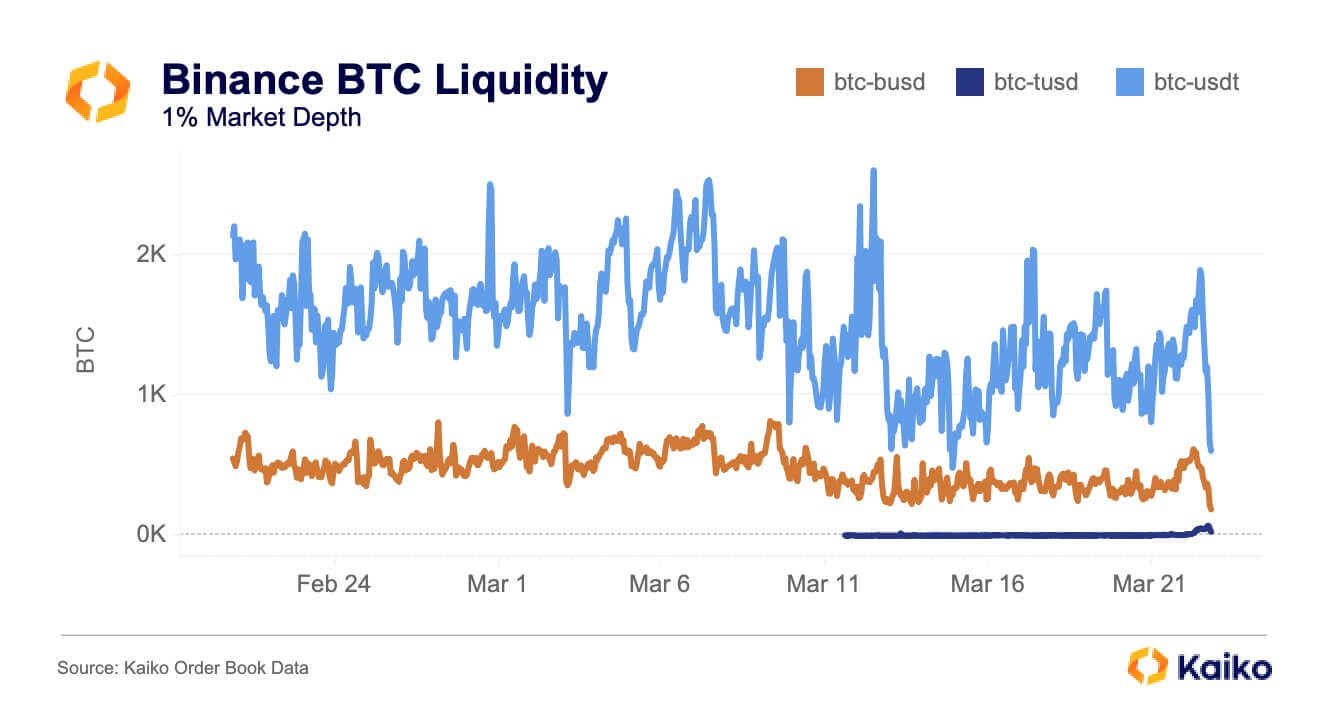

Binance’s Bitcoin (BTC) liquidity for its TrueUSD (TUSD) rose more than 250% on March 22 after it phased out its zero-fee trading for other stablecoins.

Kaiko Data researcher Riyad Carey highlighted that the exchange’s BTC liquidity for Binance USD (BUSD) and Tether’s USDT declined by 60% and 70%, respectively.

Meanwhile, the exchange’s liquidity for TUSD increased to 29 BTC from 9 BTC within a few hours.

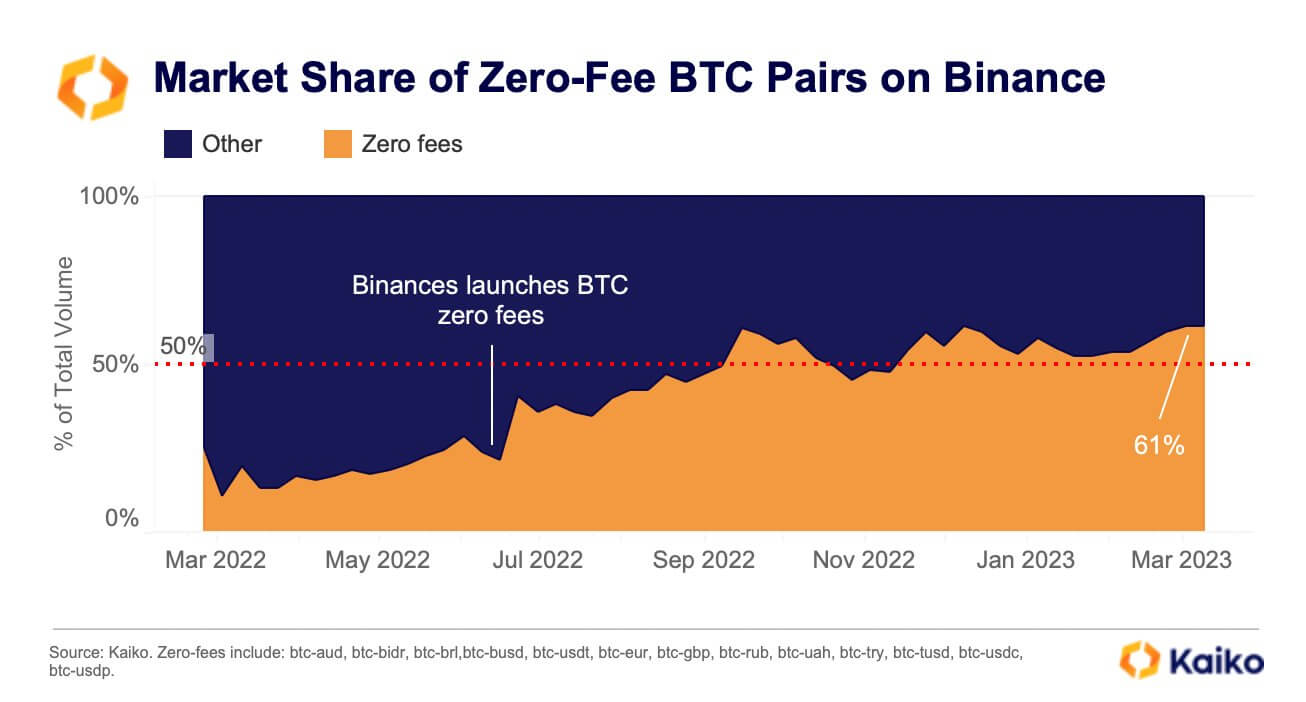

On March 15, Binance announced it was moving the zero-fee BTC trading feature from BUSD to TUSD on March 22. At the time, CEO Changpeng ‘CZ’ Zhao blamed the regulatory upheaval the other stablecoins faced for the firm’s decision.

Will this decision affect Binance’s market share?

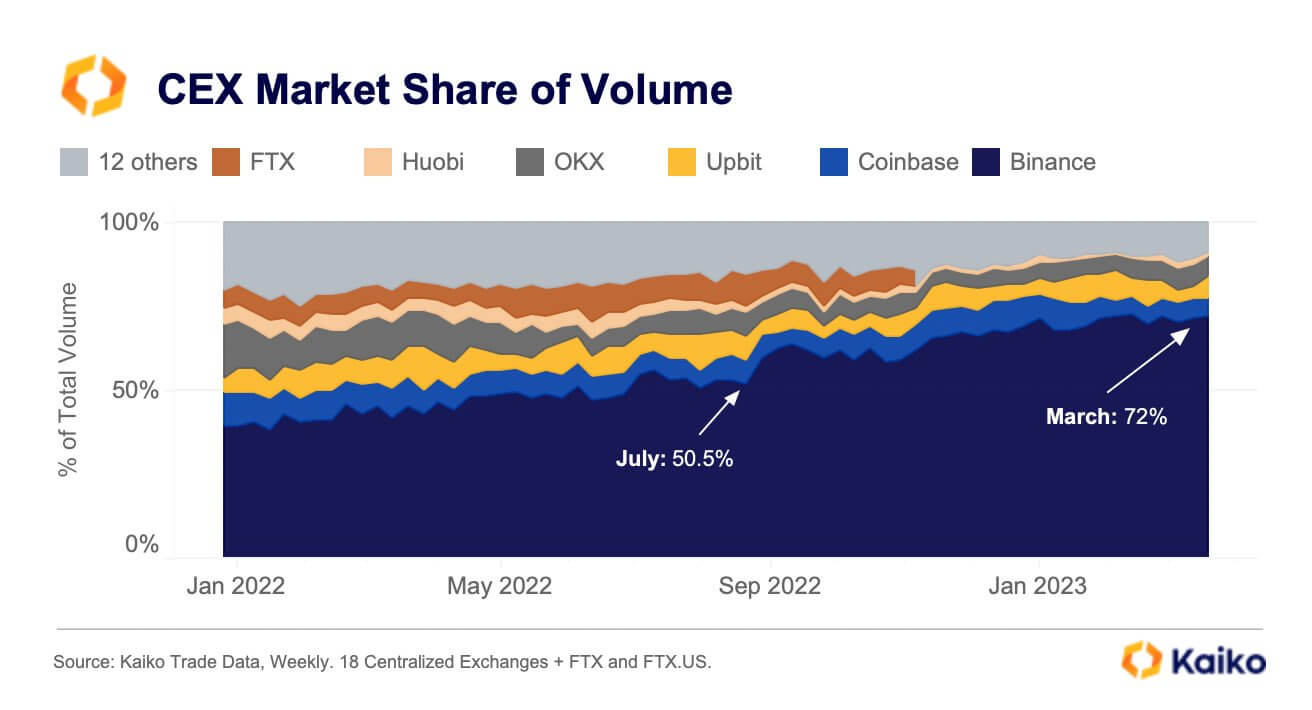

Kaiko’s director of research, Clara Medalie, highlighted the role the zero-trading fee option played in improving Binance’s market share.

According to Medalie, the free trading option helped Binance gain an additional 20% of the market since it was introduced in July 2022. At the time, Binance controlled only 50.5% of the market; however, the exchange’s market control increased to 72% following FTX’s collapse in November 2022.

Additional information from Kaiko pointed out that the zero-trading option accounted for 61% of the total volume on Binance as of the previous week.

Binance users drawn to the exchange because of its zero-fee feature could leave for other rival platforms, Medalie noted.

TUSD keeps growing

Binance’s decision would greatly benefit TUSD — emerging as a significant winner from its rivals’ recent debacle.

Carey added that Binance’s decision showed that it had made an apparent move to promote TUSD as the successor to BUSD.

Since the crackdown on BUSD, TUSD has seen its circulating supply double to over $2 billion and become the second-largest stablecoin on the Tron network. During the period, Binance minted more TUSD stablecoin and added new trading pairs for the asset.

Meanwhile, Protos’ researcher Bennett Tomlin pointed out that TUSD is one of the weirdest stablecoins in the crypto market. According to the researcher, TUSD has some undisclosed relations with Justin Sun, and bankrupt Alameda Research was also a lead investor in the asset.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  WETH

WETH  Polkadot

Polkadot  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC