AAVE, the second player in decentralized finance, has done well this year, jumping to its highest point since 2022.

AAVE (AAVE) has soared to a high of $160, up by almost 120% from its lowest point this year, bringing its valuation to over $2.5 billion.

AAVE’s DeFi TVL has jumped

The token has done well, helped by the substantial increase in assets in its network. Data shows that its total value locked in the ecosystem, has jumped to over $12.1 billion.

This growth makes it the second-biggest player in DeFi after Lido, which has over $25 billion in staked assets. It is followed by EigenLayer, Ether.fi, and JustLend.

AAVE’s growth has also led to substantial fees in the network. According to TokenTerminal, the total fees in the ecosystem this year stands at over $287 million, making it the third most profitable players in DeFi after Lido and Uniswap.

Rising whale activity helped AAVE jump in price over the past few months. For example, several whales have made substantial purchases, and currently account for most of the holders followed by investors and retail.

Data by Nansen shows that, while the number of smart money has retreated slightly recently, it remains significantly higher than June’s low of 71. The total balance held by these investors has held steady at 439,000.

The biggest smart money holds over 25,000 AAVE tokens worth $4 million plus other coins like Ethereum (ETH), Pepe (PEPE), Ondo Finance, and Beam.

AAVE has also jumped as the Federal Reserve starts cutting interest rates. In its meeting on Wednesday, the bank decided to slash interest rates by 0.50% and hinted that more were coming. Lower interest rates may lead to more inflows into lending platforms like AAVE and JustLend.

AAVE forms golden cross in July

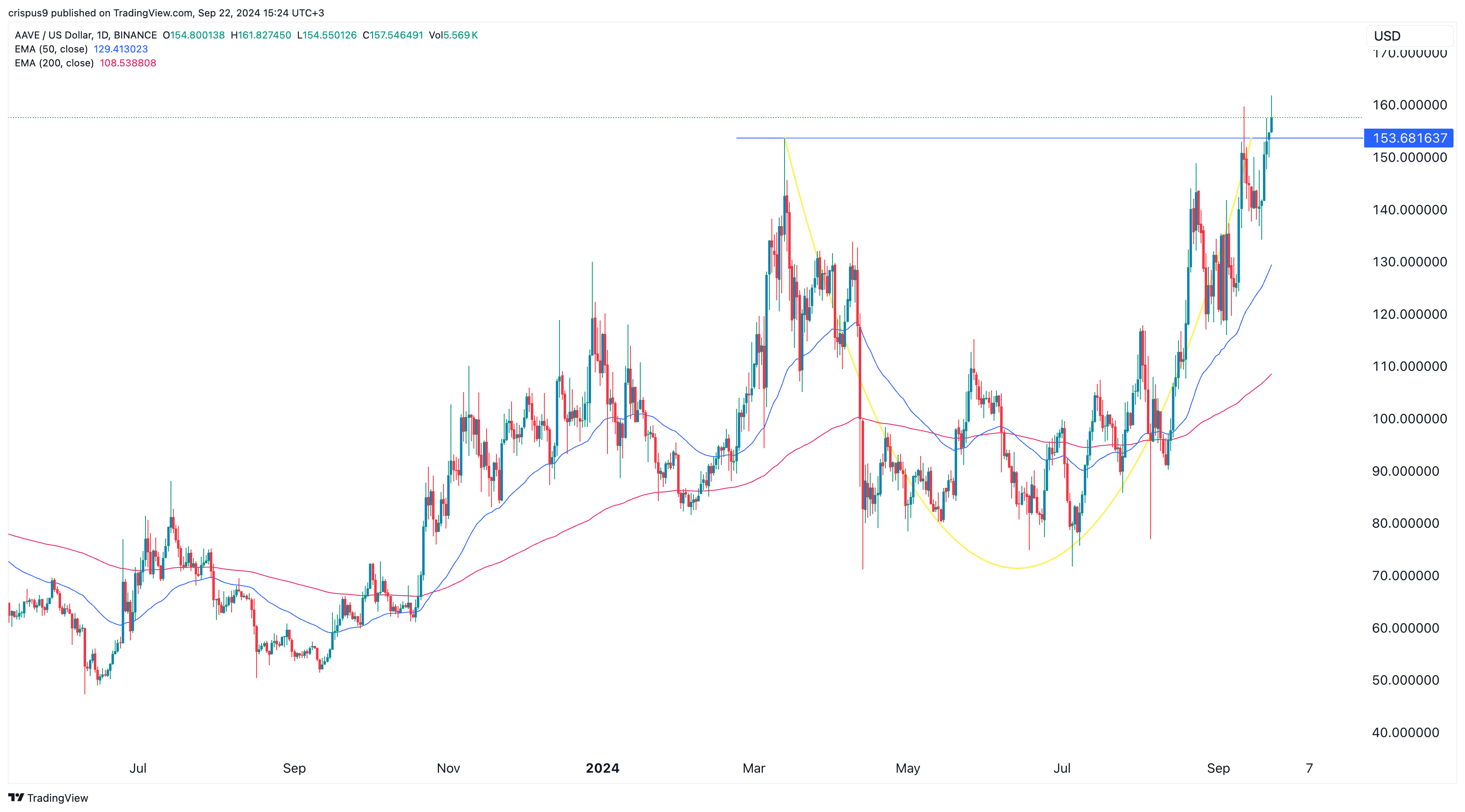

AAVE’s jump also happened after the coin formed a golden cross pattern in July as the 50-day and 200-day exponential moving averages crossed each other.

It has continued to form a series of higher highs and higher lows. Also, the coin has flipped key resistance at $150 into a support level. It has also jumped above the important point at $153.68, its highest point in March this year.

Most importantly, AAVE has formed a cup and handle pattern, a popular continuation sign.

Therefore, as the analyst below noted, there are chances that the token will continue rising as the DeFi comeback continues. If this happens, the next point to watch will be at $170.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)