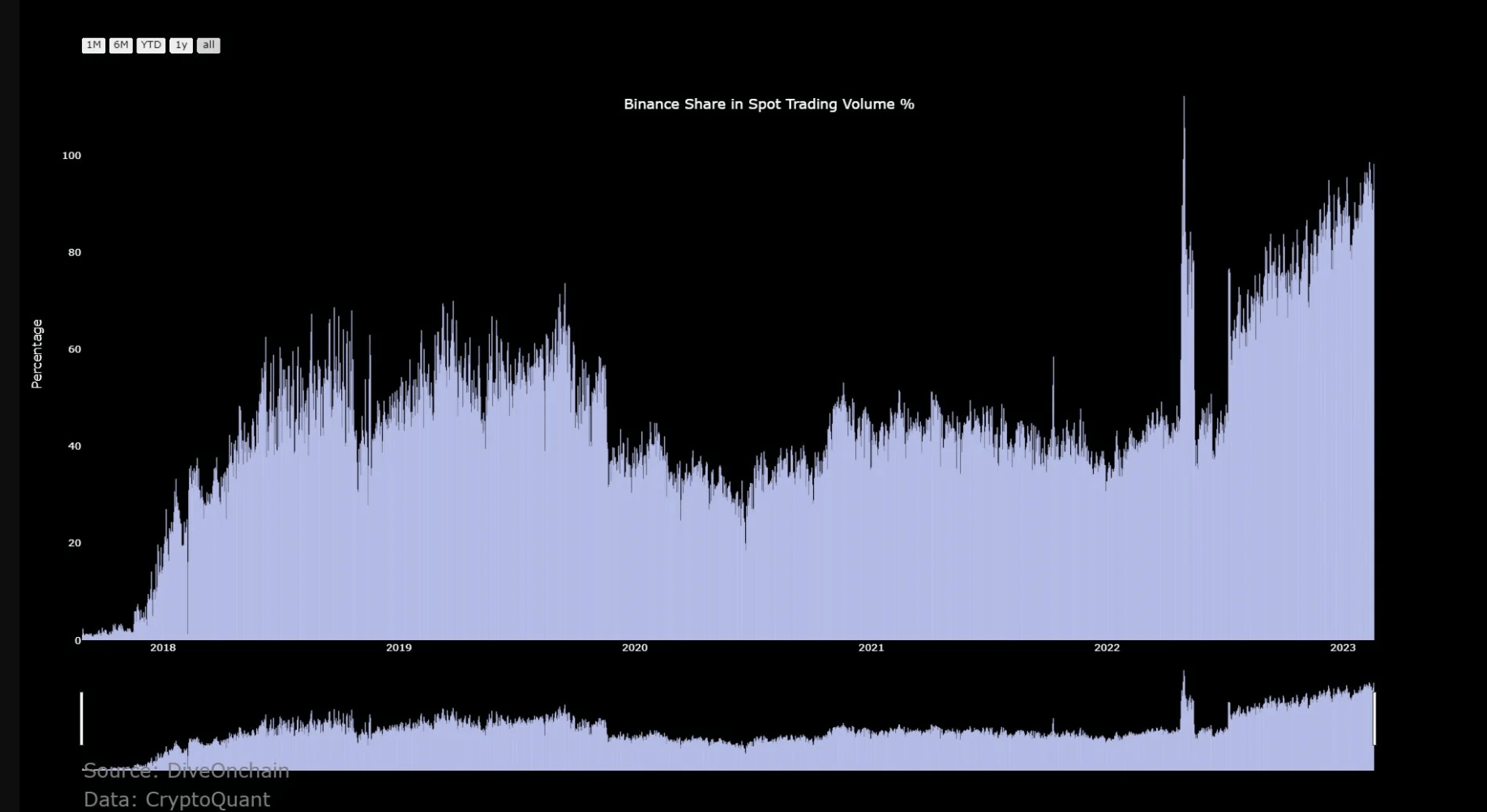

Binance is responsible for almost all Bitcoin (BTC) spot trading — with over 98% of transactions passing through the centralized exchange between Feb. 18-19.

Binance’s $6.8 billion dollar volume dominates others in the market — a trend that has only grown since the collapse of FTX, according to data from Coinalyze.

Binance has been gathering more market share by increasing its spot trading of BTC — over 5% growth since Jan. 2023. Additionally, Binance’s market share for spot volume has been continuously growing over the past year — which now amounts to almost 100% of the market share.

Binance’s success in dominating the BTC trading market can be attributed to its no-trading-fee policy. However, this also makes the exchange vulnerable to bots that can take advantage of the system. In contrast, exchanges like Coinbase charge fees of around $5-7 for transactions, making it less susceptible to bots.

In terms of daily trading volume, Binance remains the clear leader in the entire spot trading market, pushing over $21 billion, according to CoinMarketCap. Coinbase is the only other exchange with over $1 billion in daily exchange, with a trading volume of $1.4 billion.

The post Binance takes over 98% of all Bitcoin spot trading volume appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Ondo

Ondo  Aave

Aave  Bittensor

Bittensor  Aptos

Aptos  Dai

Dai  Internet Computer

Internet Computer  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  OKB

OKB  Tokenize Xchange

Tokenize Xchange  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC