Gas fees refer to the cost of conducting a transaction or executing a contract. For example, this could take the form of exchanging into a stablecoin or minting an NFT.

Since the summer of 2020, Ethereum gas fees took off primarily due to the explosion of DeFi use on the chain. Although network activity has tailed off significantly since May 2021, the adage of Ethereum being an expensive chain to use still prevails.

Ethereum gas fees are priced in gwei, which is a unit of measure equivalent to one billionth of one ETH. The exact gas cost depends on the network’s congestion at the time of transacting, with peak periods requiring higher gas fees to push through the transaction.

The current average gas price is $13.28, down significantly from the May 1 local top, when a transaction cost $474.57 on average.

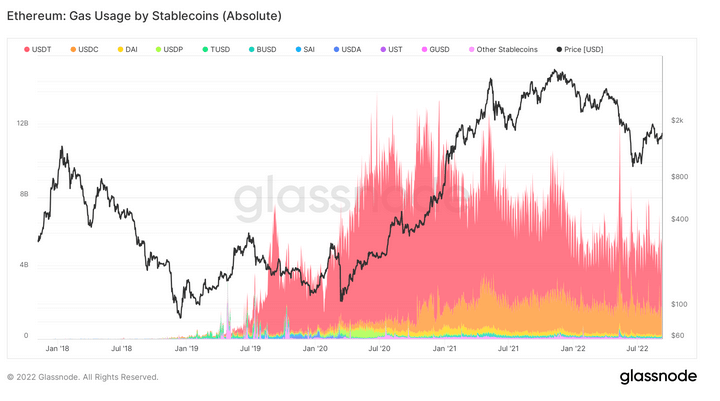

Stablecoin usage

Stablecoins are cryptocurrencies designed to minimize price volatility by keeping a fixed value, regardless of the price of Ethereum.

The market offers various types of stablecoins, such as asset-backed, including fiat, crypto, or precious metal assets, and algorithmic, which add to or subtract from circulating token supply to peg the price at the desired level.

The chart below accounts for over 150 stablecoins, but the most prominent are USDT, USDC, UST, BUSD, and DAI. USDT is the biggest stablecoin by volume and market cap, but in recent times, USDC has closed the gap.

Save for sporadic spikes, USDT’s gas usage has been trending downward since July 2020. Current usage is equivalent to approximate levels seen in January 2020.

USDC’s gas usage follows a slightly different pattern by raising to peak in April 21, again, except for isolated spikes higher since then, the overall trend has been downwards from that point.

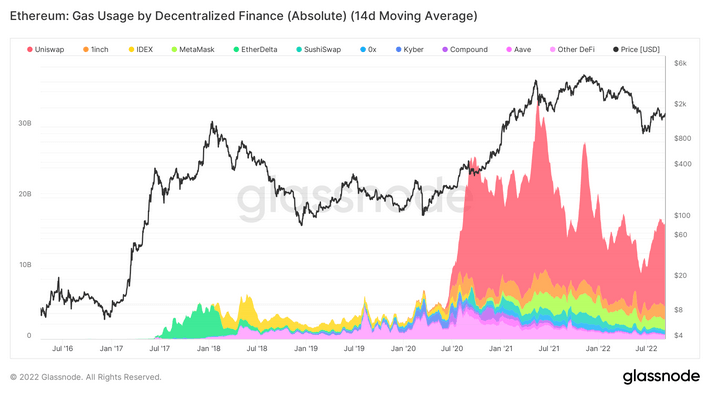

DeFi usage

Decentralized finance (DeFi) is an emerging technology that cuts out banks and financial institutions, linking users directly with financial products, which typically include lending, trading, and borrowing.

Using peer-to-peer financial networks instead of going through a middleman, users have greater control over their funds and more privacy, as DeFi protocols tend not to require KYC information.

DeFi gas usage was relatively low until the summer of 2020. From July 2020, Uniswap emerged as the leading DeFi gas user, peaking around June 2021 before tapering downwards.

Other significant gas-guzzling DeFi protocols include 1inch, IDEX, and MetaMask, which have all followed similar movements to Uniswap. Since around April 2021, MetaMask increased its gas usage, managing to maintain its proportion over time.

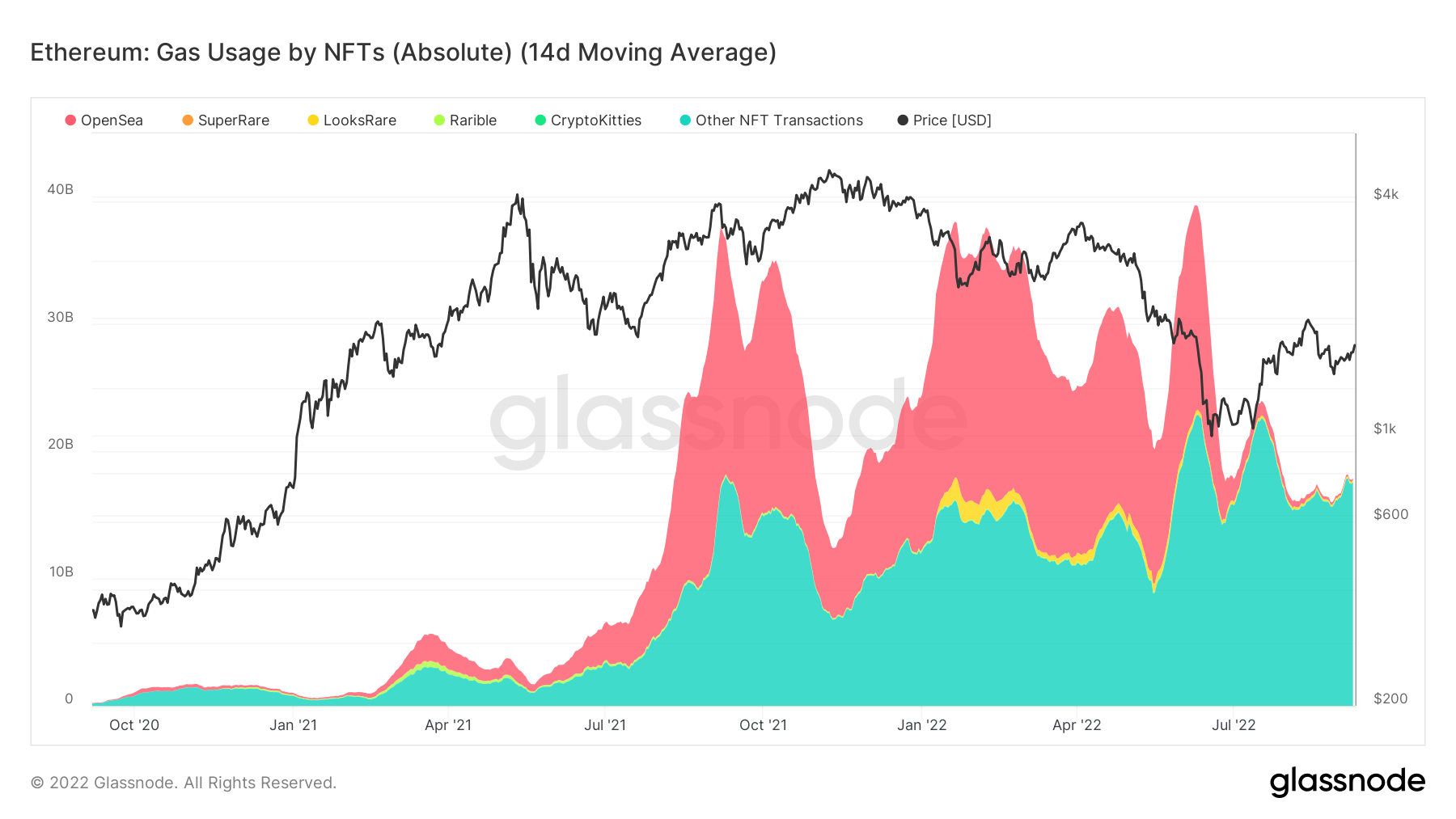

Non-fungible usage

This category includes both ERC721 and ERC1151 token standards and the gas usage from NFT marketplaces OpenSea, LooksRare, Rarible, and SuperRare.

During the 2021 bull run, OpenSea saw the biggest spikes in gas usage from NFT demand. However, from June 2022, demand has cooled significantly yet remains somewhat elevated compared to previous years.

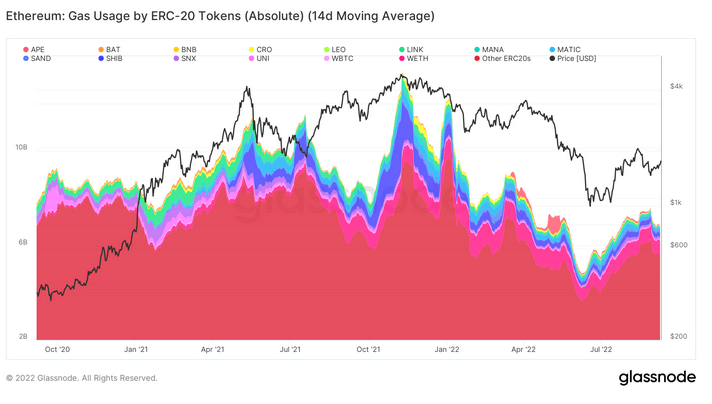

ERC-20 usage

ERC-20 is the technical standard used for all smart contracts on the Ethereum chain for fungible token executions. The chart below excludes gas usage from stablecoin contracts.

The overall gas consumed by ERC-20 contracts peaked around November 2021, leading to a downtrend that bottomed in June 2022. Since then, ERC-20 gas usage has reverted, bucking the macro trend of the previous three categories.

There are no stand-out ERC-20 contracts that consistently topped gas usage.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Shiba Inu

Shiba Inu  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Render

Render  Bonk

Bonk  Ethena USDe

Ethena USDe  Bittensor

Bittensor  WhiteBIT Coin

WhiteBIT Coin  POL (ex-MATIC)

POL (ex-MATIC)  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  dogwifhat

dogwifhat  Arbitrum

Arbitrum  MANTRA

MANTRA  Monero

Monero  Stacks

Stacks  OKB

OKB  Filecoin

Filecoin