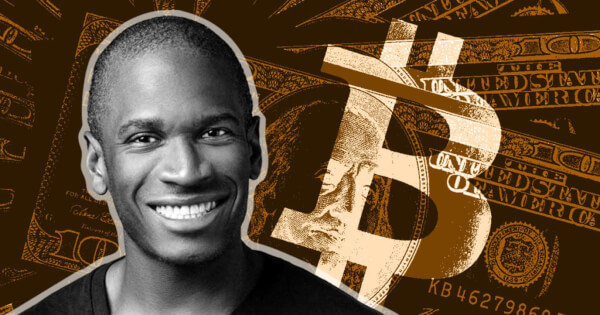

In the realm of financial analysis, few voices resonate as loudly as Arthur Hayes. His recent article, titled “Kite or Board,” has generated substantial buzz in financial circles. Hayes meticulously evaluates the U.S. Federal Reserve, forecasting significant challenges that could jeopardize its future operations. Simultaneously, he highlights Bitcoin’s rising prominence as an alternative in the financial domain.

The Federal Reserve’s Autonomy

Hayes sheds light on the Federal Reserve’s unique position, emphasizing its ability to make decisions that might not always require direct public validation. This degree of autonomy grants the Fed considerable power. However, as Hayes points out, such unchecked authority might sometimes lead to decisions that don’t align with the broader public interest.

Understanding Inflation Tax

The concept of the “inflation tax” is meticulously dissected by Hayes. Inflation, often an abstract concept for many, serves as a silent tax eroding public wealth. Hayes suggests that the majority, especially those unfamiliar with high inflation periods, might overlook this. Such an oversight can make inflationary strategies particularly appealing for policymakers.

Potential Policy Changes

Hayes delves into potential policy shifts that could address inflation. Specifically, he discusses the idea of eliminating interest on reserves and mandating a substantial proportion of deposits to be held as reserves. Such a policy, Hayes postulates, could significantly curb inflationary pressures. The math behind this assertion, as Hayes suggests, is detailed in his article, offering readers an in-depth understanding of the mechanics.

Banks in Transition

With policy shifts, the banking sector’s response becomes pivotal. The banks, guardians of traditional finance, could find themselves at a crossroads. Hayes touches upon this, hinting at the protective measures banks might adopt in light of policies that could potentially impact their profitability.

Bitcoin’s Ascendancy

The crux of Hayes’ argument revolves around Bitcoin’s potential role in this financial tableau. As traditional structures like the Federal Reserve grapple with challenges, Bitcoin, with its decentralized nature, finite supply, and global acceptance, emerges as a promising alternative. Hayes suggests that Bitcoin, free from the shackles of centralized decision-making and inflationary tendencies, could offer a transparent and viable financial system alternative.

The Impending Shift

Central to Hayes’ analysis is his forthright assertion: “I want to show readers how the Fed is doomed to fail, and how the more they try to right the ship using Volkernomics.” This sentiment underscores a significant shift in the global financial paradigm. As the Federal Reserve grapples with its challenges, Hayes believes its potential missteps could pave the way for alternative financial instruments like Bitcoin. The cryptocurrency, in Hayes’ view, is poised to redefine how transactions are conducted and how value is stored, potentially filling the void left by the Fed’s challenges.

Arthur Hayes’ insights present a comprehensive view of the challenges facing the Federal Reserve and the burgeoning role Bitcoin could play in the future. His analysis, rooted in observation and critical evaluation, offers a perspective that resonates with both crypto enthusiasts and traditional finance observers.

Image source: Shutterstock

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Sui

Sui  Hedera

Hedera  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Litecoin

Litecoin  WETH

WETH  Polkadot

Polkadot  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Uniswap

Uniswap  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  Official Trump

Official Trump  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Bittensor

Bittensor  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Dai

Dai  OKB

OKB