Discover the top-rated defi tokens with high liquidity and promising communities.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The decentralized finance (defi) ecosystem is one of the fastest-growing markets with the promise of allowing investors more control over their assets without needing third-party actors.

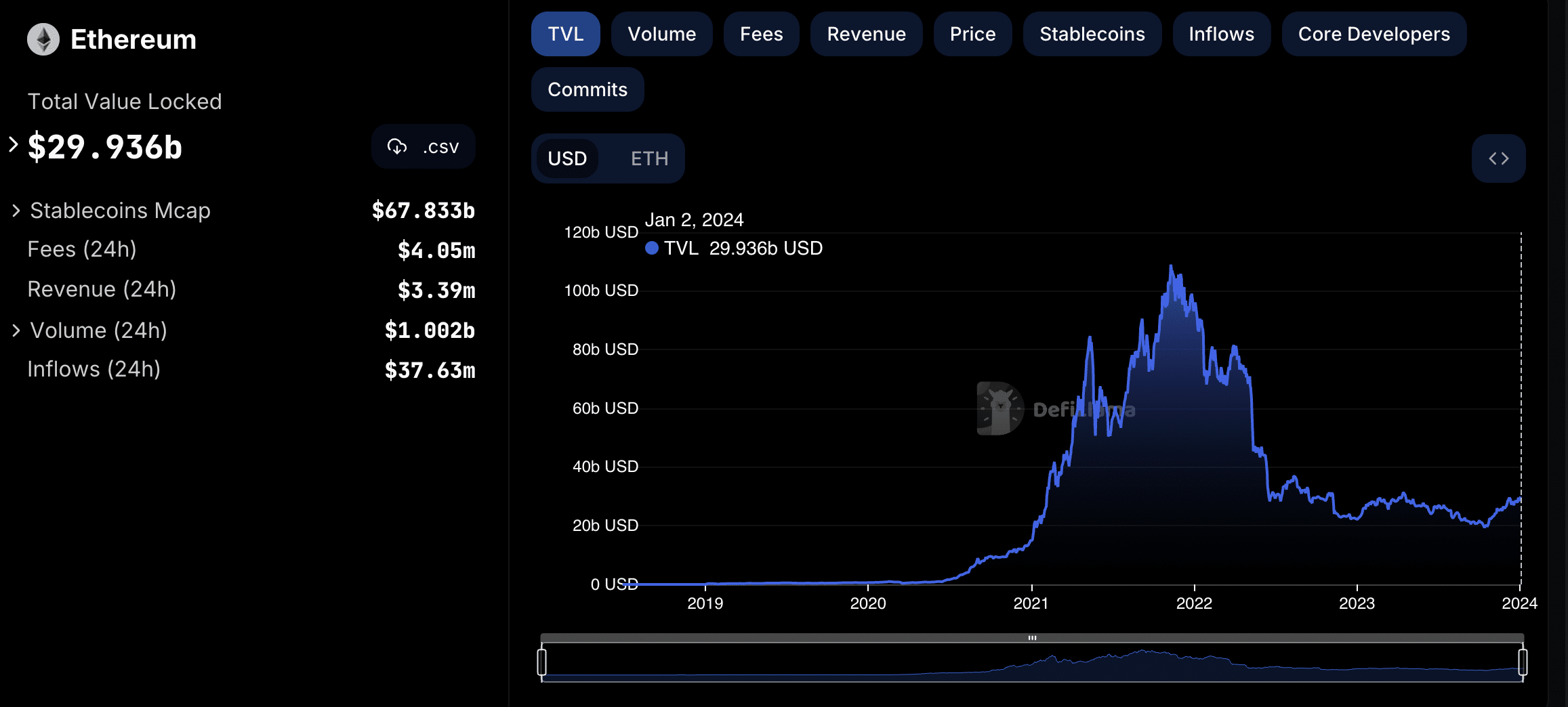

The defi total value locked (TVL) rallied to a whopping $179 billion in November 2021. However, according to DefiLlama, with the collapse of high-profile crypto companies in 2022, it dropped to a local low of $35 billion in October 2023.

The recent market-wide rally has helped defi projects gain momentum again. Per DefiLlama, the total defi TVL has been constantly rising since mid-October 2023, reaching $52 billion.

This guide explores the best performing defi crypto assets with high liquidity and great communities. Before deciding which coins are the best defi tokens to buy, conduct your own research and consider the risks.

Ethereum: the godfather

While many believe that the defi ecosystem was born with the creation of Bitcoin (BTC) in 2009, the Ethereum (ETH) blockchain provided a solid infrastructure for defi to be built on.

According to data provided by DefiLlama, Ethereum currently has a more than 50% share of the defi TVL, now standing at more than $29 billion. It’s important to note that layer-2 networks built on the Ethereum blockchain have been excluded from the TVL.

While Ethereum is not a defi protocol itself, it still gets the top spot on this list because its base infrastructure has helped many defi platforms and decentralized applications (dapps) run smoothly and reach millions of users.

Moreover, the development of Ethereum made it possible for developers to execute defi apps via its smart contracts.

Liquid staking protocols

Lido Finance: revolutionizing liquid staking

Lido Finance is a trailblazer in the staking category, emerging as the first mainstream liquid staking protocol in December 2020. Lido enables users to stake Ethereum and supported assets while maintaining liquidity.

According to the project, this flexibility allows users to earn staking rewards without locking up their assets – a feature that can be useful during periods of market volatility. Lido’s impressive TVL of over $22.5 billion makes it the largest defi protocol in the web3 scene.

Holders of Lido’s native token, LDO, can participate in governance decisions and benefit from the platform’s overall growth. With the rising prominence of liquid staking and Lido’s approach, LDO has the potential to become a valuable asset.

Rocket Pool: decentralized staking

Rocket Pool aims to simplify the staking process for Ethereum, adopting a decentralized approach. Through resource pooling, Rocket Pool allows individuals to stake with as little as 0.01 ETH, making staking accessible to a broader audience.

The protocol’s commitment to decentralization and community ownership, aligned with Ethereum’s principles, is evident in its TVL milestones. The defi protocol currently boasts a TVL of $2.9 billion, a notable increase from the $604 million figure in December 2022.

Rocket Pool’s native token, RPL, recently garnered attention following Coinbase’s investment in the token in August 2023. RPL holders have a stake in the protocol’s governance decisions. As the protocol gains popularity and trust, the RPL token could potentially witness increased demand.

Decentralized exchanges (DEX)

Uniswap: transforming token swaps

Uniswap is an automated market maker (AMM) that aims to democratize liquidity provision, enabling anyone to become a liquidity provider and earn trading fees.

With a TVL of over $3.8 billion, Uniswap is a critical infrastructure piece in the defi ecosystem, facilitating seamless token swaps with minimal slippage and fees. Governed by the UNI token holders, the protocol ensures “active stewardship” for token holders.

Due to its role as a governance token, holders of UNI actively participate in making decisions and shaping the future of the fast-growing DEX.

Balancer: empowering customizable liquidity pools

Balancer, a multi-token automated market maker, empowers users to create or add liquidity to customizable pools, earning trading fees. Known for its flexibility, Balancer allows liquidity providers to create pools with up to eight tokens, setting custom weights.

Balancer’s TVL has surged to over $993 million, placing it among the top 20 defi protocols by total value locked. As a result, the decentralized protocol now plays a significant role in the defi ecosystem.

Balancer’s native token, BAL, is central to the protocol’s governance and liquidity incentives, facilitating crucial decision-making like other protocols. The flexibility of liquidity provision and governance participation positions BAL as a token to watch in 2024.

GMX: spot and perpetual DEX

GMX has swiftly gained recognition as a decentralized spot and perpetual exchange on the Arbitrum network. Offering low swap fees and zero price impact trades, GMX’s TVL of more than $600 million shows its rapid growth and increasing interest from the defi community.

The GMX token has already demonstrated its potential for massive price surges this year amid a rally to an all-time high (ATH) of $97 in April. Despite being 45% down from this value, the token shows promise, owing to the expansion of the GMX protocol.

Curve Finance: efficiency in stablecoin trading

Curve Finance facilitates stablecoin trading in the defi space. As a DEX centered on stablecoins, Curve uses an AMM to minimize slippage and facilitate seamless trading between stable assets. The platform promises supplementary fee income for liquidity provision.

Curve Finance cuts across multiple chains — including Ethereum, Arbitrum, Polygon, and Avalanche. The protocol has maintained its influence in the defi market despite the $47 million reentrancy exploit in July 2023.

Lending protocols

AAVE: pioneering defi lending

AAVE operates as a decentralized money market protocol, allowing users to lend, borrow, and earn interest on cryptocurrencies.

Integrating features like flash loans and collateral swaps has attracted investors to AAVE. It has solidified its position as one of the largest defi lending platforms.

The protocol’s expansion to multiple chains, including Polygon and Avalanche, reflects its commitment to providing faster and more cost-effective solutions. The AAVE token emerges as a catalyst for advancements, with an impressive 55% over the past year.

Compound Finance: accessible lending and borrowing

Compound Finance differentiates itself with offerings such as cToken for multiple asset support, absence of credit checks, and dynamic interest rates. Users can supply assets to the protocol’s liquidity pool and earn interest or borrow against their supplied collateral.

Compound has recorded one of the largest surges in TVL, as the protocol breaks into the top 10 in the defi sector. The COMP token, representing a stake in governance, aligns the interests of all participants, contributing to a truly decentralized financial system.

Governance protocols

MakerDAO: the backbone of DAI stablecoin

MakerDAO, one of the largest protocols in the defi scene, operates as the backbone of the DAI stablecoin. Pegged to the US dollar and backed by surplus collateral, DAI aims to provide a stable and reliable form of cryptocurrency.

MakerDAO’s system allows users to open Collateralized Debt Positions (CDPs), lock in collateral, and generate DAI.

The governance model involving MKR token holders aims to ensure decentralization. In 2024, MKR stands out as one of the top defi tokens to watch, given its role in the MakerDAO ecosystem by acting as a mechanism to maintain DAI’s stability, as it is necessary for fees accrued Collateralized Debt Positions after DAI minting.

What is a defi coin?

A coin is usually associated with cryptocurrency. Defi coins or tokens allow you to utilize decentralized apps and platforms. These include decentralized exchanges, lending platforms, staking protocols, real-world assets, yield platforms, and dapps.

Is defi a good investment?

Every investment has its own set of risks. The defi coins mentioned above have high potential, great liquidity, and promising utilities. However, doing extensive research and taking caution before investing in defi coins is always necessary.

Where to buy defi cryptocurrencies?

You can buy defi cryptos on different centralized and decentralized exchanges. Some of the leading centralized crypto exchanges that allow you to invest in defi coins are Binance, Coinbase, KuCoin, Kraken, OKX, and Bybit.

How does defi’s future look?

Experts believe that the future for defi is bright as different countries are trying to utilize its potential. The global defi market size is expected to reach $232 billion by 2030. However, it’s crucial to remember that the crypto market is highly volatile. Consider learning how to invest in defi wisely, as it involves risks despite its potential growth.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)