Quick Take

The intricate relationship between crude oil prices and unemployment is a subject of close examination in the current economic landscape. Oil prices are on an upward trajectory, currently around $80 per barrel, a notable increase from the $66 per barrel seen in March.

Such a rise in oil prices can induce a cascading effect, escalating the prices of goods, particularly food and energy. This leads to inflationary pressures, a concern for the Federal Reserve as it counteracts its goal of preserving price stability.

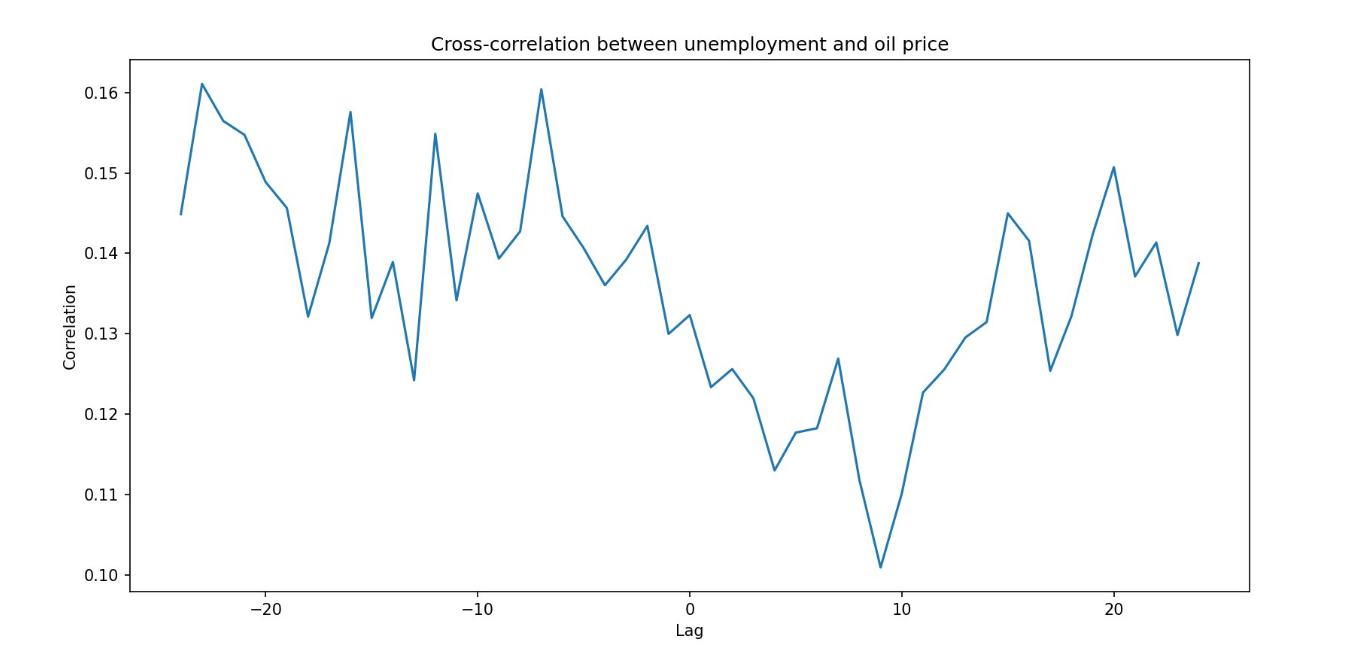

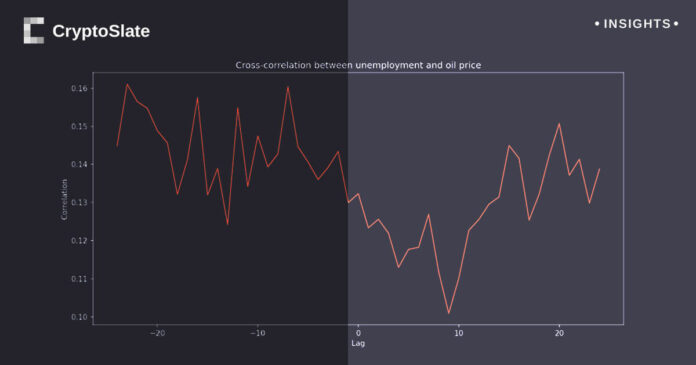

Fascinatingly, the interplay between oil prices and unemployment usually follows a specific trend. An increase in oil prices often precedes a rise in unemployment, which, excluding the COVID-19 pandemic, has led to a recession three out of four times. This correlation typically takes about six months to manifest.

The market is currently observing a negative year-over-year comparison for oil, which bodes well for the Consumer Price Index (CPI) metric.

However, given the current rising trend of oil prices, this situation demands careful monitoring. It is crucial for economic participants to vigilantly monitor these shifts to predict and lessen potential negative impacts on unemployment and inflation

This point is supported by Viraj Patel, FX & Global Macro Strategist:

“Unless oil gets back to $100/bbl it’s not ‘inflationary’. At best recent rally in commodities is less deflationary”

The post Are the complex interplays between crude oil prices and unemployment rates cause for concern? appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  WETH

WETH  Polkadot

Polkadot  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC