Join Our Telegram channel to stay up to date on breaking news coverage

Investors are closely monitoring the altcoin market for potential breakout opportunities as this year’s bull run approaches. Several low-cap coins show signs of significant upside potential. Analysis suggests that some of these assets could see remarkable price rallies. This article explores those promising tokens poised to reach all-time highs (ATH) based on technical analysis and market sentiments.

Best Crypto to Buy Right Now

Uniswap Labs recently announced several exciting developments for the Uniswap community and gaming enthusiasts. The platform merged with the CTG team, leading to the release of ‘Crypto: The Game Season 3’. Meanwhile, Polkadot has upgraded its ecosystem to enhance decentralized finance (DeFi) growth by improving liquidity and trading efficiency.

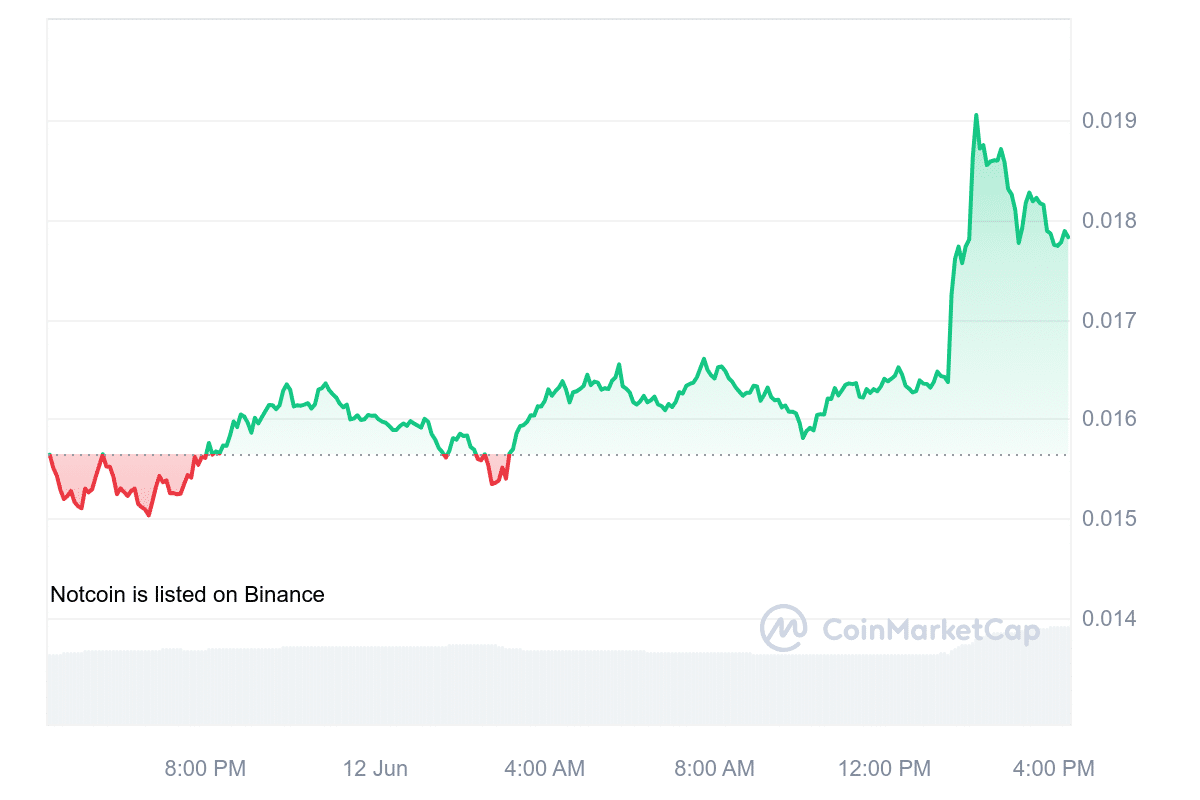

Furthermore, Wiener has successfully raised over $5 million in its presale. Additionally, Notcoin has been in high demand, with its token recently changing hands at $0.01588, reflecting a 19.03% intraday increase. These developments highlight significant strides in the crypto space, with these tokens each making notable progress.

1. Uniswap (UNI)

Uniswap Labs recently announced several exciting developments for the Uniswap community and gaming fanatics. The platform recently merged with the CTG team, leading to the release of ‘Crypto: The Game Season 3’.

This collaboration aims to provide an immersive gaming experience. According to the Uniswap Labs blog post, both teams plan to experiment with on-chain activities to give the Uniswap community top-notch experiences. The game’s first two seasons were a huge success, selling out in 18 minutes.

In addition to this merger, Uniswap Labs launched UniswapX, introduced its wallet, expanded support to more blockchain networks, and unveiled its vision for Uniswap V4. Furthermore, the team is seeking community feedback before the public launch. Uniswap V4 promises to enhance the platform’s coin-swapping capabilities.

As of the latest update, Uniswap’s native token is trading at $10.13, reflecting an intraday increase of 9.61%. The market cap is $6,074,964,579, with a 24-hour trading volume of $357,367,623.

Over 3.5M addresses have swapped on multiple chains with Uniswap 🤯 pic.twitter.com/IxOL25Tf0w

— Uniswap Labs 🦄 (@Uniswap) June 11, 2024

Furthermore, market sentiment for UNI is bullish, with the Fear & Greed Index indicating a score of 72, suggesting greed. The 14-day Relative Strength Index (RSI) is 34.94, suggesting that the token is currently neutral and may trade sideways.

Also, UNI trades 91.56% above the 200-day Simple Moving Average (SMA) of $5.28. If the market maintains UNI above the $9.90 resistance level, bullish investors may regain momentum, potentially testing the significant resistance level of $11.64.

2. WienerAI (WAI)

WienerAI is a trading bot known for its intelligence and humor. The platform has raised over $5 million in its presale. Moreover, the platform’s tokenomics structure has played a significant role in this achievement.

Furthermore, WienerAI has issued a fixed supply of 69 billion WAI tokens. Of this total, 30% is allocated to presale investors, with another 20% reserved to encourage staking. Also, an additional 20% is set aside for community rewards.

More than just a bot–WienerAI is your ultimate crypto trading companion.

We’re delighted to share some sneak peeks with our incredible and supportive community. (1/4) pic.twitter.com/kR8ypeJycj

— WienerAI (@WienerDogAI) June 11, 2024

These allocations aim to foster investor confidence and drive potential price increases. Currently, WAI tokens are priced at $0.000717 each, which is set to increase in a few hours. Following the presale, WienerAI plans to list its token on decentralized exchanges (DEX), where its value will be determined by supply and demand.

According to the platform’s whitepaper, an intensive marketing campaign will accompany these listings. It has also announced the near completion of its new trading bot. This bot uses machine learning to identify trading opportunities.

Users can input criteria such as risk tolerance or target gains, and the bot will analyze market data to find suitable trades. In addition, WAI‘s strategic token allocation, planned DEX listings, and advanced trading bot contribute to the project’s growing investor interest and market speculation.

Visit WienerAI Presale

3. Notcoin (NOT)

Notcoin began as a popular game on Telegram, introducing many users to the web3 space through a simple tap-to-earn mining feature. Its unique mechanic, engaged community, and integration with the TON blockchain have all contributed to its success.

Supported by Telegram and the Toncoin community, Notcoin has been in high demand recently. Although it experienced gains earlier, its value has declined recently. Despite this, analysts believe the token could bring significant profits, potentially up to 4000%, based on current market hype.

Furthermore, NOT is currently trading at $0.01588 with a 19.03% intraday increase at press time. Moreover, it has a market capitalization of $1.8 billion, placing it 57th among all cryptocurrencies. Its high liquidity, supported by the large market cap, suggests strong market interest.

TON will become the largest blockchain with a huge gap to the second place and it will happen quite soon.

Notcoin will properly introduce web3 to the next 300 million people through communities, education and gaming. With style.

It is not a promise, just a logical conclusion. pic.twitter.com/sldCwH5BIm

— Notcoin Ø (@thenotcoin) June 10, 2024

In addition, NOT’s origins as a game on Telegram and its strategic integration with the TON blockchain have driven its popularity. While its recent performance has seen fluctuations, market analysts remain optimistic about its future growth potential.

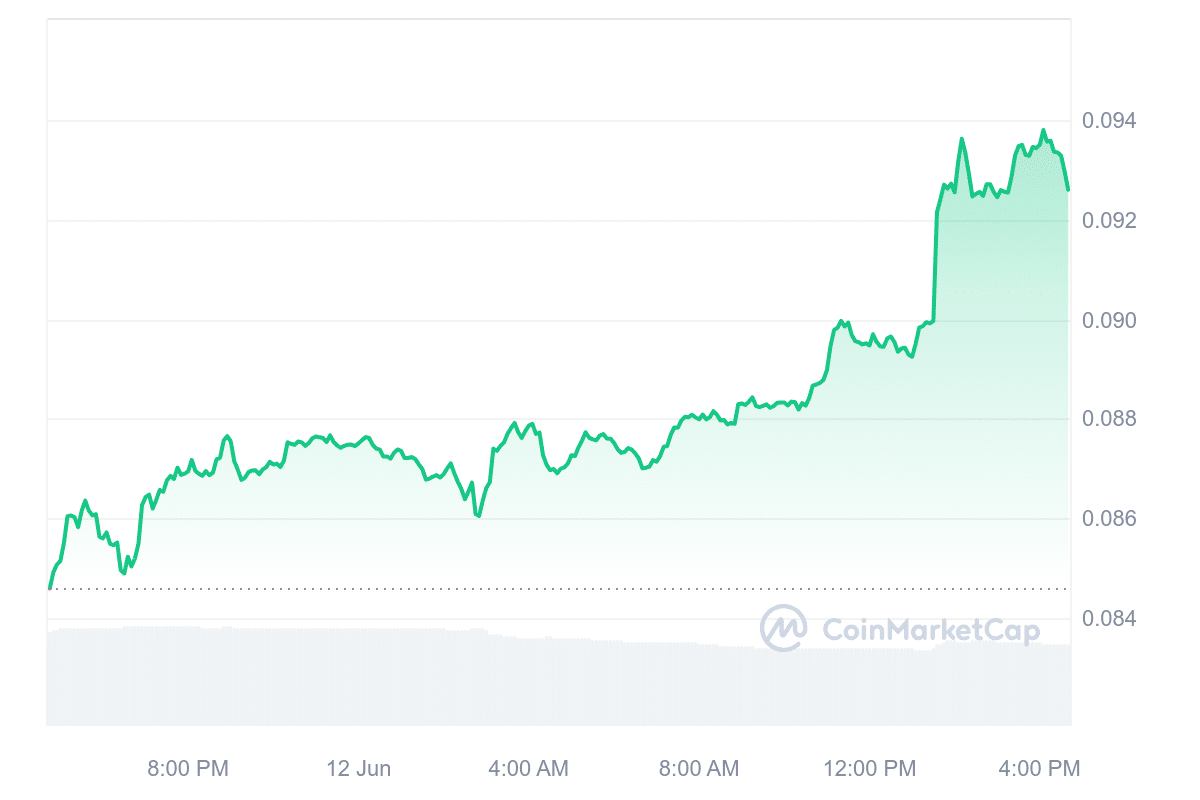

4. Hedera (HBAR)

Hedera is currently priced at $0.09285, reflecting a 9.17% increase in the past 24 hours. However, the coin has experienced a 10.00% decline over the past week and a more significant 16.59% drop over the past month.

Nonetheless, it has appreciated by more than 28% over the past six months, highlighting its overall upward trend in the longer term. The nearest resistance level for HBAR is $0.1145, with support at $0.0895.

The 10-day Simple Moving Average (SMA) is $0.0906, indicating the average price over the past 10 days. Furthermore, the current RSI is 49.37, suggesting HBAR is in a corrective phase, meaning it is undergoing a short-term price adjustment.

Despite the recent volatility, the sentiment around HBAR’s price prediction is bearish. However, the Fear & Greed Index, which measures market sentiment, shows a value of 72, indicating greed.

This suggests investors are more inclined to buy, driven by optimism or FOMO on potential gains. Additionally, HBAR trades above its 200-day SMA and boasts high liquidity relative to its market capitalization.

5. Polkadot (DOT)

Polkadot recently upgraded its ecosystem to enhance decentralized finance (DeFi) growth by improving liquidity and trading efficiency. Furthermore, this upgrade involves significant funding for Hydration, Polkadot’s leading DeFi project. The goal is to boost liquidity and trading efficiency across the network.

Moreover, the platform’s treasury has allocated 2 million DOT tokens, equivalent to $14.4 million, to Hydration, aiming to deepen liquidity pools. Despite market fluctuations, DOT has demonstrated remarkable price movements, prompting analysts to predict continued success for the token.

Imagine a blockchain ecosystem where decentralization, scalability, and security are no longer limitations…

🔦✨ Spotlight on: Polkadot 2.0

Polkadot 2.0 is designed to enhance the scalability, flexibility, and efficiency of the Polkadot network. Learn how 👇

Polkadot 2.0?… pic.twitter.com/MdkCgpOz1K

— Polkadot (@Polkadot) June 11, 2024

The token is trading at $6.70 at the time of writing, reflecting an intraday increase of 5.64%. The 14-day Relative Strength Index (RSI) is at 67.97, suggesting that the token is currently neutral and may trade upwards. In addition, Polkadot has exhibited positive performance compared to its token sale price, with 16 green days recorded in the last 30 days.

The token also boasts high liquidity based on its market capitalization. Although the sentiment around DOT’s price prediction leans towards bearish, the Fear & Greed Index registers 72 (Greed), indicating a certain level of investor optimism.

Read More

PlayDoge (PLAY) – Newest ICO On BNB Chain

- 2D Virtual Doge Pet

- Play To Earn Meme Coin Fusion

- Staking & In-Game Token Rewards

- SolidProof Audited – playdoge.io

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Toncoin

Toncoin  Shiba Inu

Shiba Inu  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)