Este artículo también está disponible en español.

Dogecoin (DOGE) holders have been put on alert by crypto analyst Ali Martinez (@ali_charts), who shared a chart on Monday highlighting a noteworthy technical setup. According to Martinez, the Market Value to Realized Value (MVRV) ratio for DOGE just formed a “death cross” with its own 200-day moving average (MA)—an event that previously correlated with major price declines.

Dogecoin MVRV Death Cross Warning

Martinez’s chart, sourced from Santiment, plots three key data points: DOGE/USD Price (black line), DOGE’s MVRV Ratio (orange line) and DOGE’s 200-day MVRV Ratio MA (red line). He commented: “DOGE just saw a death cross between the MVRV Ratio and its 200-day MA. The last two times this happened, prices dropped 26% and 44%.”

The newly printed “death cross” occurs where the orange MVRV ratio line falls below the red 200-day MA line. Historically, the analyst notes, DOGE’s price experienced two significant corrections after this same crossover: A 26% drop between early September and late October 2023 and a 44% plunge from mid-June to late September 2024.

Related Reading

Both downturns appear in shaded areas on the chart, labeled accordingly. After each of these drawdowns, Dogecoin’s price eventually rebounded, but only after reaching notably lower price levels. Looking closer at the chart, Dogecoin’s price is shown trading around $0.268. The MVRV ratio (orange line) has climbed near 91%, while the 200-day MVRV Ratio MA (red line) hovers around 78.36%.

The MVRV ratio compares Dogecoin’s current market value to its realized value (the aggregated cost basis of DOGE last moved on-chain). An MVRV of 91% indicates that market participants, on average, could be up significantly relative to their purchase price—if the ratio remains above 1. Although the exact interpretation depends on how an analyst applies the MVRV scale, a higher MVRV ratio generally implies increased unrealized gains among holders.

Related Reading

The 200-day MVRV MA is the simple moving average of the MVRV ratio over the past 200 days. It provides a longer-term baseline to gauge how far Dogecoin’s current MVRV stands above or below its historical trend. A “death cross” in this context appears when the short-term MVRV ratio (orange line) moves beneath the 200-day MVRV ratio MA (red line), often signaling a potential shift in sentiment or impending sell pressure.

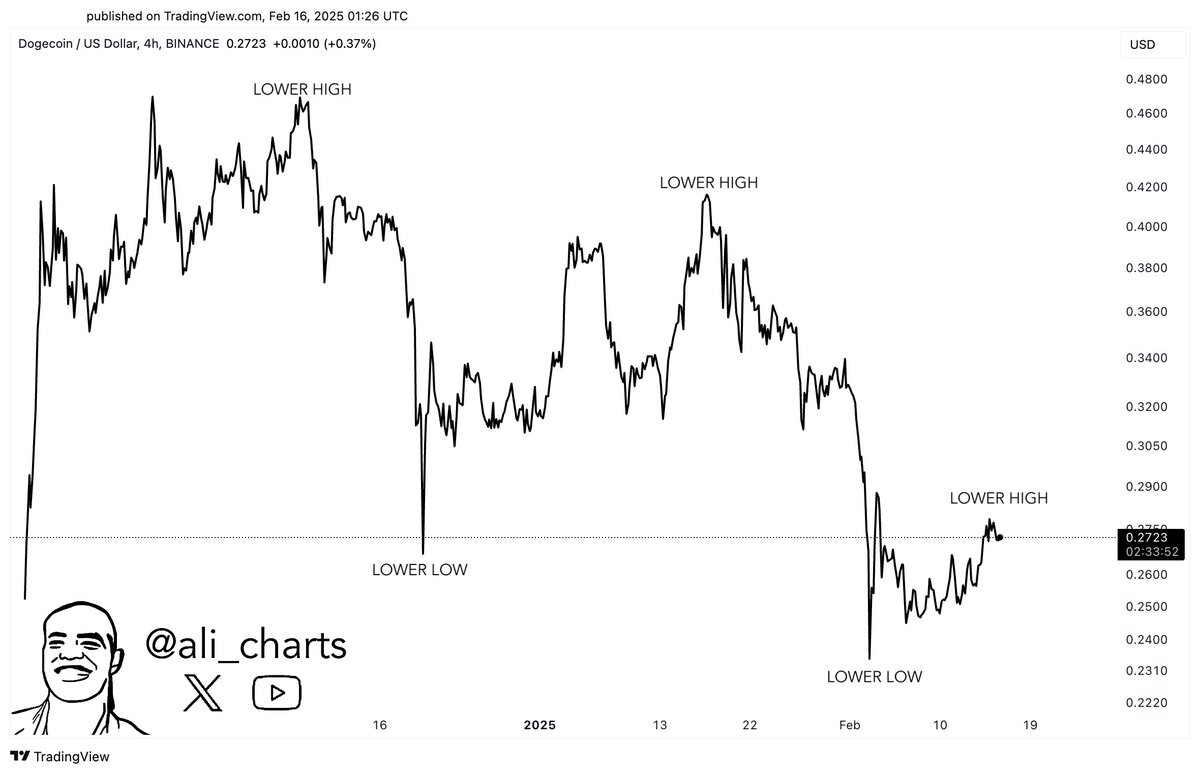

Notably, the Dogecoin price is showing some weakness over the past couple of weeks. Since the December 8 high at $0.4834, DOGE is constantly writing lower highs and lower lows, a highly bearish chart setup. Martinez shared the below chart and stated: “DOGE remains in a downtrend, forming lower lows and lower highs. A breakout above key resistance is needed to shift momentum!”

For this to happen, DOGE would need to break above $0.44. However, DOGE bulls can expect significant resistance at $0.31 (0.382 Fibonacci retracement level), $0.342 (0.5 Fib) and $0.375 (0.618 Fib). At press time, DOGE traded at $0.26.

Featured image created with DALL.E, chart from TradingView.com

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Avalanche

Avalanche  Litecoin

Litecoin  Hedera

Hedera  Shiba Inu

Shiba Inu  USDS

USDS  Toncoin

Toncoin  LEO Token

LEO Token  Hyperliquid

Hyperliquid  WETH

WETH  Polkadot

Polkadot  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Monero

Monero  Pepe

Pepe  Aptos

Aptos  WhiteBIT Coin

WhiteBIT Coin  Ondo

Ondo  Aave

Aave  NEAR Protocol

NEAR Protocol  Bittensor

Bittensor  Dai

Dai  Mantle

Mantle  sUSDS

sUSDS  Official Trump

Official Trump  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  OKB

OKB  Tokenize Xchange

Tokenize Xchange  Gate

Gate