The 5% dip in the aggregate valuation of all the assets in the crypto market was instigated by large-cap coins like Bitcoin and Ethereum. After shedding more than 6% of its value over the past day, Bitcoin was back to trading at $40k on Friday. Ethereum’s similar magnitude dip, however, managed to push the coin below the $3k threshold. At the time of press, the largest altcoin was seen exchanging hands at $2.91k.

In effect, the amount of Ethereum rekt [947 ETH worth $2.76 million] managed to exceed that of Bitcoin’s [66 BTC worth $2.64 million].

What are Ethereum traders upto?

Over the last couple of days, the long liquidations seemed to overshadow the short liquidations quite comfortably. Such was the case during the early hours of Friday too.

Currently, however, the liquidations chart has sort of becoming barren, with no clear-cut trend being established over the past few hours.

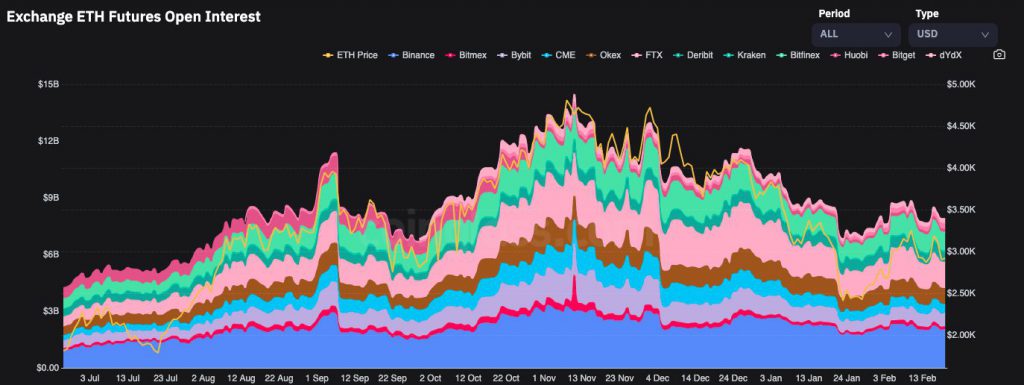

The Open Interest to has remained stagnated in the $7 billion to $8 billion brackets of late. The same highlights the hesitancy of new leverage traders to enter the market. Thus, it can be said that traders are waiting for the price trend to become concrete before stepping back into Ethereum’s arena.

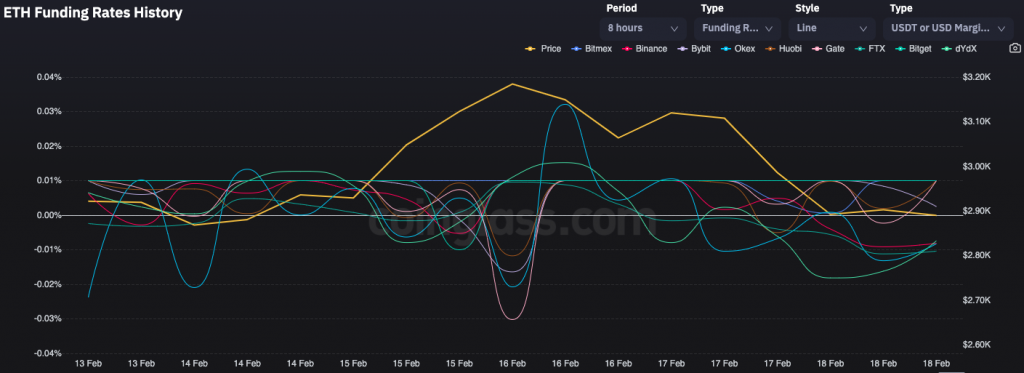

Alongside the lack of new funds entering the market, the funding rate curves have been dispersing all across the board. This means that traders who are already in the market are technically conflicted at this stage.

On a couple of exchanges like Bitmex, ByBit, and Huobi, longs were seen paying the shorts, while on platforms including Binance, FTX, and OKEx, the rates were negative and shorts were seen funding the longs.

As long as the market continues to dither, traders would remain divided and it’d be difficult for a concrete collective sentiment to take shape.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC