Price drawdown from ATH

2022 approaches year-end; it has been a historical year for all asset classes due to the rapid tightening of monetary policy worldwide and the strength of the U.S. dollar. It had severe implications on the crypto ecosystem, which has seen a wide range of liquidations and margin calls, as well as the collapse of FTX and Luna.

A mixed year for the Ethereum ecosystem saw a successful merge in September, and, as a result, ETH was net deflationary for October. However, the magnitude of losses from an investor point of view has been monumental in the DeFi ecosystem.

Ethereum is currently 73% off its all-time high, floating around $1,200; significant liquidations and deleveraging have occurred in 2022 with the fall out of Luna back in May and FTX collapse in November.

Ethereum gas usage from 2020 – 2022

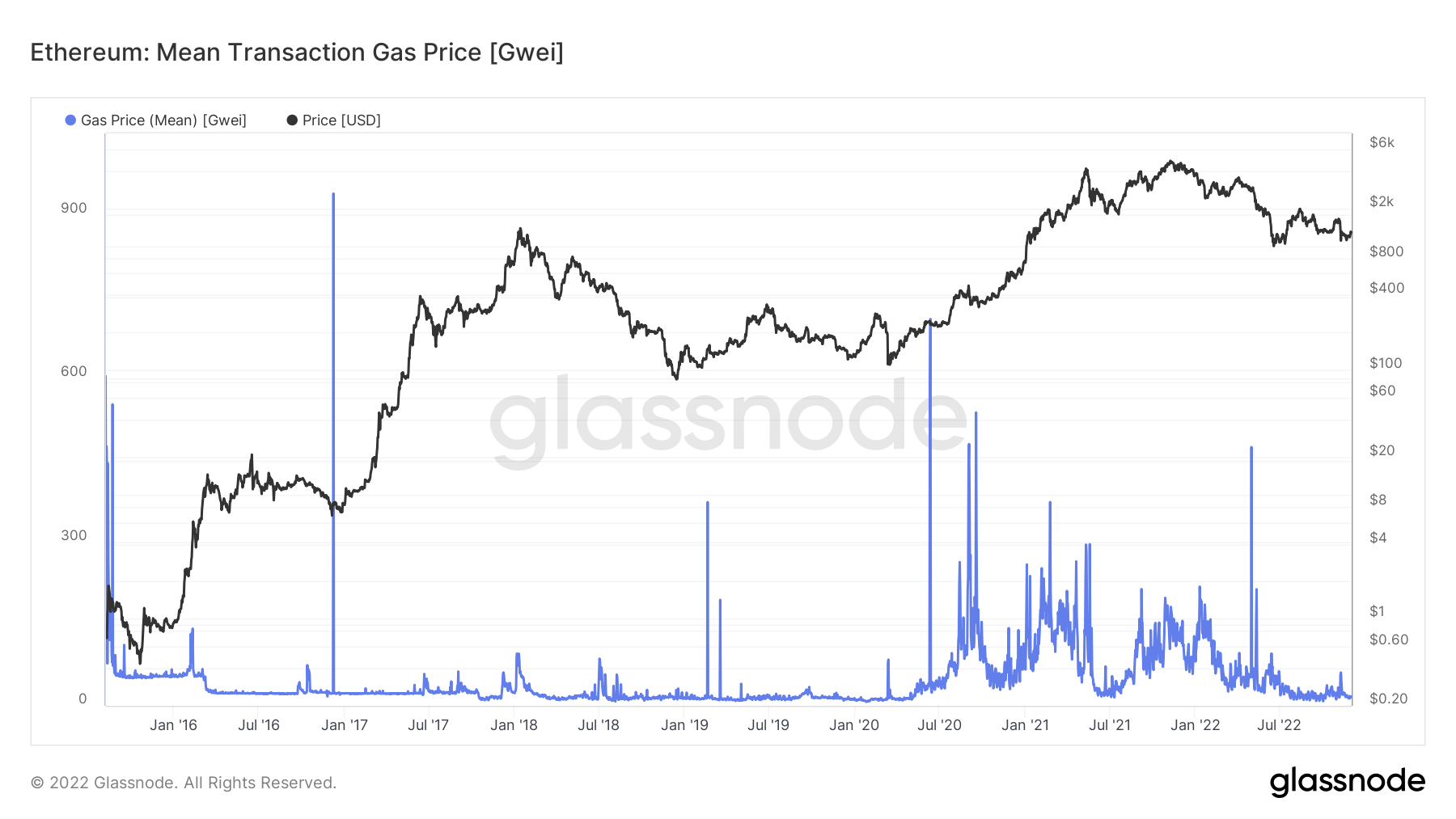

Gas fees are the cost of conducting a transaction or executing a contract. For example, this could see exchanging into a stablecoin or minting an NFT.

Since the summer of 2020, Ethereum gas fees have taken off primarily due to the explosion of DeFi use on chain.

Although network activity has tailed off significantly since the summer of 2021, the issue of Ethereum being an expensive chain still prevails.

Ethereum gas fees are priced in gwei, a unit of measure equivalent to one billionth of one ETH. Gas costs fluctuate depending on the network’s congestion, with periods requiring higher gas fees during peak demand to push through a transaction.

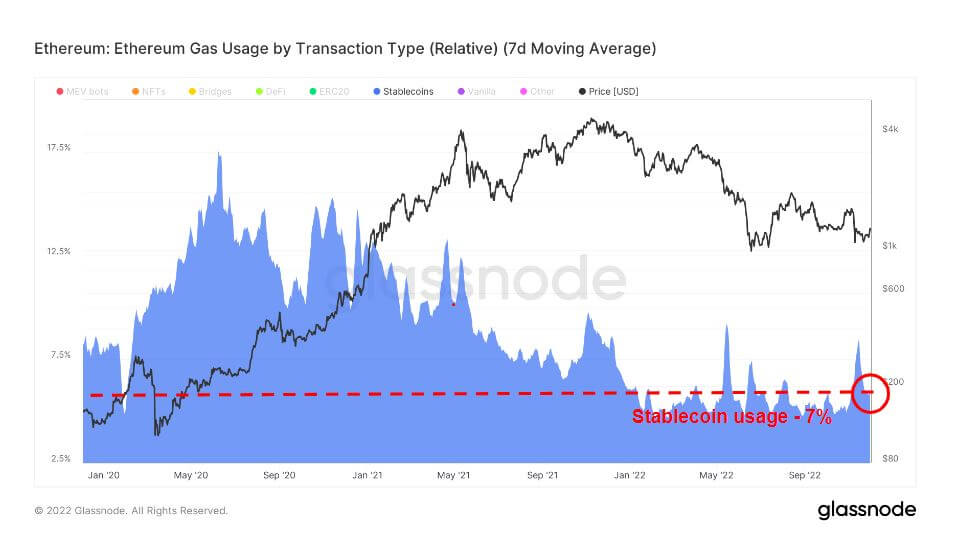

Stablecoins are cryptocurrencies designed to minimize price volatility by being pegged to a reference asset. The reference asset could be a commodity, cryptocurrency, or fiat money.

The market offers various stablecoins, such as asset-backed, including fiat, crypto, or precious metal assets, and algorithmic, which add to or subtract from circulating token supply to peg the price at the desired level.

The current gas usage for stablecoins is 7% which has been roughly flat for 2022; however, stablecoin mass adoption started at the beginning of 2020, hitting a peak of almost 20% of Ethereum gas usage.

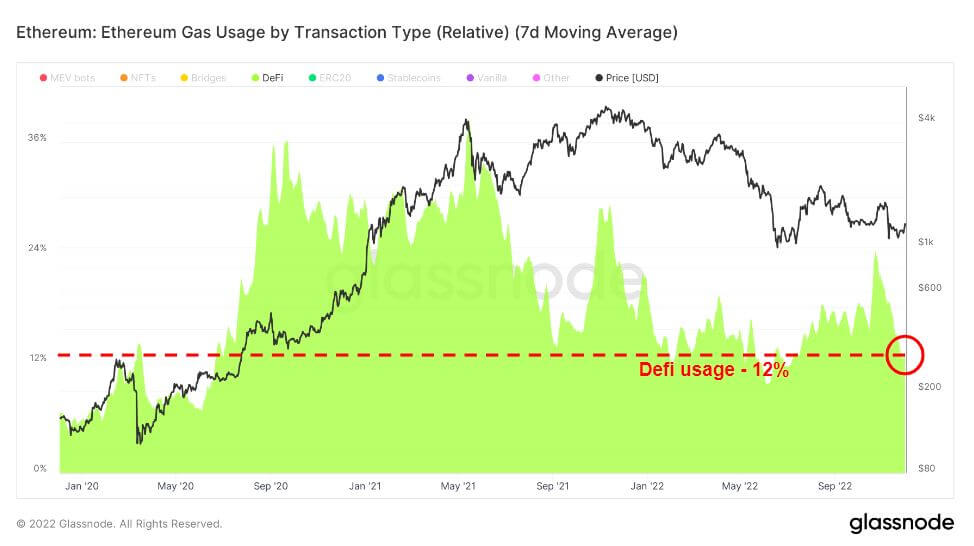

Decentralized finance (DeFi) is an emerging technology that cuts out banks and financial institutions, linking users directly with financial products, typically lending, trading, and borrowing.

DeFi followed shortly after the stablecoin boom; from July 2020, Uniswap emerged as the leading DeFi gas user, peaking around June 2021 before tapering downwards. DeFi usage has maintained a rough 12% average for 2022, above the early 2020 usage.

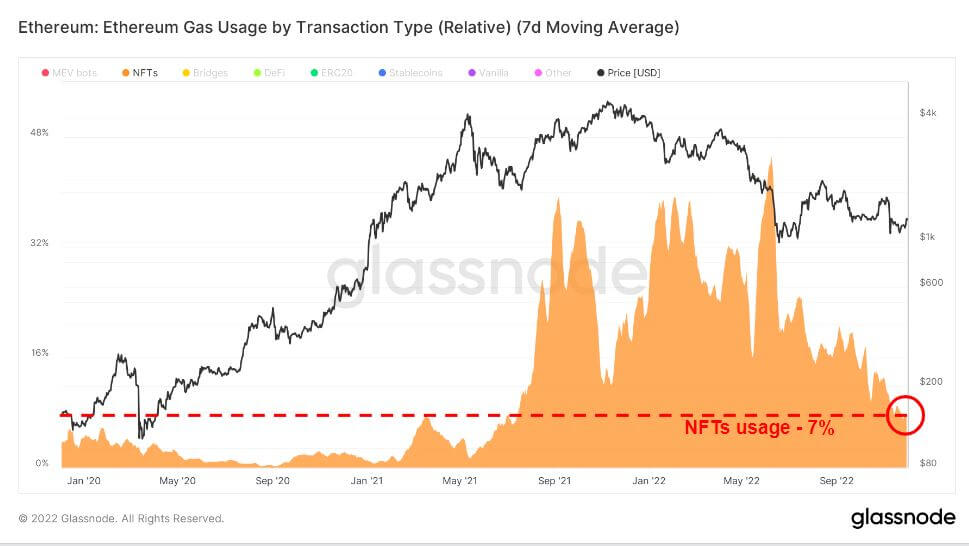

Out of the trifecta, NFTs were the last to boom in this cycle, exploding at the end of 2021. As a result, during the 2021 bull run, OpenSea saw the most significant spikes in gas usage from NFT demand. However, from June 2022, demand has cooled significantly yet remains somewhat elevated compared to previous years.

Decline in transaction count and gas price

Ethereum gas usage and transaction counts are at year-to-date lows; the mean gas price has been somewhat muted for the past four months, with slight upticks due to the recent merge and FTX collapse. While transaction count is approaching year-to-date lows, suggesting the bear market has taken its toll on users.

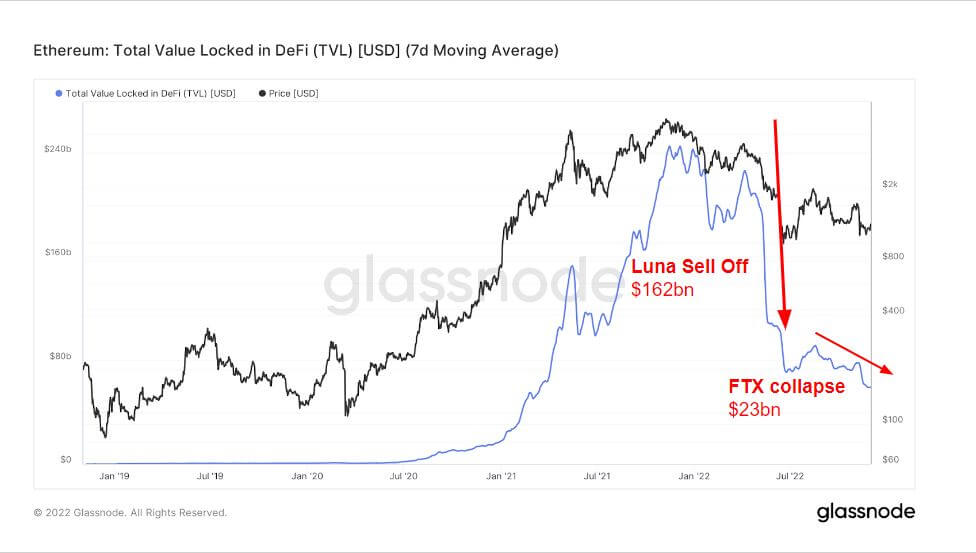

The rise and fall of TVL in DeFi (USD)

Total Value Locked (TVL) measures the total value of all assets locked into DeFi protocols. TVL is denominated in USD or ETH, while DeFi protocols offer lending, liquidity pools, staking, and more.

The chart below shows the total value locked in all of DeFi, which surpassed $240bn back in the summer of 2021, due to the nature of DeFi protocols being able to obtain leverage and the use of borrowing and using your crypto as collateral.

The bull of 2021 and the bear of 2022 have been unprecedented by any year due to the massive stimulus provided by the central banks in 2020, which saw the majority of leverage and borrowing get wiped out in 2022.

During the Luna sell-off, TVL went down over $160bn; admittedly, a sell-off occurred just before Luna during the peak of the bull run in Nov 2021, most likely investors withdrawing from the ecosystem. Furthermore, the FTX collapse resulted in a further $23bn sell-off, putting TVL at around $70bn, similar to early 2021.

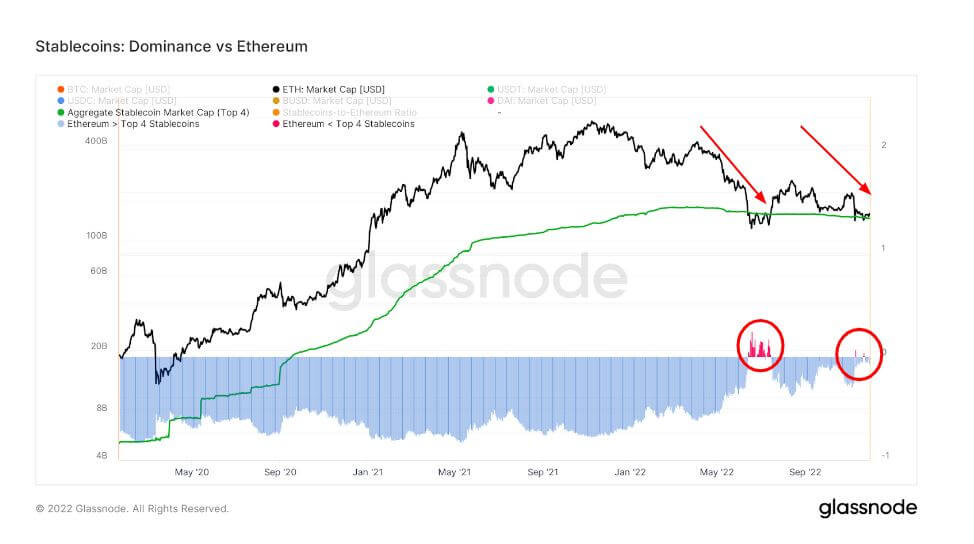

Stablecoin performance as a result of FTX collapse

Ethereum’s dominance over the top four stablecoins has been on a downtrend since May, with stablecoins becoming more dominant in June — when ETH hit its lowest price for the year.

This chart compares the Ethereum Market Cap to the aggregate value of the top four stablecoins USDT, USDC, BUSD, and DAI. Note that the supplies of these stablecoins are distributed between multiple host blockchains, including Ethereum.

In June, the ETH market cap was lower than the top 4 stablecoin market caps due to Luna, and the same happened during the FTX collapse; however, a much smaller drop for only a brief period.

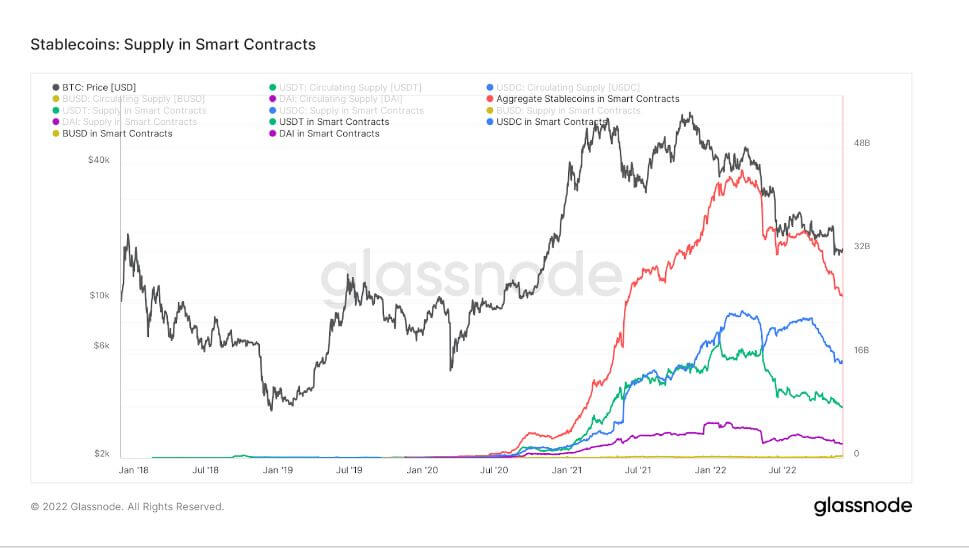

The chart below shows the total supply issued on and held within Ethereum smart contracts. This chart shows the aggregate supply held in smart contracts alongside individual traces for the top four stablecoins USDT, USDC, BUSD, and DAI.

Another noticeable trend in the stablecoin ecosystem is the severe decline in the supply of smart contracts. Aggregate supply during its peak was at $44bn; since the Luna and FTX collapse, it is now hanging around $25bn. A significant decline in all top 4 stablecoins as well.

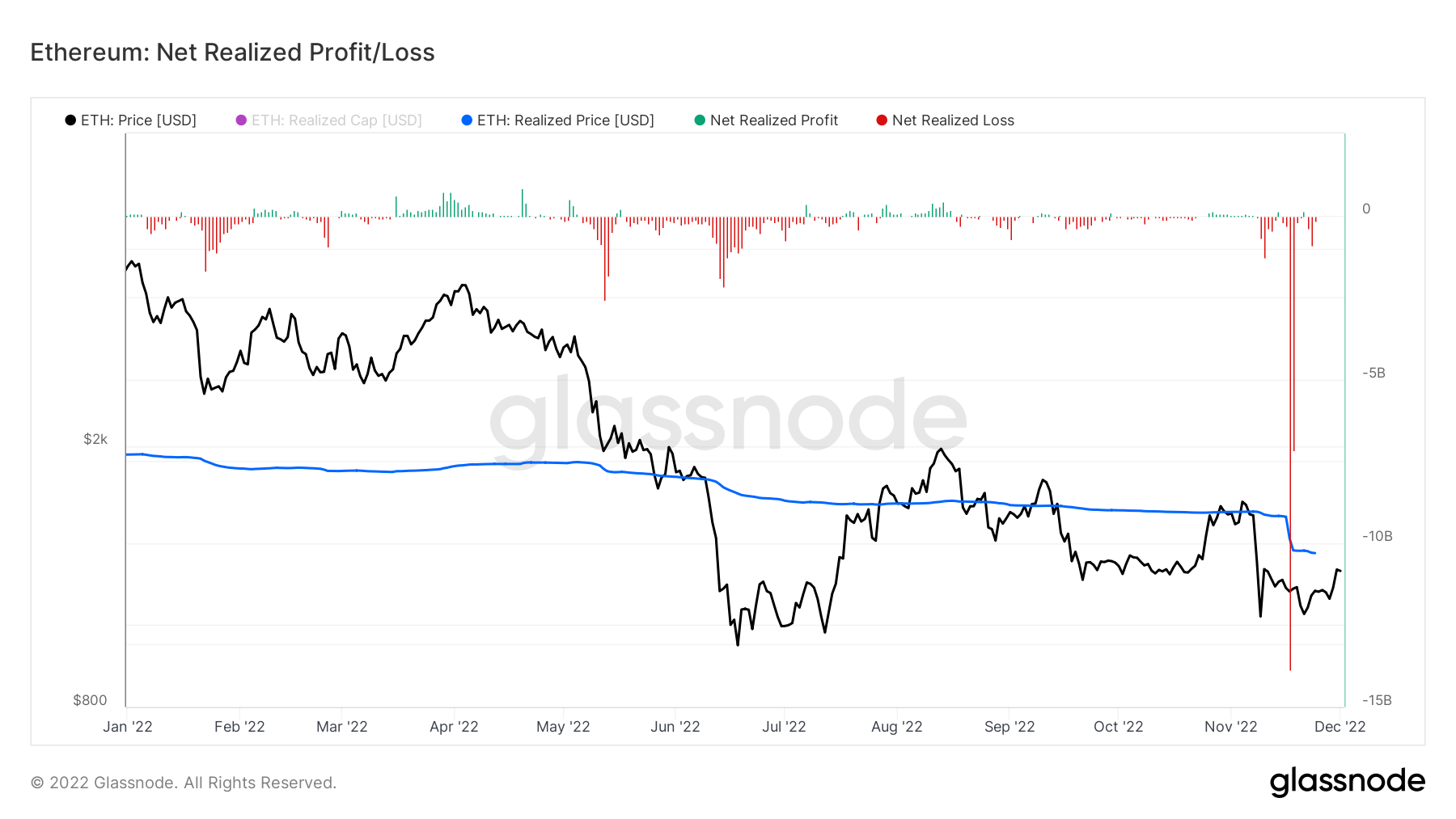

Substantial losses for Ethereum

Net realized profit/loss is the net profit or loss of all coins spent that day. The price at which each spent coin was last moved and the current price enables the calculation of the USD value the owner realized in profit or loss.

Over the week during the FTX collapse, Ethereum realized losses amounted to over $20bn, with $14bn coming on Nov. 17, multiple times worse than the Luna collapse for investors.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC