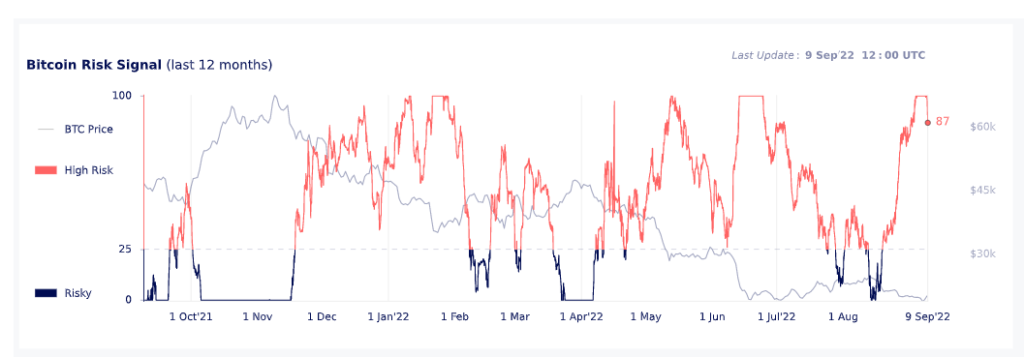

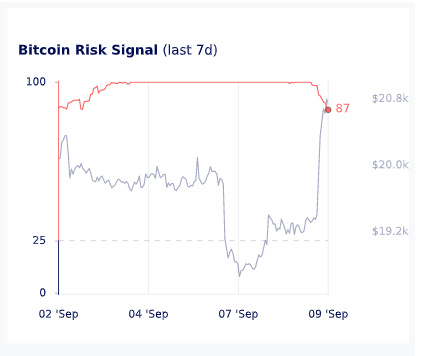

Bitcoin has rallied back to retest the $21,000 resistance but the Bitcoin Risk Signal, provided by Glassnode and Swissblock technologies, hit a yearly high on Sept. 5 and is still at 87 out of 100 following today’s pump.

The Bitcoin risk signal gauges the amount of risk of a significant drawdown in Bitcoin price. The score varies between 0 and 100. Between 0 and 25 is a risky environment and above 25 is a high-risk environment. A reading of 0 indicates a shallow relative risk of a significant drawdown.

Historically, Bitcoin has led the market in terms of price direction and relative safety. However, throughout the weeks leading up to the Merge, Ethereum has taken control of the market with the industry following the price of ETH.

Over the past seven days, Bitcoin has been at 100 on the Bitcoin Risk Signal, suggesting high risk and further downside. Bitcoin did, however, fall 7.5% on September 6 while the signal was at its highest. Yet, while the score is well above the safety zone of 25, the chart suggests traders act cautiously.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Chainlink

Chainlink  Polkadot

Polkadot  Stellar

Stellar  Pepe

Pepe  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Render

Render  Bittensor

Bittensor  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  dogwifhat

dogwifhat  Arbitrum

Arbitrum  Monero

Monero  Stacks

Stacks  Filecoin

Filecoin  OKB

OKB