Prices of some mega-cap altcoins, including Optimism (OP) and Kaspa (KAS), are on the verge of new all-time highs thanks to heightened institutional interest in the cryptocurrency sector.

Thanks to billions of dollars flowing into Bitcoin ETFs, crypto native investors appear to reinvest profits in altcoins.

After weeks of a relentless rally between Jan. 23 and Feb. 16, the global altcoin sector has grown by $108 billion as some mega-cap altcoins are close to hitting new all-time highs this month.

Kaspa (KAS) price: 7% away from all-time high

Kaspa (KAS) is a Layer-1 proof-of-work (PoW) cryptocurrency currently ranked 31st on the global crypto charts with a market capitalization of $3.2 billion. Through its GHOSTDAG protocol, Kaspa combines the security and decentralization of a PoW architecture with high block rates and minimal confirmation times of a Proof of Stake (PoS) network.

KAS has scored significant price gains in the last 3-weeks, outperforming not just the prominent PoW coins, including Bitcoin (BTC), Bitcoin Cash (BCH), and Litecoin (LTC), but also the overall altcoin market.

Between Jan. 23 and Feb. 16, KAS’s price increased by 56%, adding $1.1 billion to its market capitalization. By scoring another 7% gain, KAS will surpass its previous global peak at $0.16, recorded on Nov. 19.

Compared to the $108 billion growth in Total Market Cap, excluding BTC and ETH, KAS has attracted about 1% of all capital inflows into the altcoin market in the last 3 weeks.

Why is Kaspa’s (KAS) price rising?

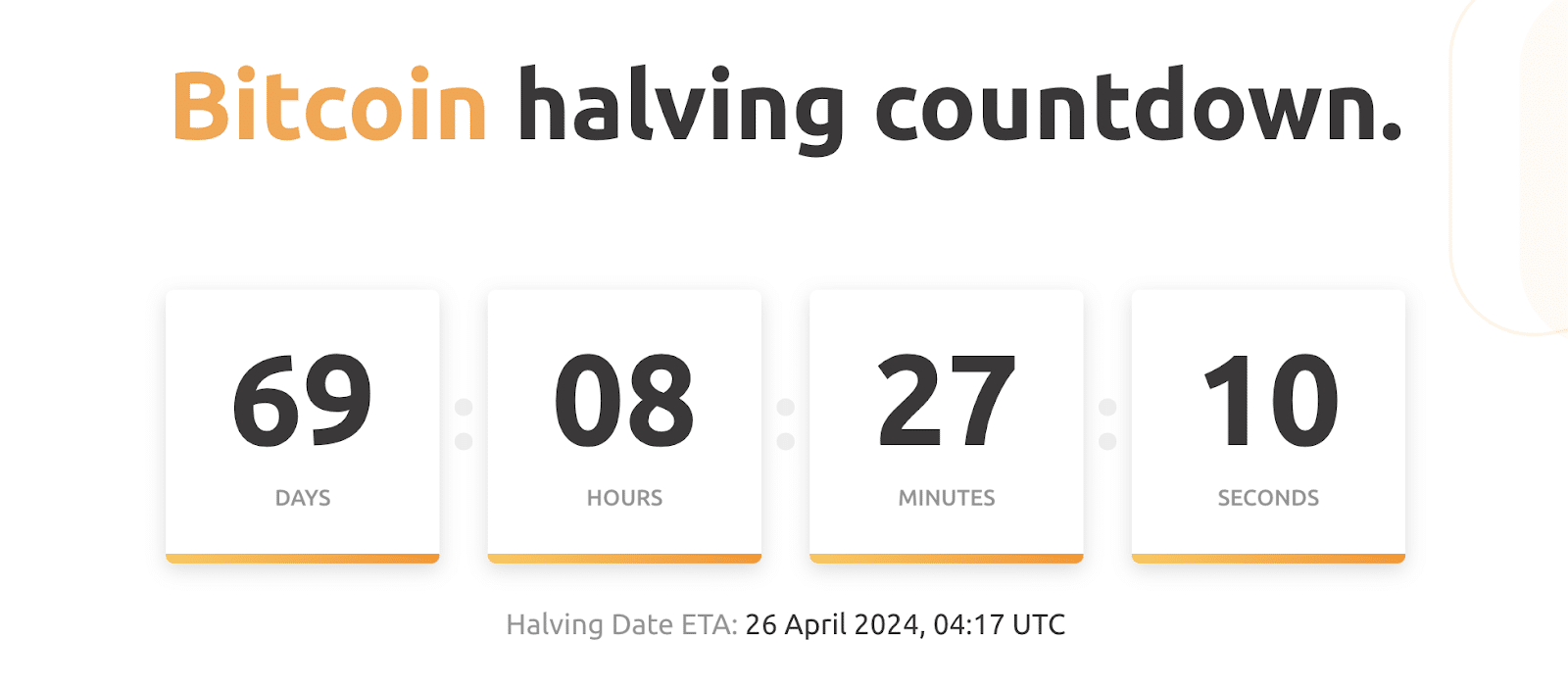

The upcoming Bitcoin halving is one dominant narrative behind Kaspa’s recent growth spurt. Industry experts expect over 20% of Bitcoin miners will go offline when block rewards are slashed from 6.25 BTC to 3.13 BTC in April 2024.

Many miners could channel their resources towards alternative Proof of Work networks, like Kaspa, that offer more attractive returns.

Hence, investors appear to be piling funds in the KAS coin to front-run the potential upside from the fallout of the upcoming Bitcoin halving. This could effectively send KAS price racing towards a new all-time high in the coming weeks.

Optimism (OP) price: 9% away from all-time high

Optimism (OP) is a prominent layer-two blockchain built on Ethereum. Optimism benefits from the security of the Ethereum mainnet and provides enhanced scalability using its innovative, optimistic rollups.

Like other Layer-2 scaling solutions, the OP allows cryptocurrency investors to carry out faster and more cost-effective defi transactions without interacting primarily with the Ethereum mainnet.

OP token has drawn investors’ attention amid increased demand for defi transactions triggered by the crypto market rally.

Between Jan. 23 and Feb. 16, Optimism’s price beat the market average, gaining 53% and adding about $1 billion in market capitalization. On Feb. 15, the OP price peaked at just 10%, away from hitting its all-time high of $4.30, recorded on Jan. 12.

Why is Optimism’s (OP) price going up?

The ongoing OP price rally appears to be driven largely by industry-wide demand for defi services.

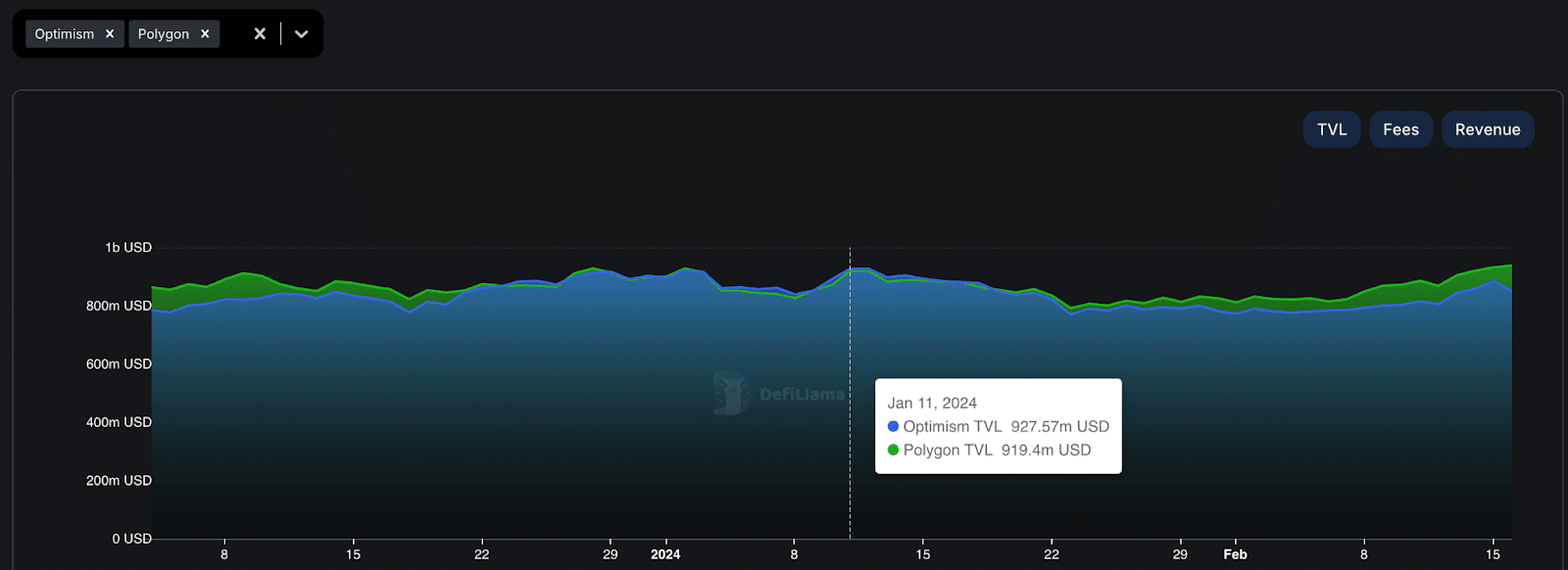

While Optimistic roll-ups were launched in 2019, the OP governance token was only launched in June 2022. But despite being relatively new on the market compared to Polygon (MATIC), Optimism has quickly grown to become one of Ethereum’s most in-demand scaling solutions over the past year.

Furthermore, the chart shows that Optimsm briefly surpassed Polygon network when its TVL peaked at $927.6 million on Jan. 11, the same day OP price hit an all-time high.

This close correlation between OP price and TVL growth trends emphasizes that the fundamental demand for defi solutions is the main catalyst behind the ongoing rally.

Optimism is home to over 100 protocols, the biggest being Synthetix (SNX), a derivatives exchange, Uniswap (UNI), a DEX, and Velodrome (VELO), an AMM.

With demand for these critical defi services still on the rise, OP looks set to close the 10% gap and reclaim a new all-time high in the coming weeks.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Sui

Sui  Avalanche

Avalanche  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  MANTRA

MANTRA  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  Gate

Gate  OKB

OKB  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC