On-chain data shows the Bitcoin mining difficulty is heading towards its sixth consecutive increase, which would be a new record for 2023.

Bitcoin Mining Difficulty Estimated To See Almost 4% Rise This Weekend

The Bitcoin “difficulty” refers to a feature on the blockchain that controls how hard the miners would find it to mine blocks right now. The metric’s value is measured in terms of the number of hashes that miners would need to generate before the next block can be found.

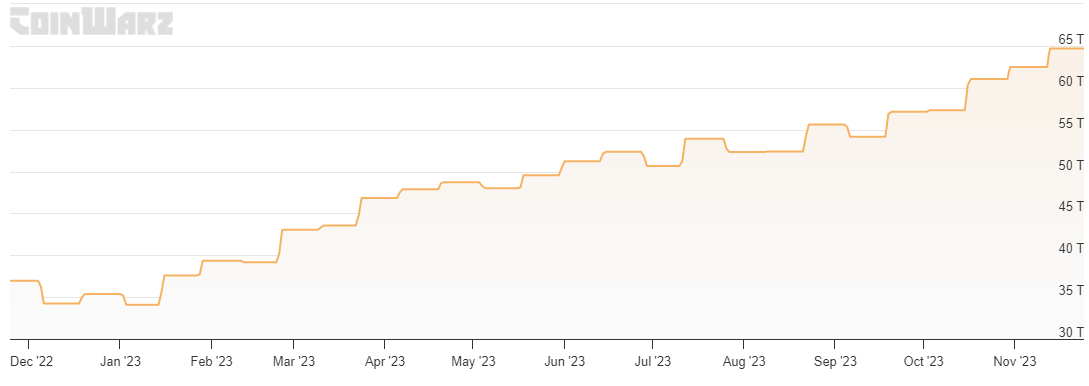

The network automatically adjusts its difficulty approximately every two weeks, and according to data from CoinWarz, the Bitcoin difficulty is set to see another such adjustment over the upcoming weekend.

Looks like the metric's value is about to go up | Source: CoinWarz

As you can see above, the Bitcoin mining difficulty is estimated to increase by over 3.8% in this coming adjustment, which would take its value to 67.14 trillion.

Now, the main question is: what’s the reason behind this difficulty increase? To understand this, you may first have to know why the difficulty feature exists on the network at all.

Whenever miners solve blocks, they get compensated in terms of BTC rewards. These BTC rewards are the only way to produce more of the cryptocurrency, so the rate at which these chain validators mine serves as the production rate for the asset.

Whenever the miners increase their total computing power (the hashrate), they naturally become faster at hashing blocks, thus claiming the BTC rewards.

Now, consider a scenario where the difficulty doesn’t exist. If miners continued to increase their computing power indefinitely, they could mow through blocks faster and faster. Eventually, the asset’s value would tank because of inflation as the market is flooded with new tokens.

Satoshi had foreseen the issue, and in an attempt to solve it, the anonymous creator had made it so that the miners would always mine at close to a network-standard rate of 1 block per 10 minutes. The feature that ensures that this is followed is indeed, the mining difficulty.

The above table shows that the average Bitcoin block time is 9.63 minutes currently, which is faster than the rate the blockchain intends to keep. This is the reason why the difficulty will go up in the next adjustment; miners will be slowed back down to the desired pace once they find it harder to find blocks.

The root cause of the recent faster block time lies in the explosive hashrate growth that the network has observed recently.

The 7-day hashrate has continued to rise | Source: Blockchain.com

Between the strong price growth and a spike in the transaction fees due to the Inscription hype returning and the network activity surging, miners have been having a great time in terms of their revenue.

So, it’s not surprising that the Bitcoin hashrate has recently seen such a rapid rise, as miners are doing everything to capitalize on the profitable opportunity.

As the metric has been setting new all-time highs for a while now, the difficulty has also been on its way up. The difficulty has seen five straight uplifts in the last five adjustments, matching the yearly record set in the year’s first half.

The value of the metric seems to have been going up since a while now | Source: CoinWarz

Thus, with another positive adjustment over the weekend, the Bitcoin mining difficulty will set another all-time high, breaking the 2023 record with a sixth consecutive rise.

BTC Price

Bitcoin is currently floating around the $37,800 mark as the asset gears up for another go at the $38,000 mark.

BTC is knocking on the door of $38,000 | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CoinWarz.com, Blockchain.com

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Polkadot

Polkadot  Litecoin

Litecoin  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Official Trump

Official Trump  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Internet Computer

Internet Computer  Aptos

Aptos  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  OKB

OKB