I wanted to write some thoughts about Bitcoin as it relates to the financial advisor industry because I think it’s a highly overlooked relationship that not many have touched on. Between the wealth management industry, financial advisors and family offices, trillions of dollars of capital is controlled. As of 2023 here are some estimates:

- Family offices manage $15 trillion in assets – UBS Global Family Office Report 2023

- The Wealth Management Industry manages $100 trillion in assets – PwC’s 2023 Global Asset and Wealth Management Survey

- The Global Wealth Management Industry manages $103 trillion in assets – Boston Consulting Group’s 2023 Global Wealth Report

This is essentially the largest collective of controlled capital in the world. As a prior financial advisor I can speak from experience, the wealth management industry is riddled with misaligned incentives. Specifically, the industry’s relationship with Bitcoin as an asset has been backwards since Bitcoin’s inception, however this may be about to change.

A few comments on the wealth management space that may sound broad and un-nuanced, but I believe to be true.

The entire wealth management and investment advisory space is built on the backbone that the “risk-free rate” is the universal benchmark which all investments should be measured against. The risk-free rate generally refers to the 10-year treasury bond’s current yield (today 4.77%). To people who have been in bitcoin for a while the concept of a risk free rate is absurd, to the other 99% of the world this is accepted as fact. As of last week total losses on US Treasuries are approaching $1.5 trillion, they don’t seem that risk free when you’re a forced seller.

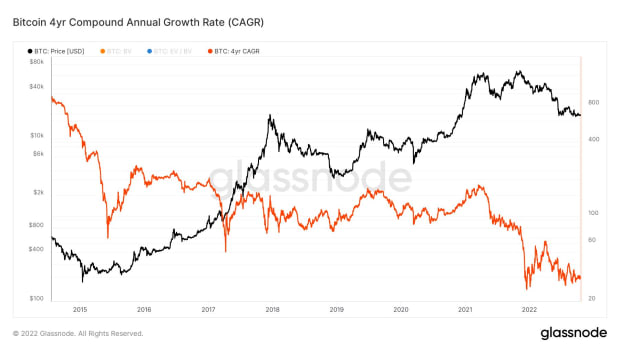

In addition, the actual rate is completely manipulated and centrally controlled by unelected actors. The result is an entire global economy making investment decisions based on a false benchmark with no ties to the free market, nobody on the planet knows what the real cost of capital is. We would argue the only thing that qualifies as “risk-free rate” is the 4 year CAGR of bitcoin in self custody (about 30% in the heart of a bear market).

This factors in the un-manipulatable monetary policy of the bitcoin network, the elimination of counterparty risk, and the free market price discovery taking bitcoin halvenings into account. All of this to say a $100 trillion industry is using the wrong benchmark.

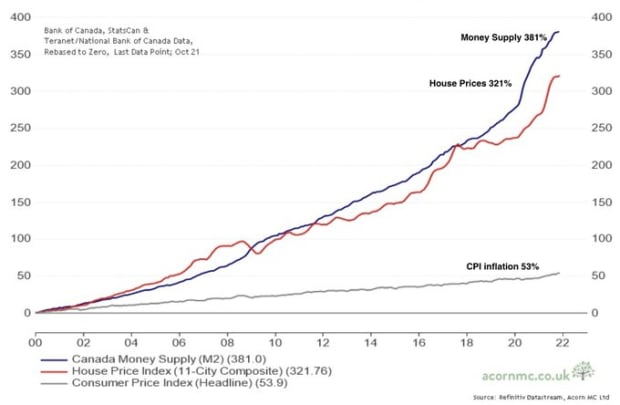

Another point in relation to the wealth management industry is the collective misunderstanding of the CPI, widely regarded as the current inflation rate. Again, many people in bitcoin have been preaching for over a decade that this number is incredibly manipulated.

The basket of goods that the CPI measures is frequently changed to fit narratives.

Alternatives to measure inflation should be considered, like the increase in M2 money supply or the Chapwood Index.

Asking any person living in this country what they’re experiencing in terms of price increases for basic items would likely give you an inflation rate closer to 20% – 30%.

The combination of these two lies proliferated throughout society is potentially the most dangerous recipe for disaster our economy has ever had. If the artificial benchmark that everything is measured against is 4.77% and the real inflation rate is something like 15% it means almost everything is negative yielding in real terms. If you denominate in USD you’re losing purchasing power almost anywhere you try to invest or store wealth, this is actually what bitcoin fixes. The wealth management industry manages $100 trillion in assets without this knowledge, that’s a very scary bubble if they find out too late.

Lastly, the investment advisory industry is built on the concept of “fiduciary responsibility”. A fiduciary is a person or organization that acts on behalf of another person or persons, putting their clients’ interests ahead of their own, with a duty to preserve good faith and trust. Being a fiduciary thus requires being bound both legally and ethically to act in the other’s best interests. On paper, this is probably what convinces $100 trillion of value to flow into the wealth management space, in practice it’s just an industry term that is not enforced at the margins or respected. For the most part, an individual or businesses incentives will always trump a vague industry guideline. This is where I think the relationship between the wealth management space and bitcoin becomes very interesting.

Currently, investment advisors have completely misaligned incentives related to bitcoin and I believe a spot ETF approval in the US will create an enormous shift in the opposite direction. Financial Advisors make fees for their Assets Under Management, if they want to offer a client bitcoin exposure right now, they more than likely need to send that clients money out of their book of business, and towards a separate broker, exchange, or custodian. The unfortunate truth is this has been the case since bitcoin’s inception and has not improved at all since I realized the situation in 2016-2017. If you were an independent advisor who could make your own decisions, there were bespoke ways to offer clients exposure that still ended up messy. Advisors could create a Self Directed IRA for clients which allows direct access to alternative investments like bitcoin. This was extra work and sometimes couldn’t be displayed or tracked in clients management software, this defeated the purpose as all clients wanted to do was see their entire net worth and all assets in a clean, concise UI. Advisors could also offer access to inferior products like GBTC, which trades at a premium or discount to bitcoin’s real price, and has many additional downsides which many came to realize.

Now it should be universally understood in the bitcoin space that owning shares of a spot bitcoin ETF is not owning bitcoin. Everybody should strive to take full self custody of their bitcoin but the reality is most of the world, especially legacy finance is not there yet. With that being said, approval of a spot bitcoin ETF via Blackrock, the largest capital manager in the world, would shift legitimate bitcoin exposure into the purview of the entire wealth management industry.

Spot ETF bitcoin exposure also aligns very well with the incentives of the investment advisors. They would be able to offer access to clients the same way they allocate to equities or mutual funds. The bitcoin exposure would be displayed within a clients portfolio, and would look just like another portion of their total net worth.

Perhaps the most important unlock is that the bitcoin Spot ETF would start to proliferate itself into the existing models that the wealth management industry relies on. In my experience, almost all investment advisors outsource allocation decisions to “experts”. The experts, as you could guess, are Blackrock, State Street, and Vanguard, essentially responsible for almost every investment model I’ve ever seen. Within these models there may be different baskets of assets, different breakdowns of risk, exposure, and sectors, but they are created by the same institutions, all chasing performance and diversification. Even legacy finance representatives that hate bitcoin for one reason or another have to admit one thing, it is the single best source of diversification in the investment world. Whether they know it yet or not, bitcoin is a hedge on sovereign credit default, it’s a hedge against centralized money printing, and it’s a hedge on the entire fiat currency system. Bitcoin offers an asymmetric investment opportunity and diversification characteristics that you simply can’t get anywhere else. For this reason, once the Spot ETF is approved it will slowly start to creep its way into the existing models that make up the capital allocation of the entire world. This may happen over years, with the Spot ETF eating .01% of a basket at a time. However, in the trojan horse of diversification, I think the bitcoin Spot ETF becomes the switch that turns on the entire Wealth Management industry to bitcoin as a must own asset in every client’s portfolio.

This is a guest post by Dillon Healy. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Ondo

Ondo  Aave

Aave  Bittensor

Bittensor  Aptos

Aptos  Dai

Dai  Internet Computer

Internet Computer  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  OKB

OKB  Tokenize Xchange

Tokenize Xchange  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC