- The ECB identifies that in emerging markets, the instability of local currencies drives demand for Bitcoin.

- Bitcoin is used in transactions and remittances, especially in countries with capital controls and underdeveloped financial systems.

A recent report by the European Central Bank (ECB) has shed light on the growing popularity of Bitcoin in emerging markets. This study reveals that, unlike in advanced economies, the instability of local currencies and the need for cheap cross-border transactions are key factors in the increased use of cryptocurrencies. This phenomenon raises questions about financial stability and the future of international remittances.

Analysis of Bitcoin in Global Economies

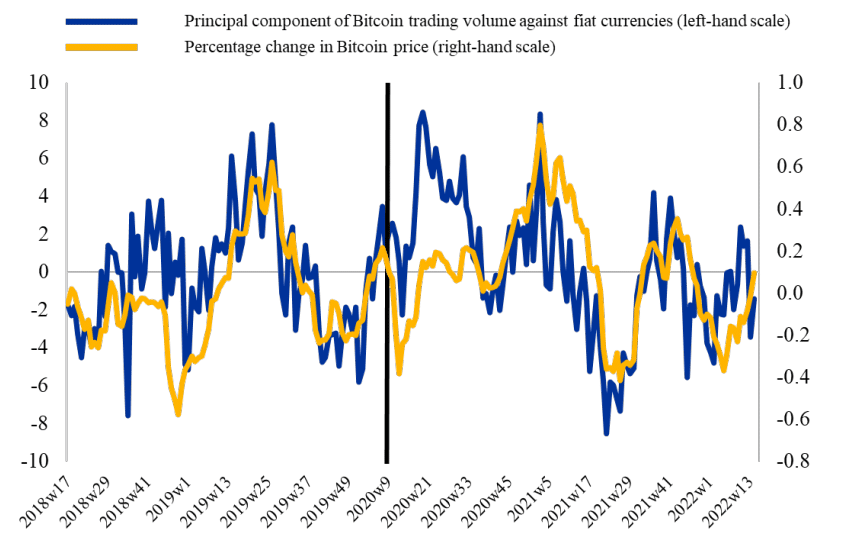

This study delves into theanalysis of Bitcoin transactions against 44 fiat currencies on major P2P cryptoasset exchanges .Using a dataset spanning January 2018 to April 2022, it examines the determinants of Bitcoin trading volume.

The study focuses on identifying intrinsic drivers of the cryptoasset market, as well as external influences derived from global financial markets and local macroeconomic factors.

Evolution of the Global Cryptoasset Cycle

The results indicate the presence of a global cryptoasset cycle driven by speculation. Factors such as volatility and momentum in the cryptoasset market, along with global financial market indicators such as liquidity and volatility, play a crucial role in Bitcoin trading.

This speculative trading pattern manifests itself consistently across various currencies and regions.

Impact on Emerging and Developing Markets (EMDEs)

In EMDEs, Bitcoin assumes an additional role as a transaction medium. The increase in Bitcoin trading in these markets is associated with the instability of local currencies. This suggests that Bitcoin is used not only for speculation, but also as a medium of exchange or store of value in contexts of high inflation or currency depreciation.

A negative correlation is observed between banking depth, digitization and global factor participation, implying that cryptoassets may offer a speculative alternative to traditional finance in EMDEs with a higher proportion of young and risk-prone population.

Dynamic Panel Models and Factor Models

The study employs dynamic panel models and factor models to investigate the drivers of Bitcoin P2P trading volume. A common factor is detected that explains a significant proportion of the variance in the data in the COVID-19 pandemic period in both AEs and EMDEs, revealing considerable cohesion in Bitcoin trading against different fiat currencies.

This common component is correlated with Bitcoin price, indicating that speculative motives prompt individuals in different regions to trade Bitcoin against their local currency.

Bitcoin: More than Speculation in Emerging Economies

Unlike in advanced economies, where currency fluctuations have not significantly affected cryptocurrency activity, in emerging countries, fiat currency instability is an additional driver for Bitcoin demand.

This suggests that, in these markets, Bitcoin is not only seen as an asset for speculation, but also as a haven of value against unstable local currencies.

Youth and Adoption of Cryptocurrencies

There is a notable correlation between Bitcoin usage and countries with young and less risk-averse populations. This phenomenon could reflect a greater openness and familiarity with emerging technologies among young people.

IMF and Financial Stability Concerns

The International Monetary Fund (IMF) has expressed concerns about the potential for cryptocurrencies to impact volatile economies and as a means to circumvent controls. The ECB report concludes by noting potential risks to financial stability in countries with limited financial development and unstable fiat currencies.

Bitcoin and Remittances: A Crossroads

Given the importance of unstable currencies and the need for economic cross-border remittances, the report suggests that it is crucial to determine which of these factors is more influential. This is especially relevant as the G20 is trying to address the costs of remittances, while volatile currencies represent a more complex challenge.

Specific Cases: Mexico and China

Mexico, despite having a volatile currency and substantial remittances, ranks 16th on Chainalysis’ cryptocurrency adoption list. This could be due to the country’s ban on cryptocurrencies and the widespread use of the U.S. dollar as an alternative value and medium of exchange.

Takentogether, these findings suggest that Bitcoin is widely used as aspeculative investment asset in advanced, emerging and developing economies, but in EMDEs, transactional services are also important .

The attraction of Bitcoin as a speculative investment and possibly also as a means of payment is reinforced by exchange rate instability, limited development of digital payment systems, and a younger population.

These results provide a comprehensive view of the drivers of Bitcoin trading, highlighting the importance of both speculative and transactional aspects in contexts of macroeconomic instability and in markets with less developed financial infrastructure.

Crypto News Flash does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products, or other materials on this page. Readers should do their own research before taking any actions related to cryptocurrencies. Crypto News Flash is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods, or services mentioned.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  Polkadot

Polkadot  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Uniswap

Uniswap  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Official Trump

Official Trump  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Bittensor

Bittensor  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  OKB

OKB