Last week, the crypto market experienced a massive sell-off that sent Bitcoin’s price down to as low as $25,000. The sharp market movement ended several months of unprecedented calmness in the crypto market.

Previous CryptoSlate analysis pinpointed the derivatives market as the primary catalyst for the aggressive sell-off. The futures market saw a significant deleveraging event, resulting in the closure of over $2.5 billion worth of perpetual futures contracts closed out in a single day.

On the other hand, the options market remained remarkably resilient during Bitcoin’s price decline. Glassnode data showed a consistent open interest for both call and put options, indicating that these instruments were largely unaffected by the market volatility.

However, it wasn’t all smooth sailing for options. One notable shift the market saw was the aggressive repricing of volatility.

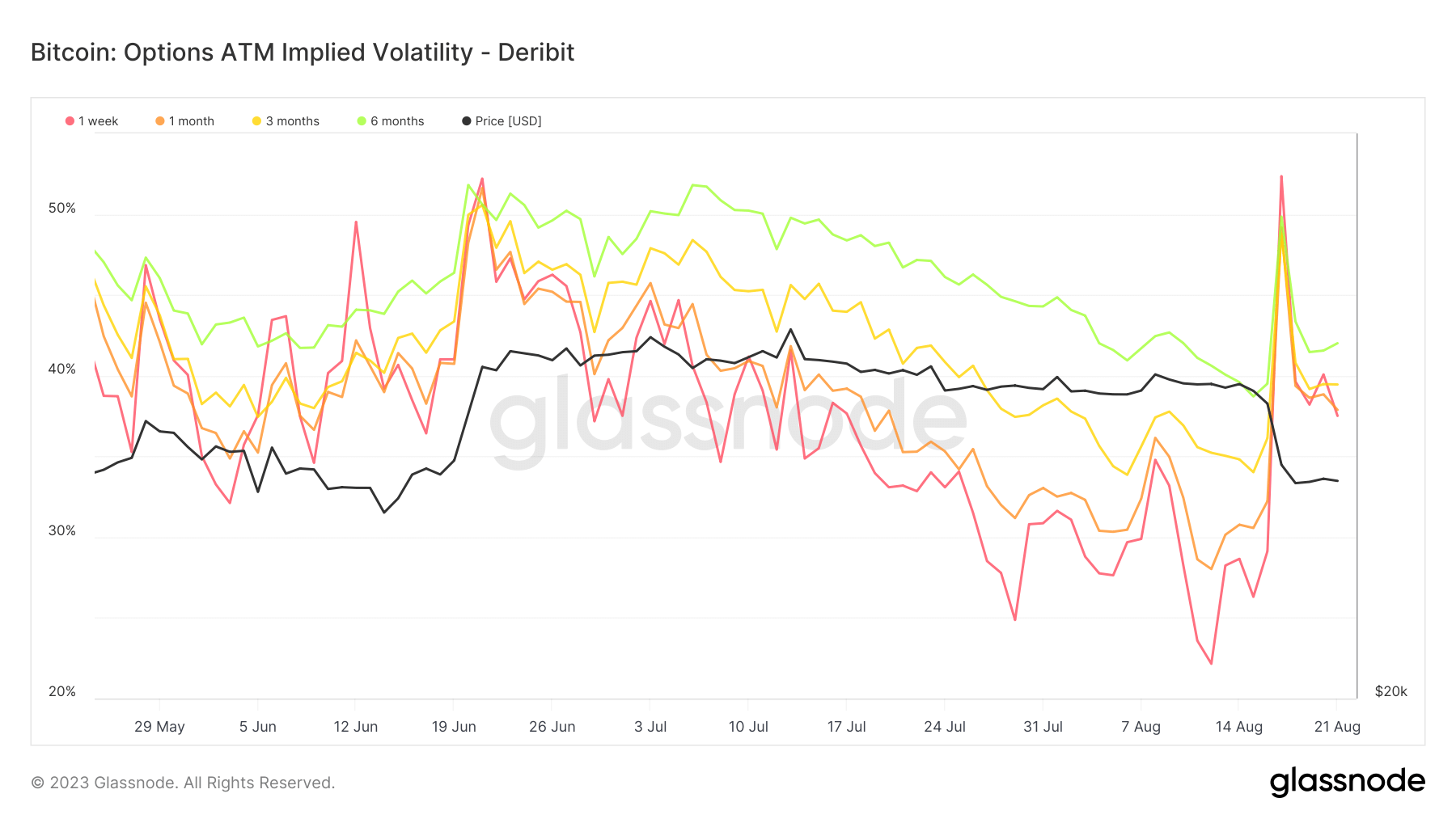

Implied volatility, a market metric that predicts the potential magnitude of asset price fluctuations based on options prices, has been unprecedentedly low throughout the summer. Implied volatility is an important metric to monitor as it provides insights into future price fluctuations, influencing trading strategies.

The tranquility in implied volatility was wiped out last week during Bitcoin’s price slump. Bitcoin’s drop to $25,000 caused the implied volatility for options set to expire in a week to nearly double. Specifically, it surged from 22.15% on August 12 to 52.35% on August 18.

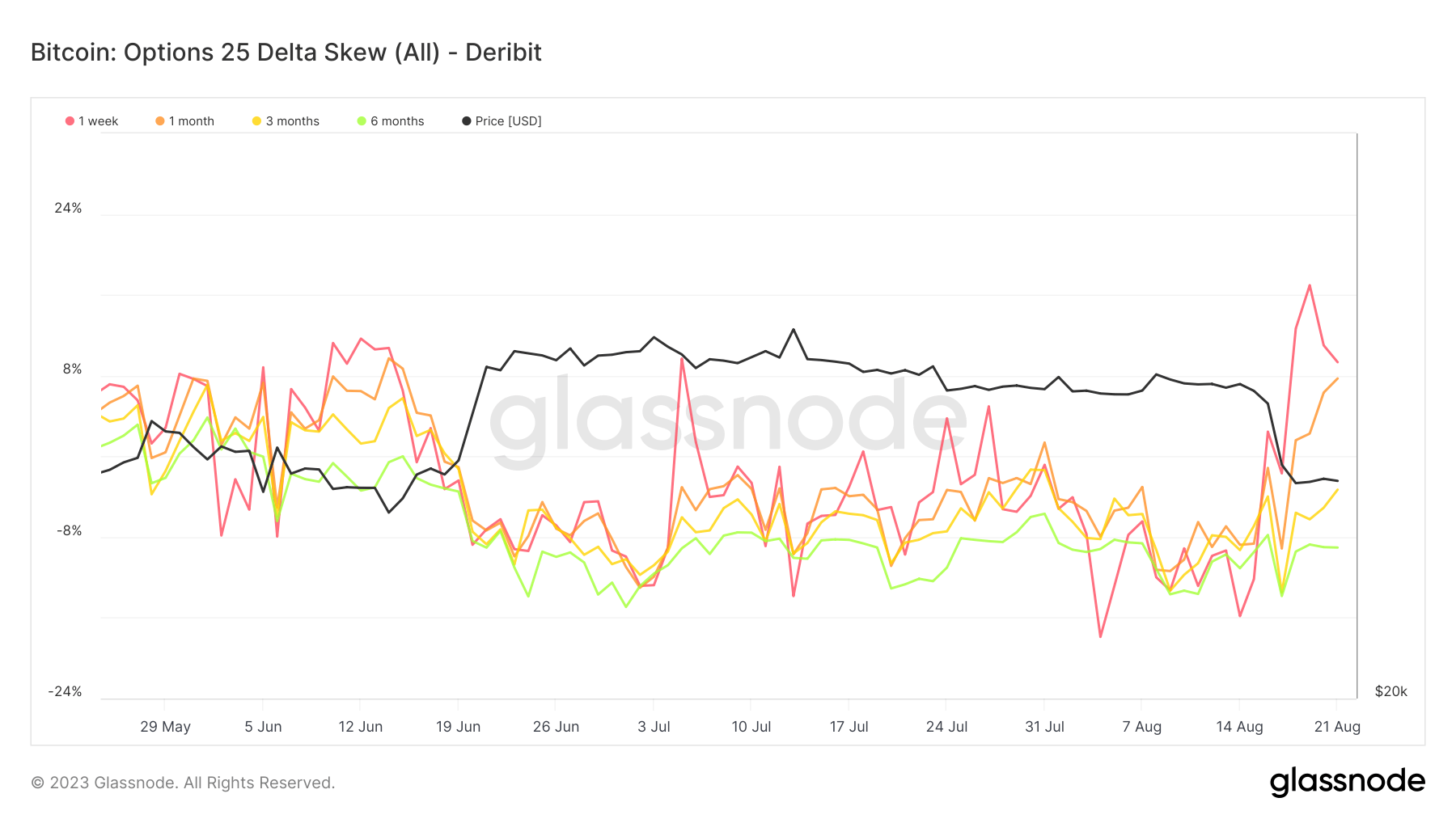

Another metric that underwent a significant shift was the 25 delta skew for options. This skew, which measures the difference in implied volatility between out-of-the-money puts and calls, leaped from -15.8% to 16.9% for options expiring in one week. A positive skew indicates that puts are more expensive than calls, suggesting a higher demand for downside protection and bearish sentiment.

While the crypto market’s recent turbulence rattled many sectors, the options market remained a beacon of stability, at least in terms of open interest. However, the sharp adjustments in implied volatility and the 25 delta skew underscore the market’s heightened sense of uncertainty and caution.

The post Bitcoin dips but options market holds steady appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC