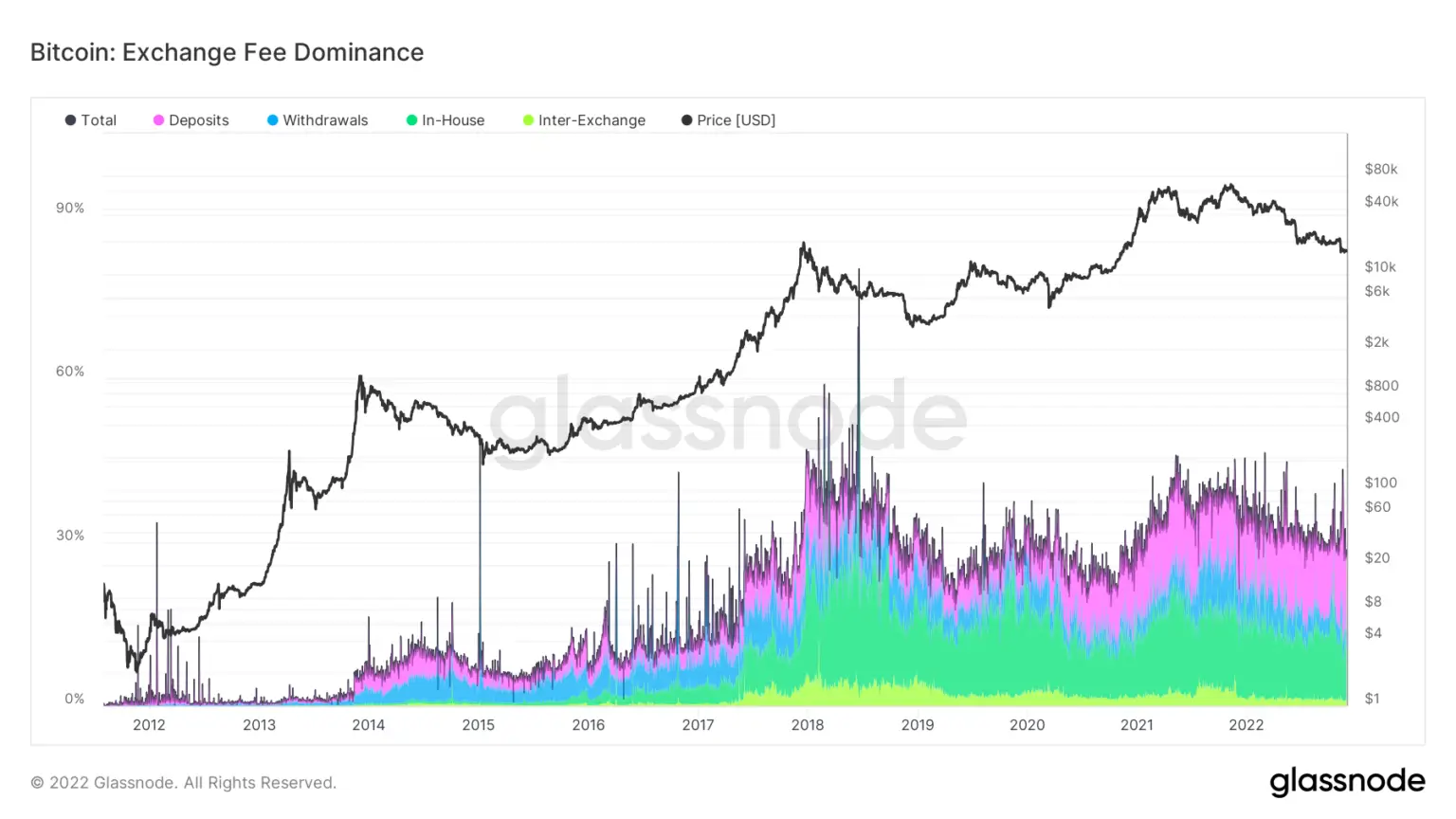

Research: Analysis of crypto transaction fees suggests exchanges prefer to move to Bitcoin.

CryptoSlate analysts looked into the on-chain data on the crypto exchange’s internal transactions to reveal that they prefer to use Bitcoin to transfer funds internally.

The Exchange Fee Dominance metric is a percentage of total transaction fees paid concerning on-chain exchange activity. The type of transaction that costs a fee is divided into deposits, withdrawals, in-house, and inter-exchange.

The chart above shows Bitcoin transaction fees consisted of 36% of all exchange revenue sources related to Bitcoin. It also demonstrates that deposits and in-house transfers have grown exponentially over the past five years.

CryptoSlate Exclusive

Mythbusting Solana – downtime, competition, and technology with Matt Sorg of Solana Foundation – SlateCast #38

Solana Labs’ Product and Technology Leader, Matt Sorg, gave an exclusive interview to CryptoSlate and talked about Solana (SOL) and its future in the crypto sphere.

Sorg said he was drawn to Solana because it was a “differentiated technology” in terms of scalability, speed, and future potential. He said:

“Solana is differentiated technology, there is a lot of noise in the space about how things l scale in the future but Solana is ready today and has a very clear path in scaling very arbitrarily in the future in a very user-friendly way.”

Sorg also mentioned that he expected the crypto space to evolve into a multi-chain future where “different chains and different protocols will take some learning from other protocols.” He argued that Solana would be more configurable over time to fit into this multi-chain environment.

News from around the Cryptoverse

Alameda invested in Genesis before the collapse.

According to Bloomberg, Alameda Research invested $1.15 billion in total in Genesis Digital before the market imploded and the mining industry started to suffer.

Galaxy CEO expects Bitcoin to see $500K

According to a Bloomberg article published on Dec.1, Galaxy Digital’s CEO Michael Novogratz expects Bitcoin to increase to $500,000 based on the Federal Reserve’s interest rate increases.

House Committee on Financial Services thanks SBF for being candid

The U.S. House Committee on Financial Services chair Maxine Waters Tweeted to thank FTX founder Sam Bankman-Fried for being candid about the FTX fallout and invited him to join their hearing on Dec. 13.

Binance Labs to invest $4.5 million in Ambit Finance

Binance Labs announced that it committed to investing up to $4.5 million in Ambit Finance to boost trustless DeFi development on BNB Chain.

Crypto Market

In the last 24 hours, Bitcoin (BTC) increased by +0.33% to trade at $17,001, while Ethereum (ETH) increased by +1.11% to trade at $1,288.

Biggest Gainers (24h)

Biggest Losers (24h)

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Polkadot

Polkadot  Litecoin

Litecoin  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Internet Computer

Internet Computer  Aptos

Aptos  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  OKB

OKB