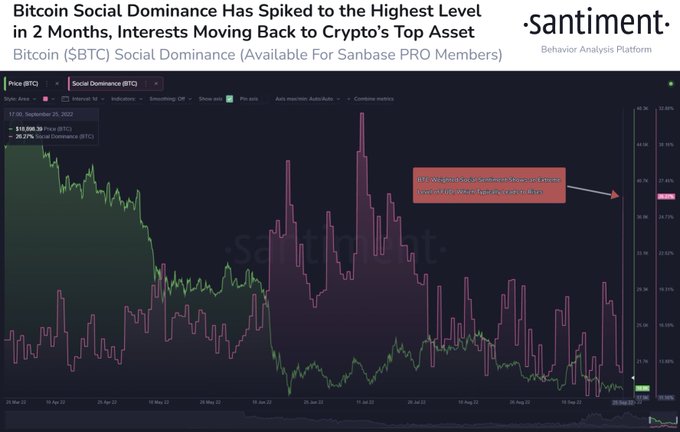

Interest in Bitcoin (BTC) spiked on social platforms over the weekend, leading to its social dominance surging, according to Santiment.

The crypto insight provider explained:

“A spike in Bitcoin interest on social platforms came this weekend. Among crypto’s top 100 assets, BTC is the topic in 26%+ of discussions for the first time since mid-July. Our back testing shows 20%+ dedicated to Bitcoin is a positive for the sector.”

Source: SantimentTherefore, the renewed Bitcoin interest is happening amid the top cryptocurrency trading below the psychological price of $20,000. BTC was hovering around $19,038 during intraday trading, according to CoinMarketCap.

Furthermore, Bitcoin has been trading much below its all-time high (ATH) of $69,000 set in November last year. The bearish momentum spread over the year in 2022, one of the factors triggered by like interest rate hikes from the Federal Reserve (Fed).

Interest rate surges usually have bearish impacts on high-risk assets like Bitcoin. For instance, Bitcoin (BTC) sank to $18.5K on September 19 based on global monetary tightening concerns, Blockchain.News reported.

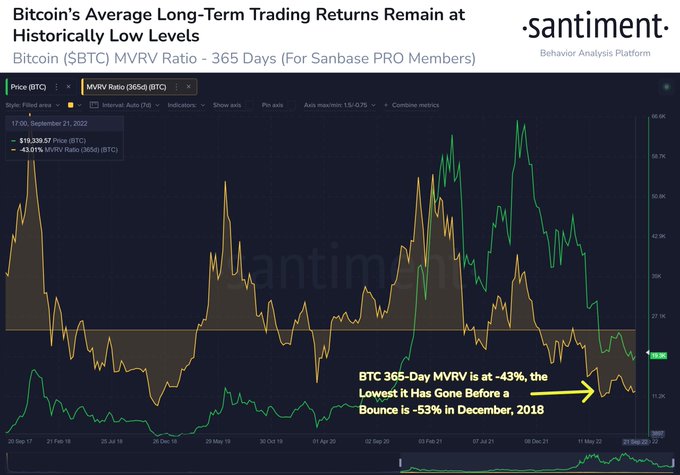

On the other hand, BTC’s average long-term trading returns continue trending at historic low levels. Santiment pointed out:

“Bitcoin remains -72% from its November, 2021 all-time-high. With such a market cap drop, active traders that have transacted over the past year are down an average of -43%. Historically, MVRV hasn’t dropped much further than this before a rebound.”

Source: SantimentFurthermore, key Bitcoin whale addresses have depleted their holdings to levels last seen in April 2020.

Santiment acknowledged:

“The amount of Bitcoin held by whales has been dropping for 11 months now. As fears of inflation and a world recession continue, addresses holding 100 to 10k BTC have lowered their percentage of supply held of crypto’s top asset to 29-month lows.”

With the number of non-zero BTC addresses reaching a monthly high, it remains to be seen how the leading cryptocurrency plays out in the short term as more participants continue entering the market.

Image source: Shutterstock

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  dogwifhat

dogwifhat  Monero

Monero  Stacks

Stacks  OKB

OKB  Filecoin

Filecoin