The ongoing bear market did little to curb the rising use of stablecoins. On the contrary, dollar-pegged coins like USDT and USDC saw a parabolic growth in market cap this year, becoming a defacto settlement currency of the crypto industry.

Following the collapse of Terra and its algorithmic stablecoin UST, the two stablecoin giants took over the majority of stablecoin volumes — and they show no sign of stopping.

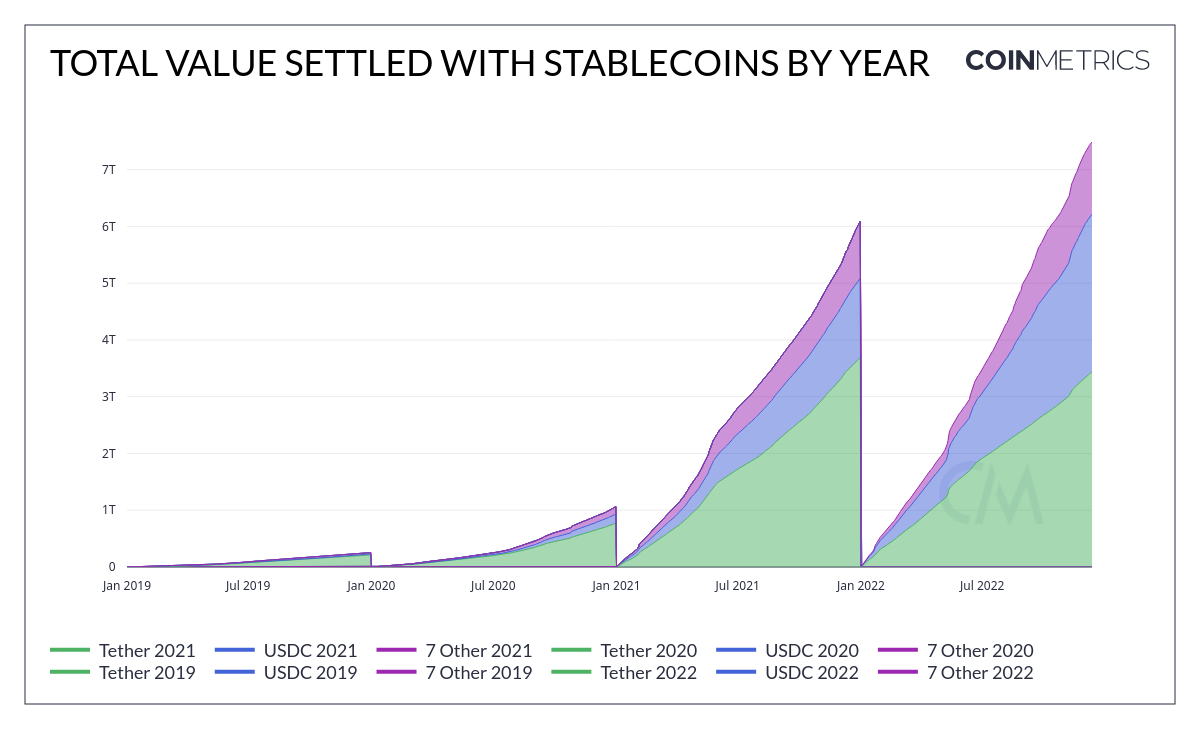

According to data from CoinMetrics, over $7 trillion in value has been settled with stablecoins in 2022. This is a significant increase from the $6 trillion settled in 2021 and the $1 trillion settled the year before.

Some analysts predict that the value settled with stablecoins could reach as much as $9 trillion in 2023, second only to Visa, which processes around $12 trillion in value per year. Others believe their on-chain volume will surpass not only Visa but also the aggregate volume of all four major card networks — Visa, MasterCard, American Express, and Discover.

However, even if the settlement value stays flat next year, it will surpass almost all the other large settlement providers individually — including Mastercard, American Express, and Discover.

Mastercard, the second-largest card issuer in the world, processed around $2.2 trillion in value so far in 2022, falling way behind the combined settlement value of the seven largest stablecoins. For example, American Express settled around $1 trillion in value this year, while Discover settled less than $200 billion in transactions.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC