Despite CFTC suing Binance, Bitcoin on-chain data has so far shown no signs of FUD developing among traders on the cryptocurrency exchange.

Bitcoin On-Chain Metrics Related To Binance Are So Far All Normal

Yesterday, news came out that the US Commodity Futures Trading Commission (CFTC) has filed a lawsuit against Binance and its CEO, Changpeng Zhao, for violating derivatives trading rules in the US. Following the announcement, the market reacted with the price of Bitcoin, which went below the $27,000 level.

Users on the exchange itself, however, seem to be calm so far. As an analyst in a CryptoQuant post explained, FUD around the exchange is currently not visible in BTC on-chain data.

The first relevant indicator here is the exchange netflow, which measures the net amount of Bitcoin entering into or exiting the wallets of the exchange. The below chart shows the recent data for this metric.

The value of the metric seems to have been slightly negative in recent days | Source: CryptoQuant

As displayed in the above graph, the Bitcoin Binance netflow has had a negative value recently, meaning that investors have withdrawn a net number of coins from the platform.

Normally, when exchanges have trouble surrounding them, investors develop FUD, and many withdrawals are seen from the exchange. However, while some withdrawals have been seen, their magnitude is still relatively low.

From the chart, it’s apparent that bigger spikes were seen earlier this month alone. This suggests that users haven’t gone into a state of panic yet as they feel safe enough to keep their coins in the custody of Binance.

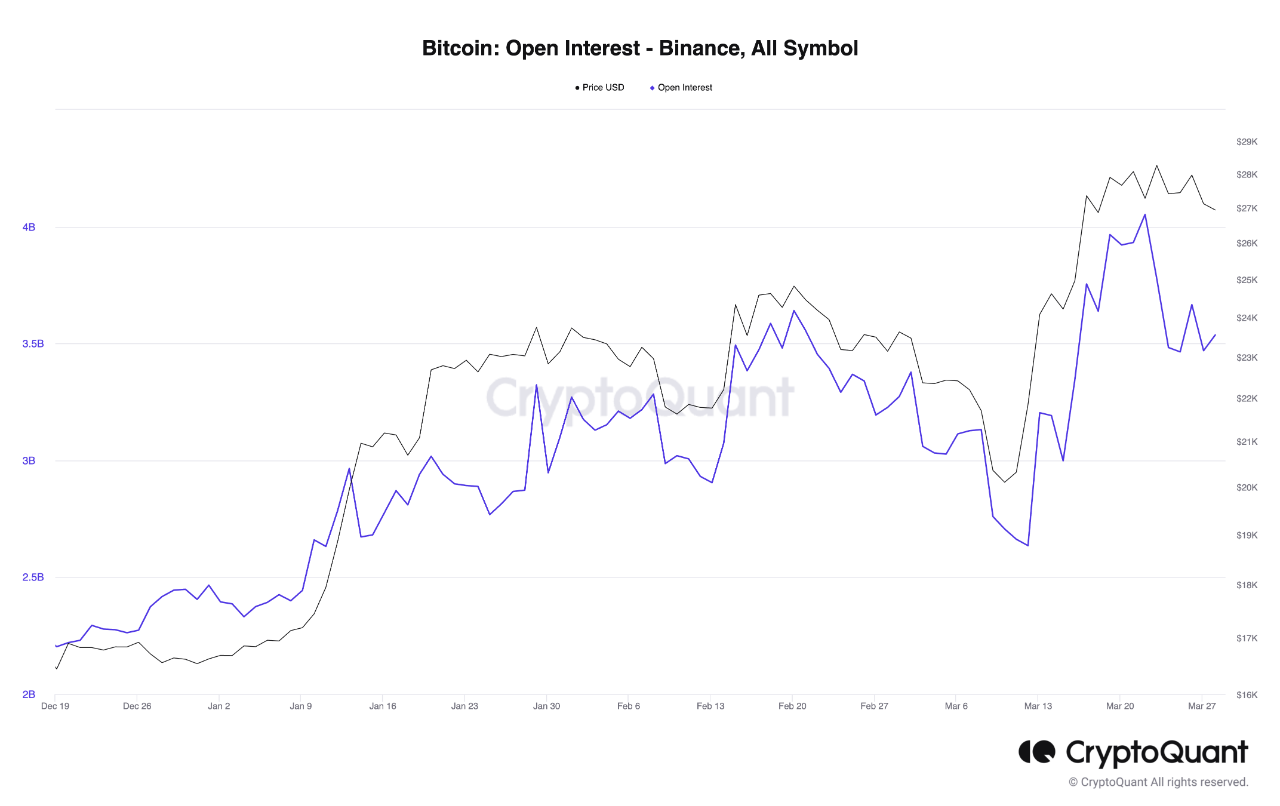

Next is the metric related to the derivative market, the open interest, which measures the total amount of Bitcoin futures trading contracts that are open on Binance.

Looks like the value of the metric has been relatively high recently | Source: CryptoQuant

As is visible in the graph, the Bitcoin open interest on Binance has climbed too high values with the recent price surge. The metric’s value has registered no significant change following the CFTC news, suggesting that the derivative traders have also not closed a large number of contracts and, thus, have not shown any signs of FUD.

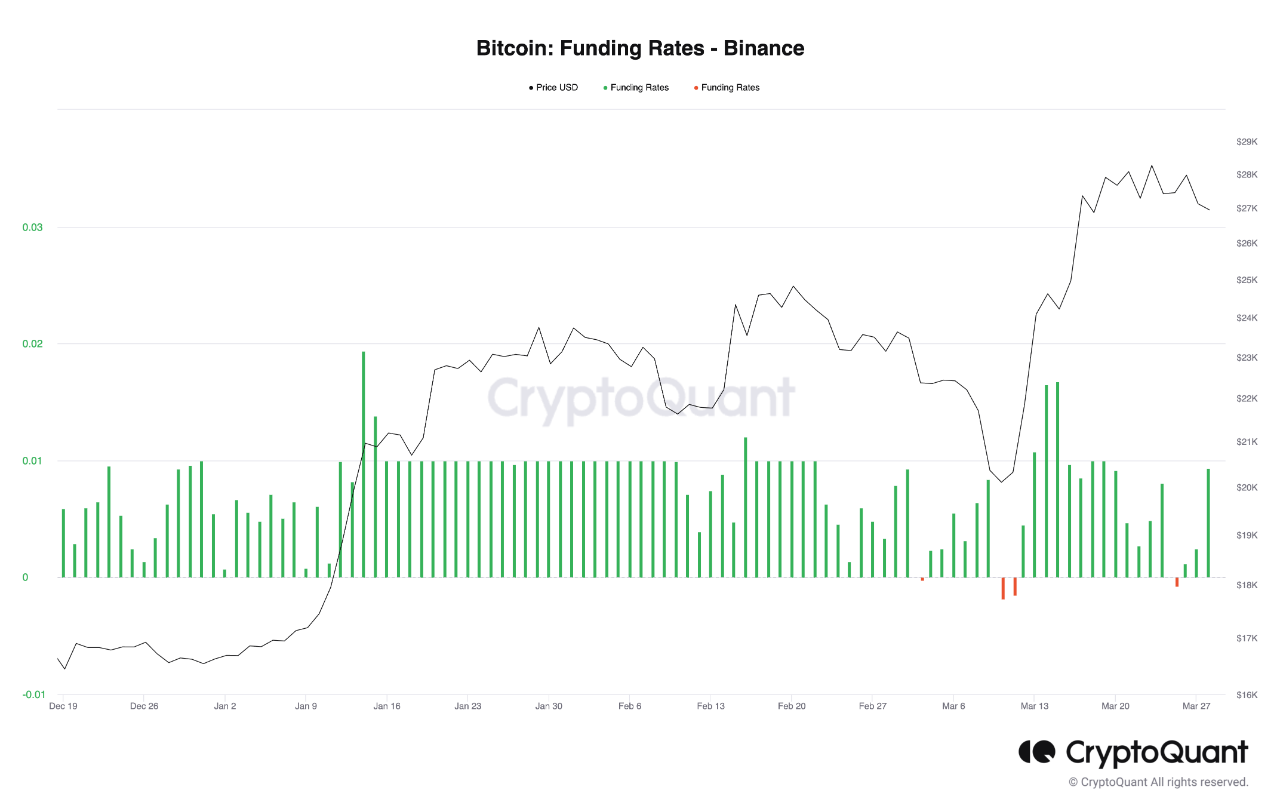

The funding rate, a measure of the periodic fee that futures contract traders are exchanging with each other, has also remained positive, showing that investors on the platform continue to be bullish about BTC.

The metric has a green value at the moment | Source: CryptoQuant

All these indicators show that traders on the platform, whether spot or derivative ones, have not shown any noticeable reaction to CFTC suing the exchange. That is, of course, at least the story so far; it’s currently unclear whether things might change in the coming days.

BTC Price

At the time of writing, Bitcoin is trading around $26,800, down 4% in the last week.

BTC has declined below $27,000 | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  Shiba Inu

Shiba Inu  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  WhiteBIT Coin

WhiteBIT Coin  Pepe

Pepe  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Dai

Dai  Internet Computer

Internet Computer  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)