Crypto prices have been fluctuating in both directions since the beginning of the week. No decisive trend has been able to strongly establish itself. Nonetheless, the cumulative valuation of all coins has been revolving below $1 trillion of late, shedding light on macro-weakness. Amidst the ongoing ebb and flow, funds have been shuffling within the ecosystem itself. Most flows into Bitcoin have come via the Tether route over the past 24 hours.

On the contrary, injections via the fiat route have been comparatively meager. On the other hand, market participants have also made diversions from Bitcoin to Ethereum and other stablecoins like Binance’s native BUSD.

Amid fund shufflings, fuel is being added to one particular speculation: Asians are dumping crypto, while participants from the West have been buying the same dump during the eastern trading hours. However, does the same indeed HODL true?

Bitcoin

A recent CoinMetrics report chalked out time-based patterns and brought to light a few interesting trends. The activity levels of some crypto assets have been depicting high amounts of clustering during certain times of the day, while have remained lackluster during other times.

The East has been quite stern with respect to crypto embracement when compared to the West. China, for instance, issued crackdowns on Bitcoin mining last spring and summer. Investors on their part also, are fairly less concentrated on the Eastern side of the sphere when compared to the Western. The same has been having a direct impact on trade activity. Per CoinMetrics,

“Most activity for Bitcoin is now concentrated during European/US business hours with a noticeable downward change in the percentage of activity during Asia/Pacific hours…”

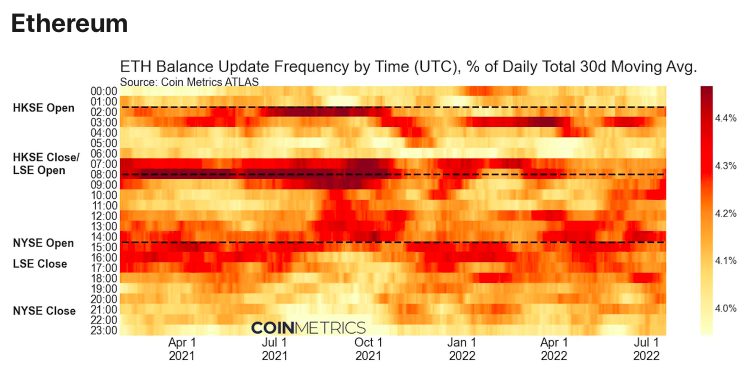

Ethereum

Unlike Bitcoin, Ethereum has not necessarily been showing any strong daily pattern. As depicted below, balance updates are somewhat dispersed.

However, price-wise, ETH’s movements have had more thrust and vigor of late relative to that of Bitcoin. From late 24 June until mid 26 June, Ethereum dipped by close to 19%, while Bitcoin lost merely 10% of its value. In the said period, however, no particular Asian market dump, US market buy pattern took any concrete shape. Nonetheless, it should be noted that a couple of exceptional green candle(s) were registered by Ethereum and Bitcoin on 25 July, and the same roughly materialized during the late EST hours.

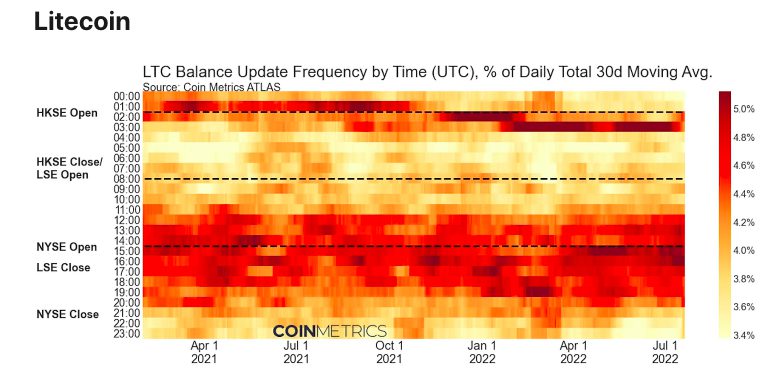

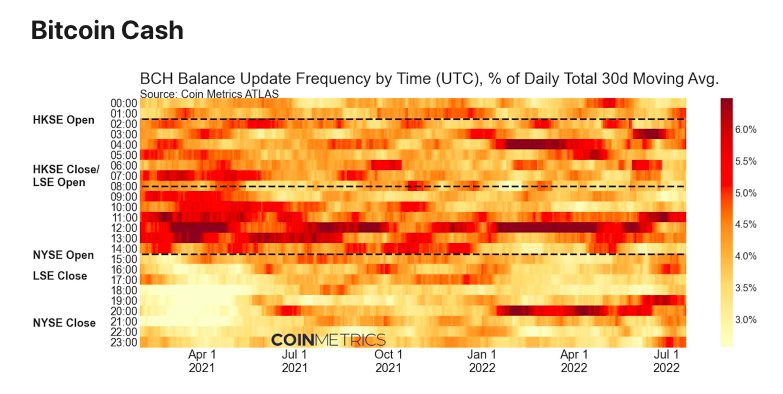

Alts: Litecoin, Bitcoin Cash

Alts have not necessarily been treading on the same path. Take the case of Litecoin, for instance. Per CoinMetrics,

“Litecoin exhibits some interesting behavior clustering roughly between 1:00-3:00 UTC, which aligns with the Asia/Pacific market open, clustering tightly around a single hour bin.”

Having said that, it doesn’t mean that Western participants have completely washed their hands off this Altcoin. A fair rise in Litecoin has also been noted during the LSE and NYSE sessions too.

Bitcoin Cash, on its part, has three clusters at 3:00, 12:00, and 20:00 UTC. The same is indicative of the fact that activity is most concentrated in Asia/Pacific and London sessions. However, when compared to last year, their activity seems to be fairly suppressed.

So now, even though a few clustering trend patterns and a rise in activity has been noted of late, there’s no clear proof that one set of participants are buying the other’s dump. As highlighted in the price chart above, a rise in activity has not always corresponded to a rise in price.

And of late, color streaks have been more predominant on the price charts, indicating the rolling over of positive/negative market sentiment from one trade session to another. Thus, keeping the of-late movements in mind, the speculation in question doesn’t necessarily HODL true at the moment.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  Hyperliquid

Hyperliquid  USDS

USDS  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC

![Chainlink [LINK] Price Prediction: October End 2023](https://news.coinspectra.com/wp-content/uploads/2023/10/36916c121ba1402fbc496bf825c3052b-100x70.jpg)