Data shows a mass amount of short contracts have seen liquidation in crypto derivatives during the past day following Bitcoin’s rally above $66,000.

Bitcoin Recovery Has Triggered Large Derivatives-Related Liquidations

According to data from CoinGlass, the cryptocurrency market as a whole has observed a large amount of liquidations on the derivatives side over the last 24 hours.

“Liquidation” here naturally refers to the process that any contract undergoes after accumulating losses of a certain degree, where its platform has to close it up forcibly. Below is a table that shows the total amount of liquidation over the past day.

Looks like a large amount of contracts have been flushed during this period | Source: CoinGlass

As is visible, more than $135 million in cryptocurrency derivatives contracts belonging to over 52,000 traders were liquidated during this window.

This derivatives flush has disproportionately affected the short holders, as $93 million of their contracts were caught in it. In more concrete terms, 68.4% of the liquidations involved the shorts. This is natural because Bitcoin and other assets have seen green returns in the past day.

More than $42 million longs still managed to get liquidated despite the positive performance, suggesting that speculators jumped on with overleveraged positions when the surge took place. Still, they arrived too late and found liquidation when the initial leg-up cooled off.

As is usually the case, Bitcoin-related contracts contributed the most to this liquidation event, as the heatmap below suggests.

The breakdown of the liquidations by symbol | Source: CoinGlass

BTC’s $47 million liquidations significantly outweighed Ethereum’s this time, whose $16 million figure is more similar to Solana’s $12 million share. This would suggest the appetite for speculation around ETH has been unusually low recently.

A mass liquidation event like today’s is popularly known as a “squeeze.” During a squeeze, a sharp swing in the price triggers a large number of liquidations, which only feed back into the price move, thus unleashing a cascade of liquidations.

The shorts saw the most liquidations the past day, so the event would be called a short squeeze. Historically, such large liquidations haven’t exactly been rare in the cryptocurrency market.

This is because most coins can be quite volatile, and speculation is rife. Overleveraged positions can be quite risky in this market, so it’s not surprising that when volatility like today’s emerges, many traders get caught off guard.

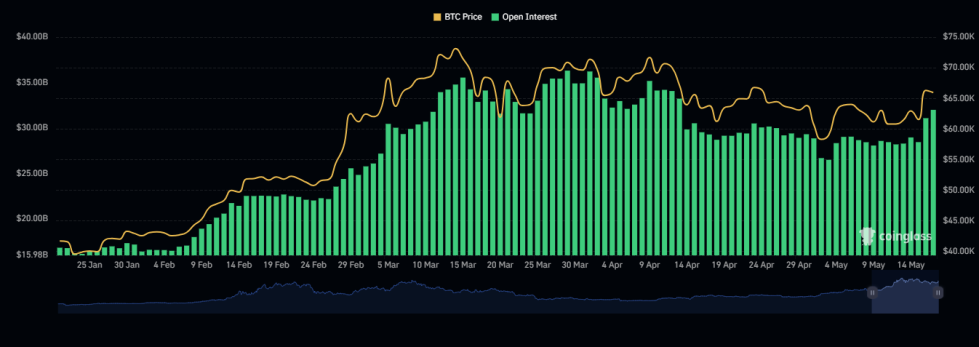

The warning signs that liquidations would pop up had already appeared when the surge began yesterday, as the Bitcoin futures Open Interest, a measure of the total amount of open positions, had shown a rise.

The value of the metric appears to have gone up over the past couple of days | Source: CoinGlass

The chart shows that Open Interest is still high even after the surge, suggesting that the squeeze hasn’t been able to put off the speculators.

BTC Price

At the time of writing, Bitcoin is trading at around $66,000, up 8% over the past seven days.

The price of the coin seems to have shot up over the last day | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, CoinGlass.com, chart from TradingView.com

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Litecoin

Litecoin  Polkadot

Polkadot  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Aptos

Aptos  Internet Computer

Internet Computer  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  OKB

OKB