Disclosure: This is a sponsored post. Readers should conduct further research prior to taking any actions. Learn more ›

A&T Capital launches the ‘Web3 Trends 2023’ report and delves into the six trends that will shape the future of the Web3 era.

- Revolutionary shift in internet infrastructure

- ZK layer2

- Parallel Computing, Modular Design and Application-Specific Blockchain

- AA wallet vs EOA wallet

- Trends in Exchanges: Transparency and Decentralization

- Growing Importance of the MEV Market

1- Web 3.0 brings a revolutionary shift in internet infrastructure.

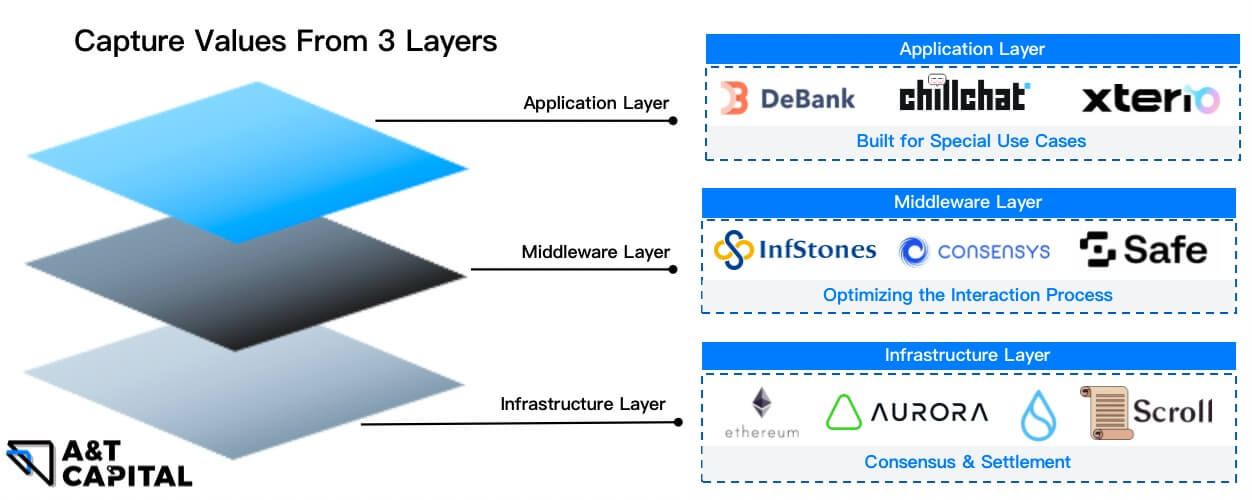

The primary market investment AUM for Web3.0 has surpassed $50 billion, and the NFT market has grown to over $20 billion with more than 3 million holders. We are seeing significant potential for value capture across all layers of applications, middleware, and infrastructure.

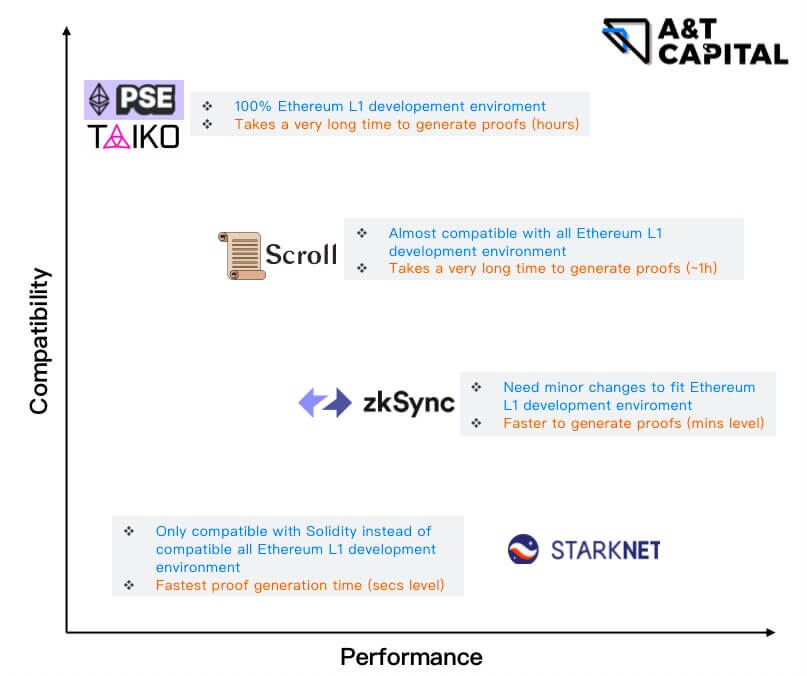

2- ZK Layer2 will scale Ethereum in long-term while ZKP has endless possibilities

ZK Layer 2 solutions, such as Scroll, StarkNet, and zkSync, will enable scalability for Ethereum in the long-term.

ZKP technology has endless possibilities beyond just scaling, including connecting various blockchains and reducing barriers for developers.

These solutions will be widely available by 2023 and will coexist to meet diverse needs.

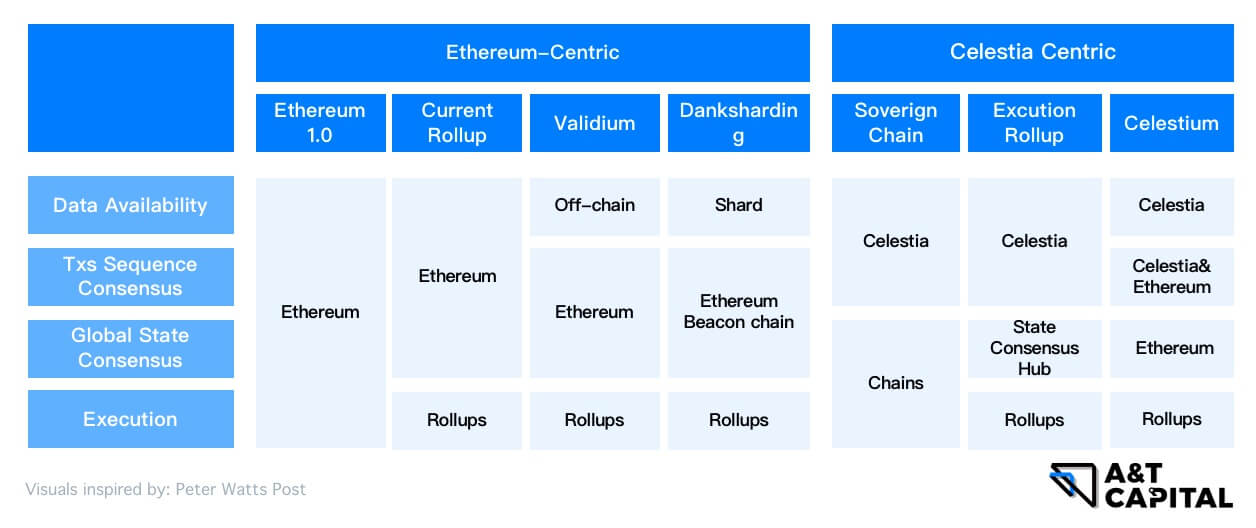

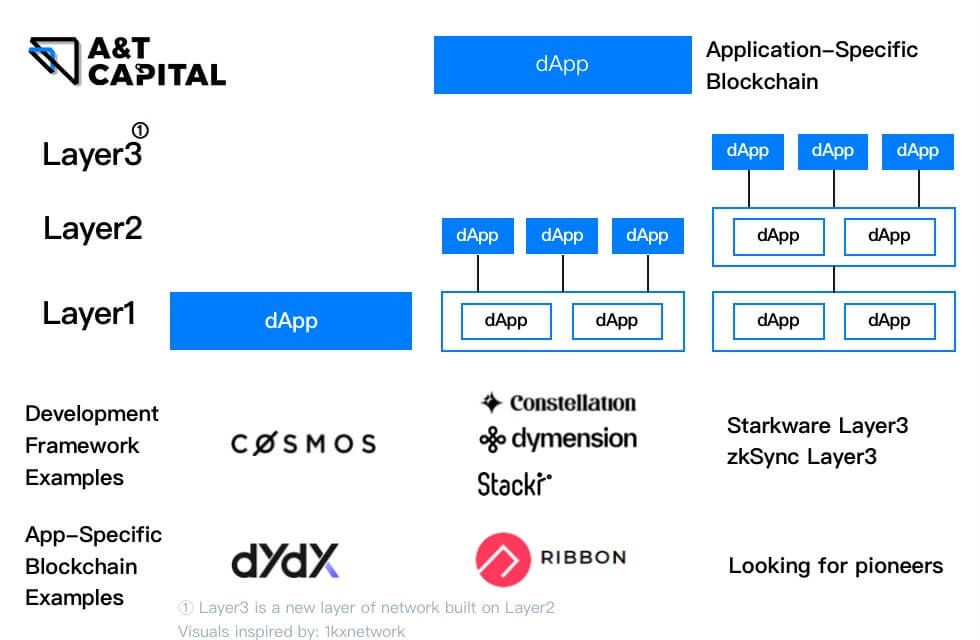

3- Parallel Computing, Modular Design, and Application-Specific Blockchain

The utilization of parallel computing technology offers the optimal performance for maximizing blockchain computation capabilities. Additionally, the modular design has emerged as the leading approach for unlocking the full potential of blockchain technology.

In addition to finance and money, many applications in various industries, such as gaming and social media are seeking to utilize blockchain technology, which is putting pressure on the underlying infrastructure.

An application-specific blockchain is a good fit for high performance, customizability, and value capture.

4- AA vs EOA Wallet

As the gateway to Web3, wallets today face challenges in terms of security and user experience. AA and EOA wallets are gaining popularity as they aim to achieve Web 2.0-level security and user experience while making different trade-offs.

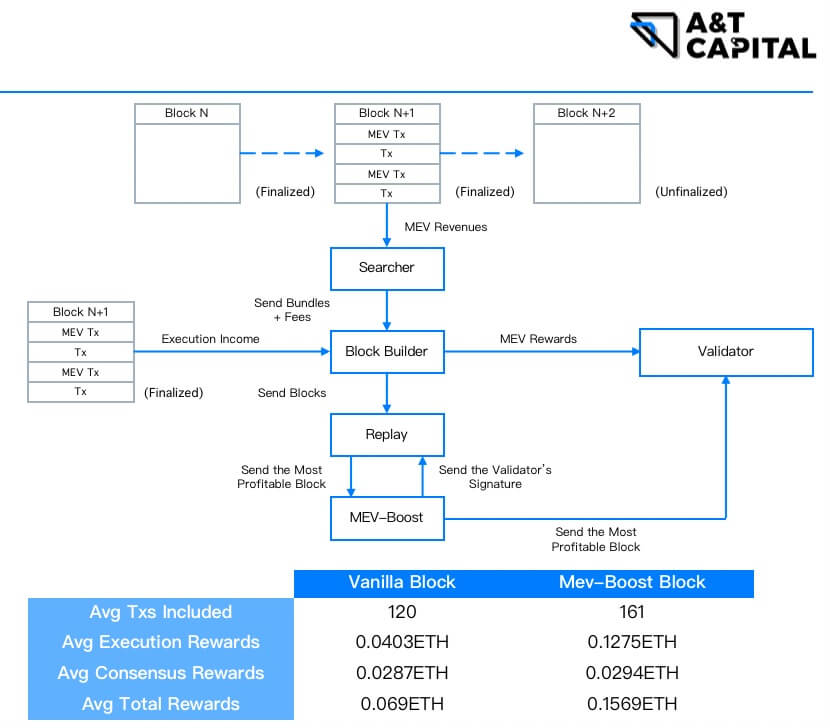

5- The Increasing Significance of the MEV Market

Access to the MEV market can significantly increase validator revenues. As of December 31, 2022, the average value of MEV Boost blocks is more than three times that of vanilla blocks.

Block builder has paid over 70,000 ETH to validators within three months of the Ethereum Merge, and the MEV in total is projected to continue rising.

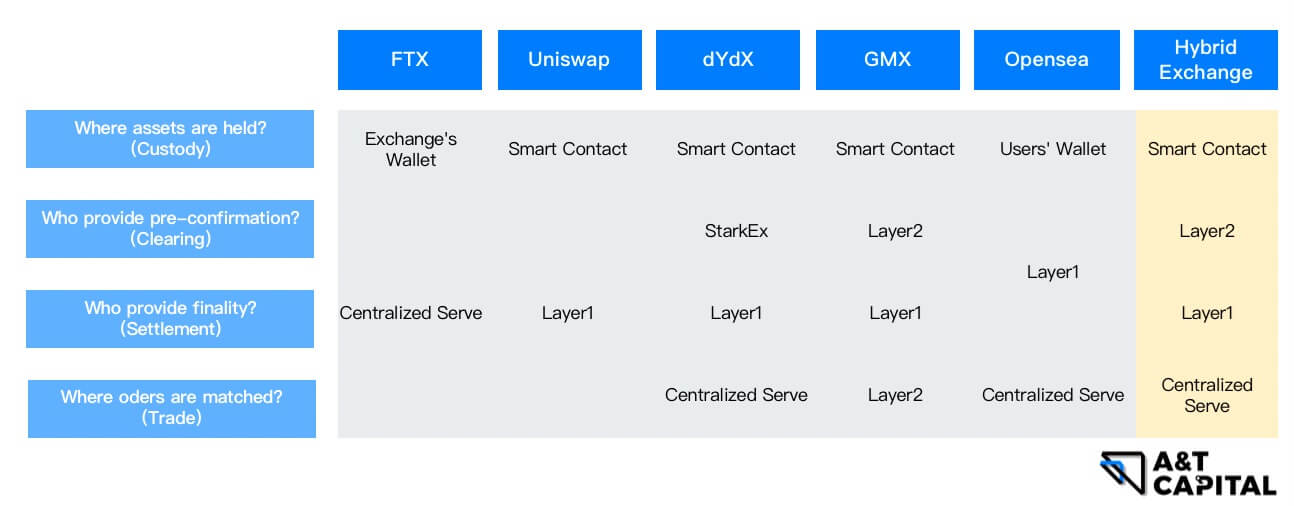

6- Trends in Exchanges: Transparency and Decentralization.

Exchanges are becoming more transparent by publishing Proof of Reserves, and this trend will likely grow in 2023. Additionally, hybrid exchanges that separate themselves from custody and clearing functions are expected to become more prevalent in the market.

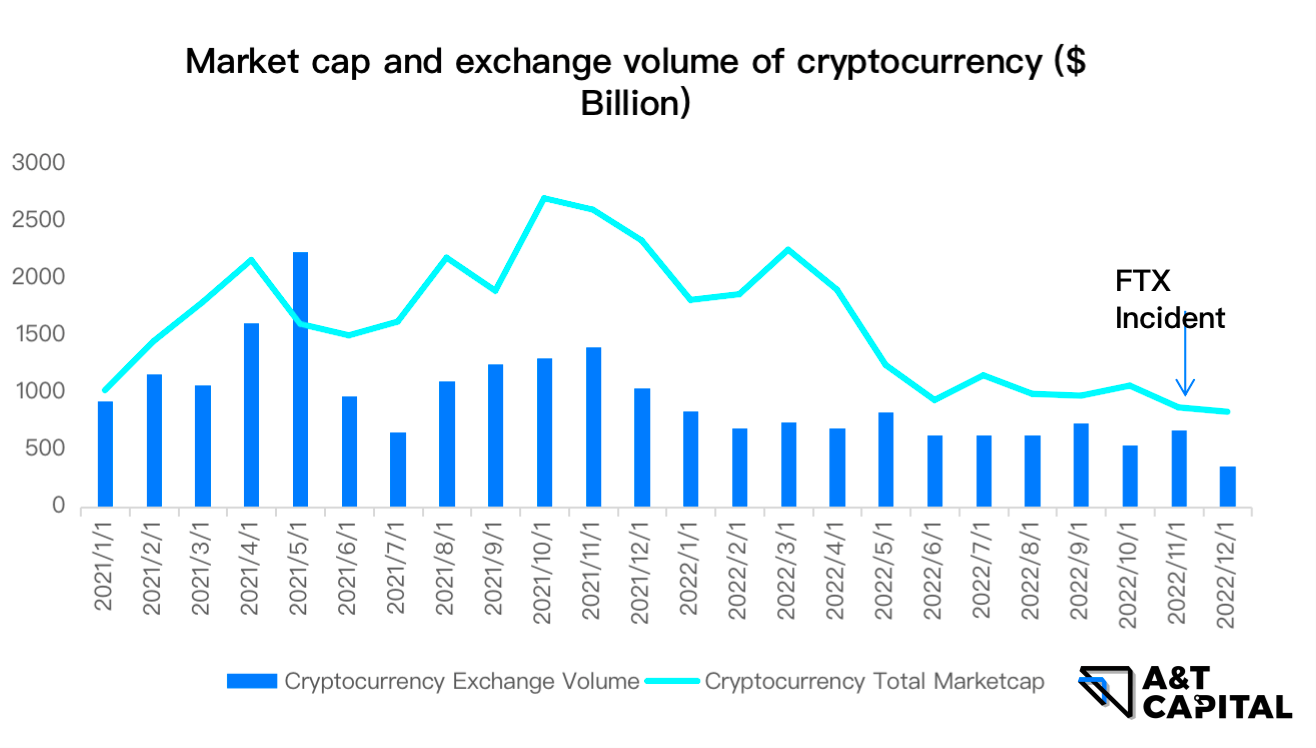

Lessons from FTX’s Failure and the Market’s Decline

FTX’s fall highlights the importance of proper risk management, transparency, and regulatory compliance. Additionally, it also shows the risks of using customer funds for internal purposes and the dangers of over-leveraging.

As the crypto market continues to evolve, it’s important for players in the industry to learn from the mistakes of the past and strive for better practices in the future.

Conclusion

A&T Capital envisions Web3.0 as a transformative technology that will bring greater efficiency, security, and convenience to the digital landscape while opening up new opportunities for creativity and impact.

In 2023, A&T Capital plans to invest, build, and empower the Web3.0 ecosystem.

For the full report, please check: https://capitalant.com/pdf/web3-trends-2023.pdf

—————-

About A&T Capital: A&T Capital is an early-to-growth stage venture fund for emerging disruptive technologies. Led by three founding partners based out of Berlin, Singapore, and Shanghai, it is supported by a dynamic global team of researchers and analysts. In 2021, it raised a 100M pool of funds. The portfolios include Bitcoin Suisse, Celestia, Cobo, Consensys, Gnosis Safe, Infstones, Mysten Labs, and Scroll.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)