Crypto exchanges can earn revenue through various means, including lending to margin traders, liquidation fees, and on/off ramping charges. However, the core revenue generator remains taking a fee on transactions.

There are multiple types of transactions and, therefore, many types of transaction fees. When comparing different transaction fees on the Bitcoin and Ethereum chains, the data suggested exchanges prefer to use the former to transfer value internally.

Transaction fees

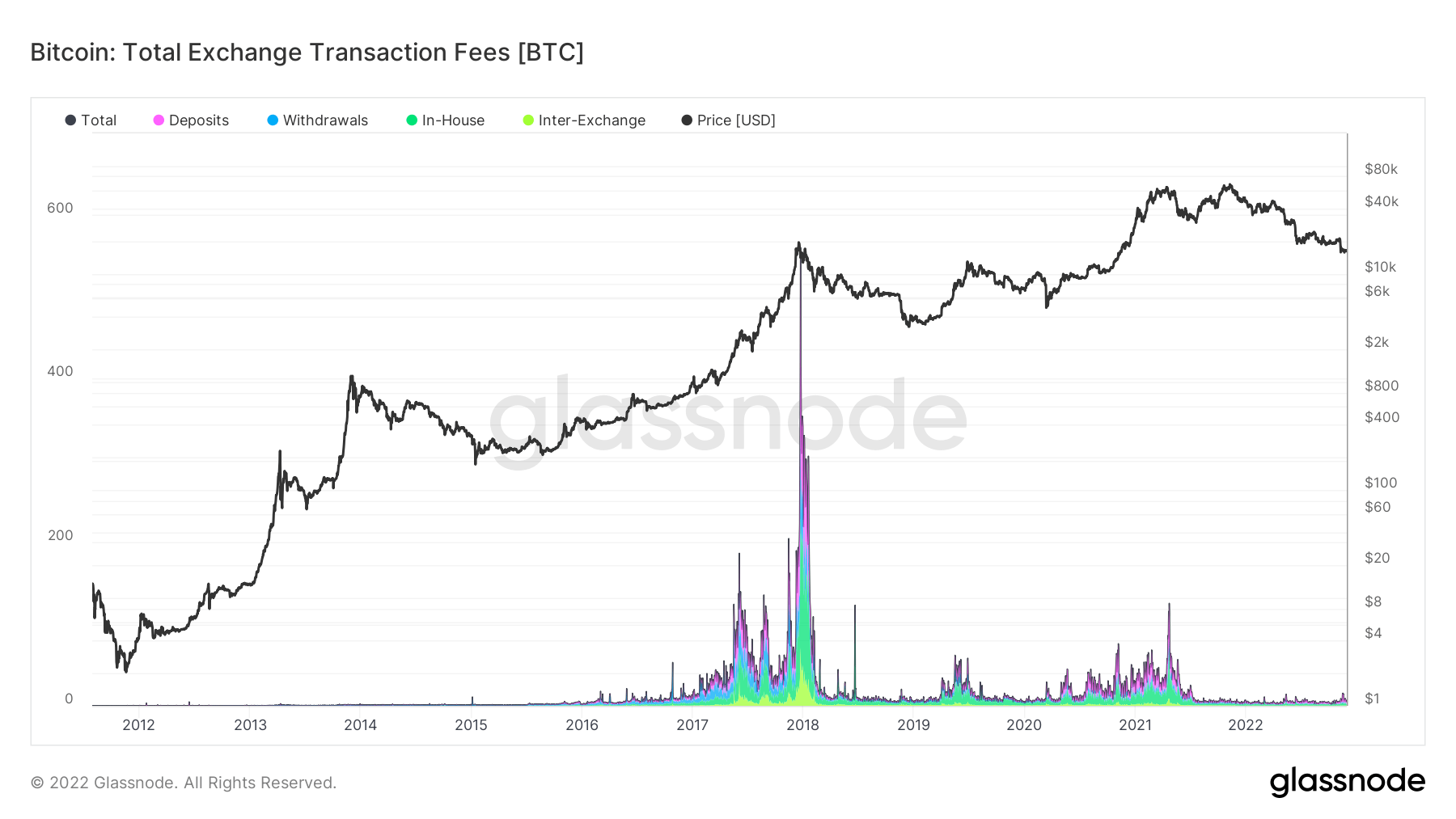

On-chain data provided by Glassnode and analyzed by CryptoSlate showed an erratic history for fees earned by exchanges on Bitcoin transactions.

The chart below features a considerable spike in fees towards the end of 2017, as BTC hit its $20,000 previous cycle peak.

The 2021 bull market saw another fee spike in April 2021, albeit significantly less than the 2017 bull, as BTC approached $65,000.

Strangely, the most recent bull market top, of $69,000 in Nov. 2021, was not accompanied by another fee spike, suggesting comparatively less exchange activity versus April 2021.

Since April 2021, fees through Bitcoin transactions have sunk significantly and remain truncated.

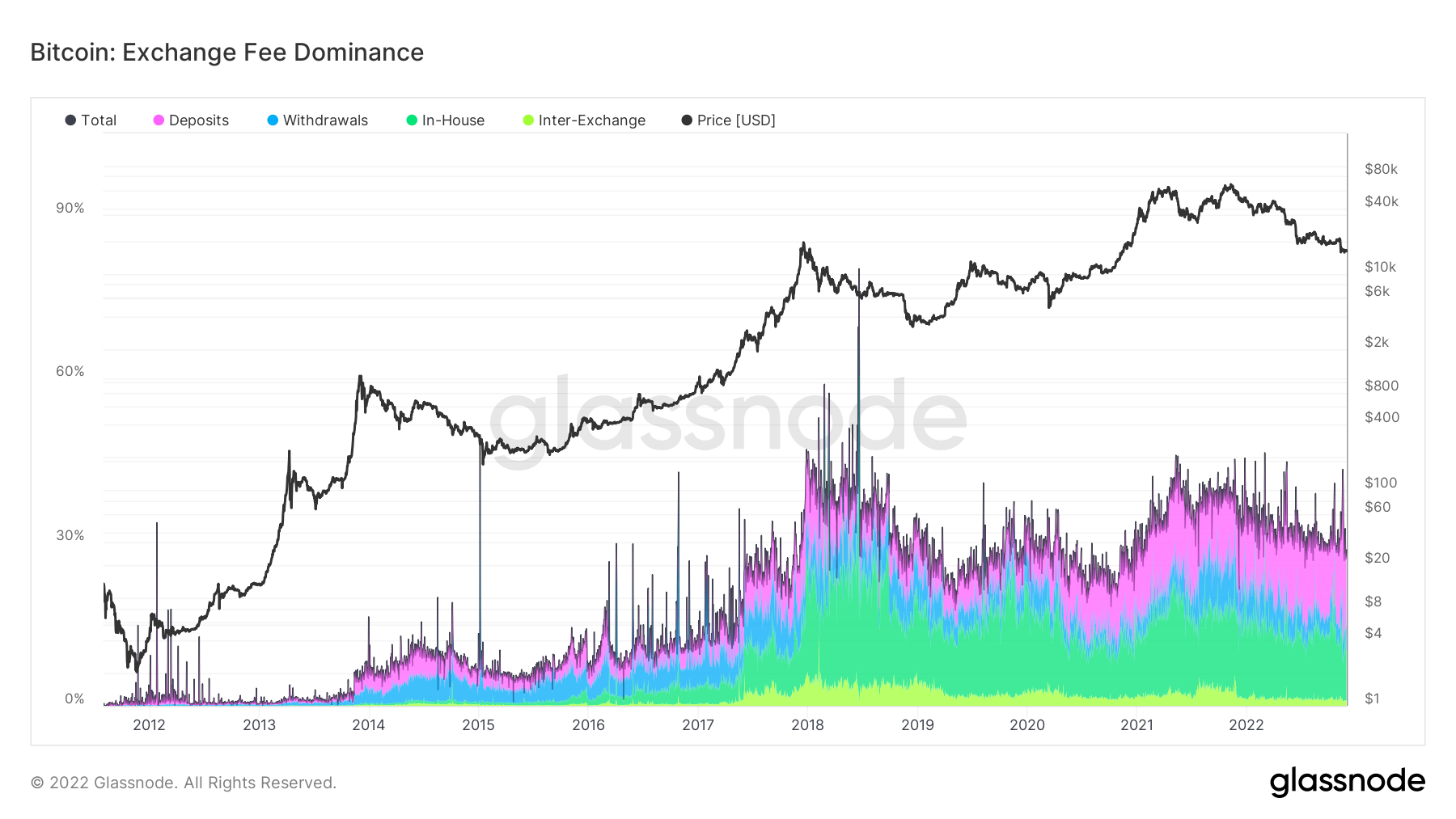

Bitcoin: Exchange Fee Dominance

The Exchange Fee Dominance metric is defined as the percentage of total transaction fees paid in relation to on-chain exchange activity. This is further split into the type of transaction that earned the fee as follows:

- Deposits: Transactions that include an exchange address as the receiver of funds.

- Withdrawals: Transactions that include an exchange address as the sender of funds.

- In-House: Transactions that include addresses of a single exchange as both the sender and receiver of funds.

- Inter-Exchange: Transactions that include addresses of (distinct) exchanges as both the sender and receiver of funds.

The chart below shows Bitcoin transaction fees made up 36% of all exchange revenue sources related to BTC. This is further split:

- Deposits – 21%

- Withdrawals – 4%

- In-House – 10%

- Inter-Exchange – 1%

Over the past five years, the categories of Deposits and In-House have grown exponentially.

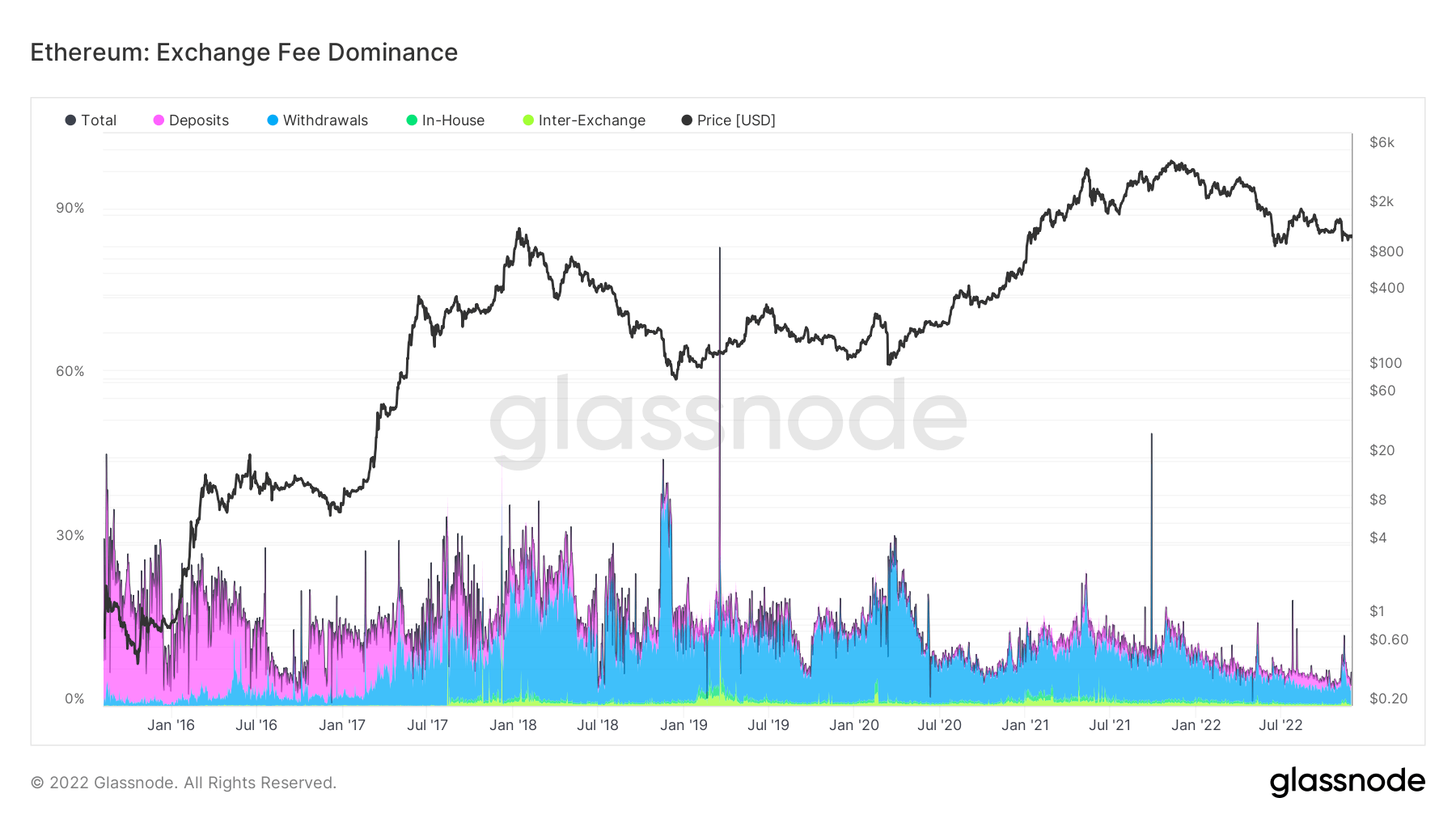

Ethereum: Exchange Fee Dominance

Analysis of Ethereum’s Exchange Fee Dominance paints a very different picture. Currently, Ethereum transaction fees account for 5% of exchange revenue sources related to ETH.

Withdrawals make up the most significant category of transaction fee type, which has been the case since July 2017.

The relative lack of In-House fees compared to Bitcoin suggests exchanges prefer not to use ETH when transferring funds between internal wallets.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  Hyperliquid

Hyperliquid  USDS

USDS  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC