Despite the prevailing differences between the 2000 dot-com bubble and the post-COVID-19 bubble, they still share numerous similarities. The 2000 tech bubble began in the late 1990s and continued until 2002, while the post-COVID-19 bubble started in 2019 and lasted until 2022.

Let’s have a look at both eras:

Dot-com Bubble:

The dot-com bubble, also known as the Internet bubble, manifested from speculative investing, an abundance of venture capital funding, and a failure of dot-coms to produce either product or real revenue.

In the midst of capital markets pouring money into the sector, start-ups were in a race to become big quickly and companies without proprietary technology abandoned fiscal responsibility. As a result, the majority of the 457 initial public offerings (IPOs) made by Internet companies between 1999 and 2000 were internet-related. Further, there were 91 IPOs in the first quarter of 2000 alone.

Eventually, the bubble burst, leaving many investors with steep losses. However, despite the bubble, Amazon, eBay, and Priceline have managed to survive. Furthermore, this laid the foundation for internet applications like Twitter and Facebook which ushered in a new era of communication and technology.

Covid-19 Bubble:

During the Covid-19 lockdowns, narratives changed from centralized communication technology to a focus on decentralized technology for some at the cutting edge of the tech industry.

Like the 2000 tec bubble, the Covid-19 bubble was also accompanied by much speculation for digital assets and an increase in available capital as a result of quantitative easing and stimulus checks.

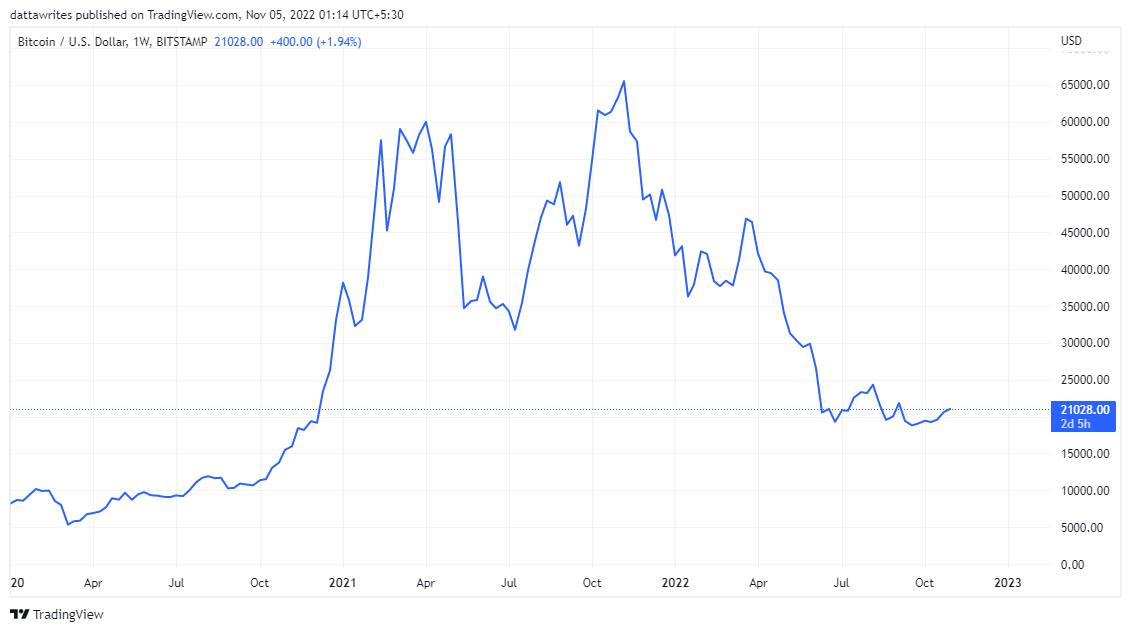

Bitcoin’s price was $19,000 in November 2020, but by 13 March 2021, it had surpassed $61,000 for the first time as more investments led to an increase in market cap. Cryptocurrencies like Ethereum, Solana, and DogeCoin also rose sharply. Bitcoin and Ethereum peaked at $67,566.83 and $4,812.09, respectively, on November 7, 2021.

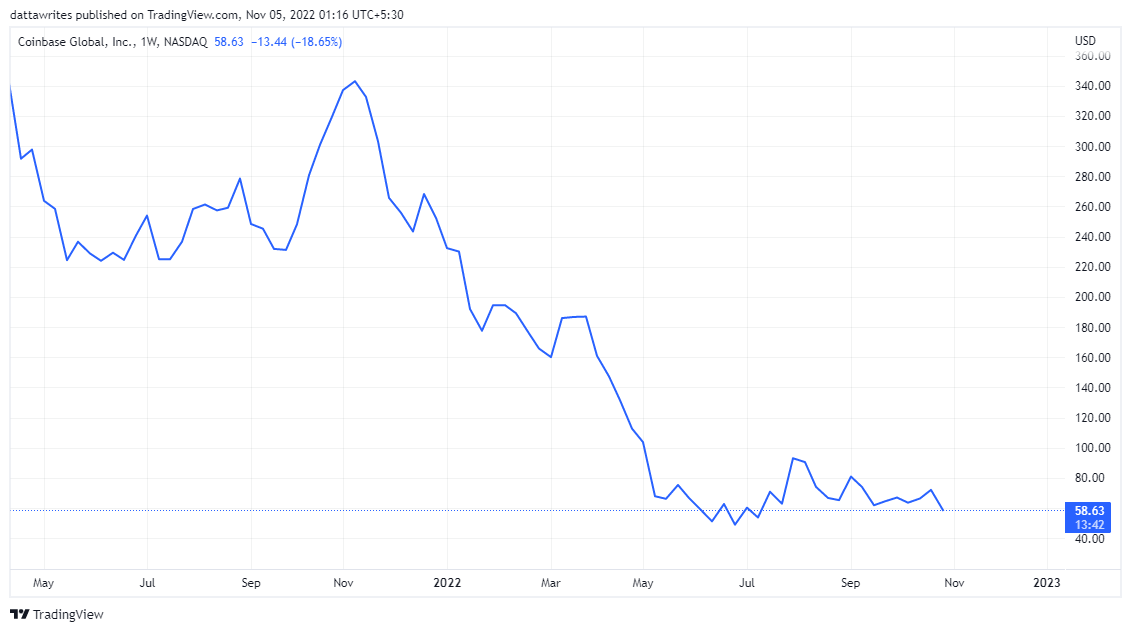

Additionally, Coinbase, the much-hyped crypto exchange, went public on NASDAQ on April 14. Its market cap climbed to $85.8 billion as the share price grew by 31% to $328.28 on its first day.

By the end of 2021, the crypto market began to fall along with the rest of the market. During September 2022, Bitcoin fell below the 20k mark, along with other altcoins and NFTs.

On 10 May 2022, Coinbase, with shares down nearly 80% from their peak, announced that people would lose their funds if they went bankrupt. In addition, firms like Celsius Network and SkyBridge Capital announced the halt of withdrawals and transfers.

Despite this, the COVID-19 bubble did have a massive impact on Bitcoin and Ethereum prices. Currently, even after Fed’s recent rate hikes, Bitcoin could be seen as a more stable bet than safer assets like Gold and NASDAQ.

One notable similarity between these two eras is rampant speculation. In the 2000s, intense speculation about dot-coms dominated global discussions. Now, there is growing speculation about Bitcoin, DeFi, meme coins, and NFTs.

Further, amid both the tech bubble and the COVID-19 bubble, VCs kept investing, showing confidence in the future of these industries.

Notably, the economic and financial environment obtained about 22 years ago differs from now. Then, the US was the undisputed global leader, and markets ran smoothly. Now, the global market is enduring rampant inflation, leaving the US struggling to retain its status.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC