Bitcoin’s (BTC) correlation with the Nasdaq sank to 3% in June, according to data from Kaiko – indicating diverging sentiment between cryptocurrencies and tech stocks.

The price-performance for the leading cryptocurrency in June was between $24,800 and $31,360, opening the month at $27,200.

BlackRock’s spot Bitcoin ETF filing on June 15 was a bullish catalyst, reversing the prior downtrend to a new year-to-date high of $31,440 some eight days later.

Since then, Bitcoin has been trading in a narrow band between $29,860 and $31,030 – falling 3% since its YTD high on June 23.

Meanwhile, the tech-heavy Nasdaq 100 has been in a continuous uptrend since the start of the year – reaching a YTD high of $15,230 on June 16. Since Bitcoin’s year-to-date high on June 23, the Nasdaq has risen 0.7%.

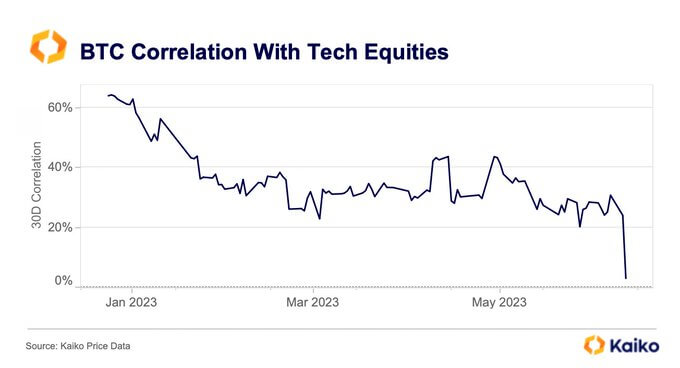

On a 30-day basis, the Bitcoin-Nasdaq correlation started the year at 60% and slipped to 22% by March, indicating a decrease in the similarity of price movements between the two. This period of change consolidated somewhat, with the correlation struggling to rise above 45%.

The Bitcoin-Nasdaq correlation has continued to move lower throughout the year, dropping sharply to 3% this week from over 20% in May.

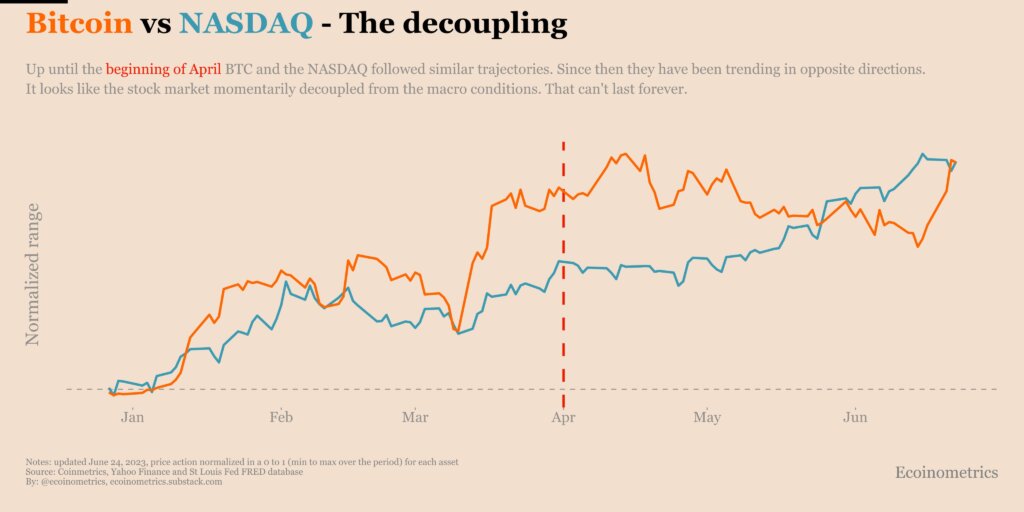

Data research firm Ecoinometrics published a chart of Bitcoin-Nasdaq range movements from the start of the year to June 24. It showed a similar trend between the two until April, after which a “nice decoupling” occurred.

Ecoinometrics further commented that the Nasdaq’s performance is disconnected from the broader macroeconomic landscape – implying an uptrend reversal is on the cards.

“But this bear market rally for stocks cannot escape the bleak macro picture forever.“

The post Bitcoin correlation to Nasdaq sinks to 3% low in June appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  LEO Token

LEO Token  Hedera

Hedera  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  Sonic (prev. FTM)

Sonic (prev. FTM)  sUSDS

sUSDS