This has been the year of mining difficulty and hash rate, as they kept increasing to record new all-time highs (ATH) despite the declining trend in Bitcoin (BTC) price, according to data analyzed by CryptoSlate.

Mining difficulty refers to miners’ chance of finding the required hash code to mine one block. Hash rate, on the other hand, measures the computational power required to find one hash code. Therefore, increasing the mining difficulty pushes the hash rate up and vice versa.

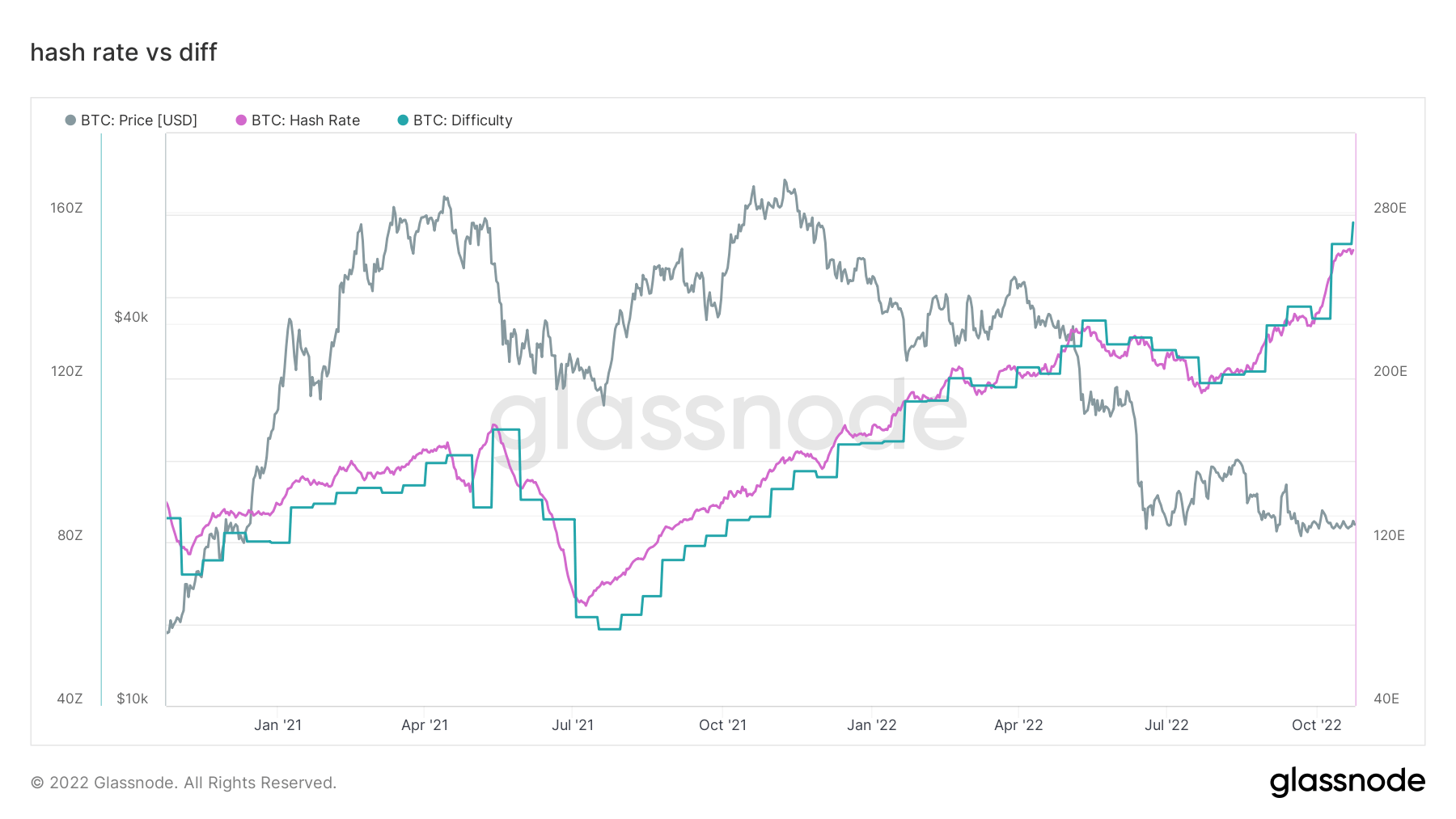

Hash rate and difficulty have increased exponentially since the year’s beginning. The chart above shows the hash rate with the pink line and the mining difficulty with the turquoise one.

This year’s first ATH in mining difficulty was recorded on Jan. 21, when it increased by 9.32 % and reached 26.64 trillion. Almost two weeks later, on Feb. 18, another spike in difficulty recorded a new ATH at 27.97 trillion. Despite falling Bitcoin prices and the tumbling market, the hash rate and mining difficulty continued its increase at the same pace, recording a new ATH almost every few weeks until May 2022.

For a short period between May and September, both the hash rate and difficulty fell. However, they remained above the year’s first ATH level at 26.64 trillion. In September, an upwards surge in both indicators started again when the mining hash rate increased by 60% in 24 hours. It continued to increase and recorded new ATH levels on Oct. 3 ct. 5. This increase was followed by a 13.5% surge in mining difficulty on Oct. 10.

The final increase of the year was recorded on Oct. 24, when Bitcoin mining difficulty increased another 3.4% and recorded a new ATH at 36.84 trillion. The hash rate is holding at 260 EH/s at the time of writing and is yet to respond to the soaring mining difficulty.

Reasons behind the hash rate increase

There is no one reason behind the increase in the hash rate. Essentially, the hash rate increases as a result of an increase in the number of miners, a couple of reasons can be listed when explaining the exponential growth of the number of miners.

One of the reasons could be because of the Ethereum (ETH) merge, which took place at the end of September. With the merge, the Ethereum network switched its Proof-of-Work system to a Proof-of-Stake one, which left Ethereum miners out of work. Most Ethereum miners likely switched to Bitcoin mining, which could have recorded a significant increase in the number of Bitcoin miners.

During the 2021 bull run, the majority of the Bitcoin miners have ordered new mining rigs to expand their businesses, which are being shipped now. As more and more mining rigs reach their destinations, more are being plugged in and start mining, which increases the number of miners in the network.

In addition, due to the bear market prices, mining equipment older than 2019 lost profitability once Bitcoin fell below the $22,600 limit. The industry realized the problem and rolled its sleeves to develop better mining rigs with more efficient chips. To compensate for the loss, a new generation of mining equipment is being sold at affordable prices, which also pushes the number of miners higher, resulting in the hash rate spiking even more.

These facts are just a few of the many factors that cause the spike in hash rates. Since these factors are more like trends than one-time events that increase the number of miners, there is no way of knowing if they’ll increase the number of miners enough to cause another spike in the hash rates.

Consequences of the high hash rate

Increasing hash rate and mining difficulty make Bitcoin mining more competitive, which puts immense pressure on all miners. Especially inefficient ones could not handle the increasing rates left the network.

During 2021, a trend of going public emerged amongst miners to collect easy funding. Most of them expanded their operations at the time with the funding they collected. However, after the bear market started in May, most of their share prices fell by 80%. This fall was accompanied by a lot of talk about possible insolvencies.

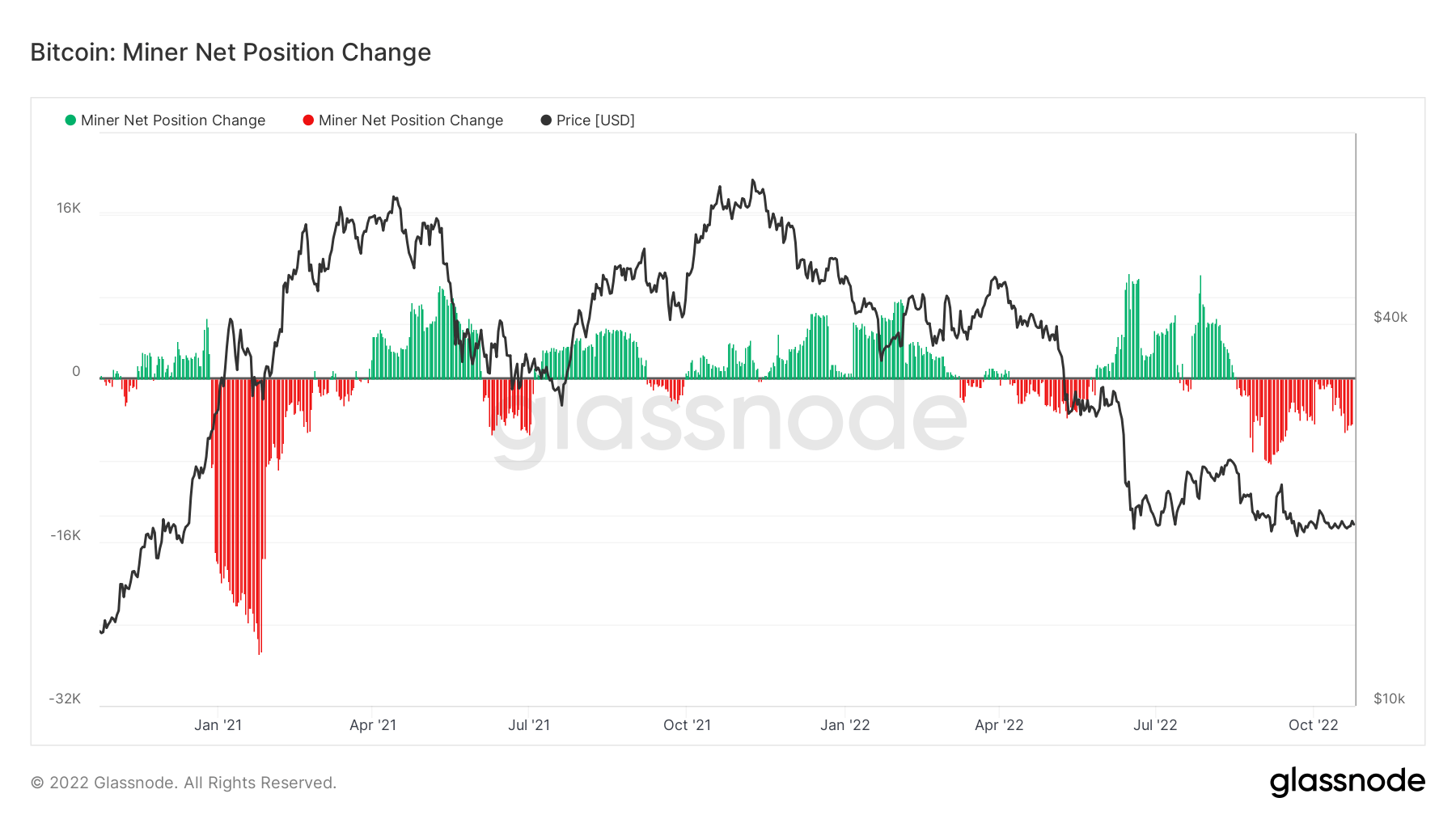

The Miner Net Position Change data also indicates that miners have been selling at the most aggressive rates of the past two years since September. The Miner Net Position Change demonstrates the 30-day rate of change in Bitcoin miners’ unspent supply. The red areas in the below chart indicate miner sellouts, while the green ones show token accumulation in miners’ accounts.

Excluding the January 2021 bull market, miners have been selling at the highest rates since 2021. Miners tend to hold and wait until the price recovers before selling. However, the current rate of sellouts occurs out of miners’ need for funding to keep their operations going.

A study from June revealed that public mining companies sold over 30% of the Bitcoin reserves only during the first four months of 2022. Compass Mining and Core Scientific are only two examples of mining companies that were in trouble. Core Scientific had to sell out 79% of its Bitcoin reserves to pay its debts, while Compass Mining had to shut down one of its mining facilities, unable to pay the electricity bill.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Hedera

Hedera  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  Polkadot

Polkadot  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Uniswap

Uniswap  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Official Trump

Official Trump  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Ondo

Ondo  MANTRA

MANTRA  Aave

Aave  Monero

Monero  Aptos

Aptos  Internet Computer

Internet Computer  WhiteBIT Coin

WhiteBIT Coin  Ethereum Classic

Ethereum Classic  Bittensor

Bittensor  Mantle

Mantle  Cronos

Cronos  Dai

Dai  POL (ex-MATIC)

POL (ex-MATIC)  OKB

OKB