Join Our Telegram channel to stay up to date on breaking news coverage

Crypto traders are always on the hunt for the best cryptocurrencies to buy on any given day – we list some high potential coins in this post.

Many investors actively seek the best investment options in cryptocurrencies. Injective, Uniswap, and Stellar have emerged as cryptocurrencies generating significant interest. This article will explore the factors fueling the growing enthusiasm for these cryptocurrencies and assess their recent performances. By doing so, we aim to show why they are considered among the best cryptocurrencies to buy now.

Best Crypto to Buy Now

SOL recently approached the $100 mark. This price increase was fueled by sustained enthusiasm for the blockchain‘s swift transaction capabilities, cost-effectiveness, and a flurry of meme coin issuances. This trend has persisted for three weeks.

Furthermore, key metrics indicate that Solana has become a compelling choice for on-chain traders. Over seven days, trading volumes and network fees on Solana surpassed those on Ethereum.

1. KuCoin Token (KCS)

In a collaborative effort to advance the Bitcoin (BTC) ecosystem, KuCoin Labs and Zoopia have established a strategic partnership. Zoopia aims to create a lively space where users can maximize their BRC20 tokens. This can be achieved through safe staking, earning rewards, and participating in auto-compounding.

KuCoin Labs, having closely followed BTC’s development, has set aside funds to support BTC-native projects. The collaboration has positively impacted KuCoin Token, leading to a notable uptrend. Current sentiments predict a bullish trend, with the Fear & Greed Index at 73 (Greed).

Furthermore, KCS is trading above the 200-day moving average, with good performance compared to the token sale price. Additionally, there was a substantial 69% price increase in the past year. Over the last 30 days, the token has shown positive movement on 17 days, accounting for 57% of the observed period.

🎄 Giveaway every day till 2024 – join Day 2 of #KuCoinCountdownParty2024 with @script_network! 🥳🎉

To enter:

1️⃣ Follow @kucoincom & @script_network

2️⃣ Like & Repost

3️⃣ Comment your Xmas blessings, tag #KuCoinCountdownParty2024 + 2 friends

4️⃣ Fill in this form:… pic.twitter.com/RTES4YVoys— KuCoin (@kucoincom) December 25, 2023

KCS has a circulating supply of 80.12 million out of a maximum supply of 171.25 million KCS. In market cap rankings, KCS ranks 7th in the Exchange Tokens sector and 23rd in the Ethereum (ERC20) Tokens sector.

2. Uniswap (UNI)

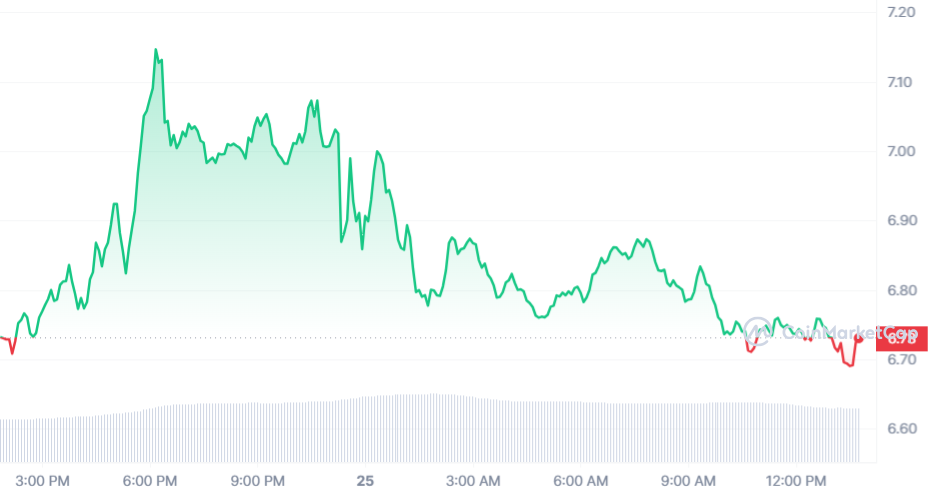

Uniswap had a noteworthy week as its token value jumped from $5.92 to $7.07, marking a solid 23.42% increase. The sentiment around Uniswap price prediction is bullish, with a Fear & Greed Index 73 indicating market greed.

Over the last year, Uniswap has demonstrated a substantial price increase, registering a 37% increase. Notably, the token is currently trading above its 200-day simple moving average, a trend that typically signifies positive market sentiment. Uniswap also boasts high liquidity, which is evident in its market cap.

Furthermore, Uniswap holds the 4th position in the DeFi coin sector and second in the Exchange Tokens sector. It also ranks 1st in Yield Farming and Ethereum (ERC20) Tokens sectors. Notably, UNI’s circulating supply is 598.19 million out of a maximum supply of 1.00 billion UNI.

UniswapX unlocks the potential for cross chain swaps. 👀

Aggregated liquidity across chains. No bridging required.

Dive into the whitepaper to learn more about what’s possible with UniswapX.https://t.co/ZfzvLB8DsN

— Uniswap Labs 🦄 (@Uniswap) December 17, 2023

Uniswap’s recent market performance and positive sentiment portray a robust standing in the decentralized finance landscape. These factors, coupled with its consistent liquidity and supply dynamics, contribute to a comprehensive understanding of Uniswap’s current position in the market.

3. Stellar (XLM)

Stellar has seen significant price changes lately, hitting a high of $0.796465. XLM ranks 1st in the Stellar Network sector and 17th in the Layer 1 sector, placing it among the best crypto to buy now. Additionally, it has experienced a noteworthy 75% increase in the past year.

Notably, the asset trades above its 200-day simple moving average, indicating a sustained positive trend. Analyzing the recent 30-day trend, 60% of the days were marked by positive gains, totaling 18 green days. Stellar further boasts high liquidity, supported by its substantial market cap.

With the technical pieces now in place, the Stellar network validators have agreed to a January 30 vote on the Mainnet upgrade to Protocol 20, which should give the ecosystem time to prepare by installing relevant software. Here’s how to prep👇 https://t.co/4JSaUDIgWn

— Stellar (@StellarOrg) December 19, 2023

Furthermore, stellar’s liquidity, measured by market cap, is solid, highlighting its position in crypto. The sentiment around Stellar’s future price is optimistic, with a Fear & Greed Index at 73 (Greed).

4. Sponge V2 ($SPONGEV2)

Sponge V2 has taken a step forward from its earlier version, $SPONGE. Sponge V2 is worth $16 million and has gathered a community of 11,500 holders. The annual interest rate (APY) has been a steady 40% for four years.

📣 We’re excited to announce that #Sponge is bridging from V1 to V2!

Stake your $SPONGE to earn #SpongeV2 tokens. 🧽💦

Buy and stake now for a special V2 token bonus! Don’t miss out 🔥#MemeCoin #Web3 #BullMarket pic.twitter.com/bYmkg1TNrU

— $SPONGE (@spongeoneth) December 18, 2023

One distinguishing feature of the $SPONGE is its Stake-to-Bridge model. This system makes it easy for $SPONGEV2 holders to transition to V2 through staking, all while keeping and rewarding them. Furthermore, a Play-to-Earn (P2E) game has been added to the ecosystem to enhance the token’s utility and community engagement.

A transparent allocation of the 150 billion token supply for staking rewards and the integration of P2E gaming underscores $SPONGEV2’s commitment to user incentivization. This transparency is deemed crucial in establishing credibility and trust within the community.

Looking ahead, $SPONGEV2 is aiming for primary exchange listings and using its 30,000-member community for potential growth. However, investors are advised to conduct thorough research before considering involvement.

Visit SPONGEV2 Presale

5. Injective (INJ)

Injective and Starship recently teamed up, marking a big move in Web3 finance. Injective, known for its speedy and innovative blockchain, is helping Starship enhance its fundraising platform.

Injective’s blockchain makes it easy for developers to create fast and flexible DeFi experiences. They also make the fundraising process smoother for both projects and investors. Regarding market dynamics, the current sentiment surrounding Injective is bullish, as reflected in the price prediction. With 83.76 million INJ tokens circulating out of 100 million, an inflation rate of 14.72% has created 10.75 million INJ in the last year.

Market rankings showcase Injective’s prominence as 5th in DeFi Coins, 2nd in Layer 2, and 1st in the AI Crypto sector. The numbers tell a positive story – a 3,192% price increase last year, outperforming all top 100 crypto assets and staying above the 200-day simple moving average.

There are now multiple walkthrough guides for onboarding onto Injective!

Get started today on the only L1 built for finance regardless of which chain you’re coming from.

Read more 👇https://t.co/YHXKZxuCbm

— Injective 🥷 (@Injective_) December 23, 2023

Furthermore, INJ has seen a remarkable 3,192% price increase in the last year, outperforming 100% of the top 100 crypto assets. Additionally, Injective has surpassed Bitcoin and Ethereum, maintaining a positive trajectory above the 200-day simple moving average.

Furthermore, Injective has seen 15 green days in the last 30 days, accounting for 50% of the period. The project trades near its all-time high and cycle high, underscoring its resilience and sustained positive momentum. The partnership with Starship positions Injective as a key player in Web3 finance.

In addition. its technology and market performance make it a standout player in DeFi, hinting at a potential shift in how we handle financial tools.

In summary, the partnership with Starship positions Injective as a key player in the evolution of Web3 finance. The project’s robust technology and positive market performance make it a noteworthy player in the DeFi landscape, demonstrating its potential to reshape how we engage with financial instruments.

Read More

New Crypto Mining Platform – Bitcoin Minetrix

- Audited By Coinsult

- Decentralized, Secure Cloud Mining

- Earn Free Bitcoin Daily

- Native Token On Presale Now – BTCMTX

- Staking Rewards – Over 100% APY

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Litecoin

Litecoin  Polkadot

Polkadot  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Aptos

Aptos  Internet Computer

Internet Computer  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  OKB

OKB