Bitcoin, the world’s largest cryptocurrency by market cap, tumbled below the $45,000 price level this morning, leading to a market-wide price carnage as a result.

Data further shows over $328 million worth of crypto positions were ‘liquidated’ this morning, with over 87,000 individual trading accounts affected. The market, however, seemed to temporarily stabilize at press time, putting a stop to what was the second sudden drop in as many weeks in the crypto market.

Come and gone

‘Liquidations,’ for the uninitiated, occur when leveraged positions are automatically closed out by exchanges/brokerages as a “safety mechanism.” Futures and margin traders—who borrow capital from exchanges (usually in multiples) to place bigger bets—put up a small collateral amount before placing a trade.

In traderspeak, ‘longs’ occur when investors are betting on prices of a certain asset to rise, while ‘shorts’ occur when they are betting against that asset.

Bitcoin ‘longs’ took a bulk of those liquidations this morning, data from analytics tool Bybt shows. $93 million worth of Bitcoin futures positions were liquidated, with $62 million—65% of all traders—of those being longs.

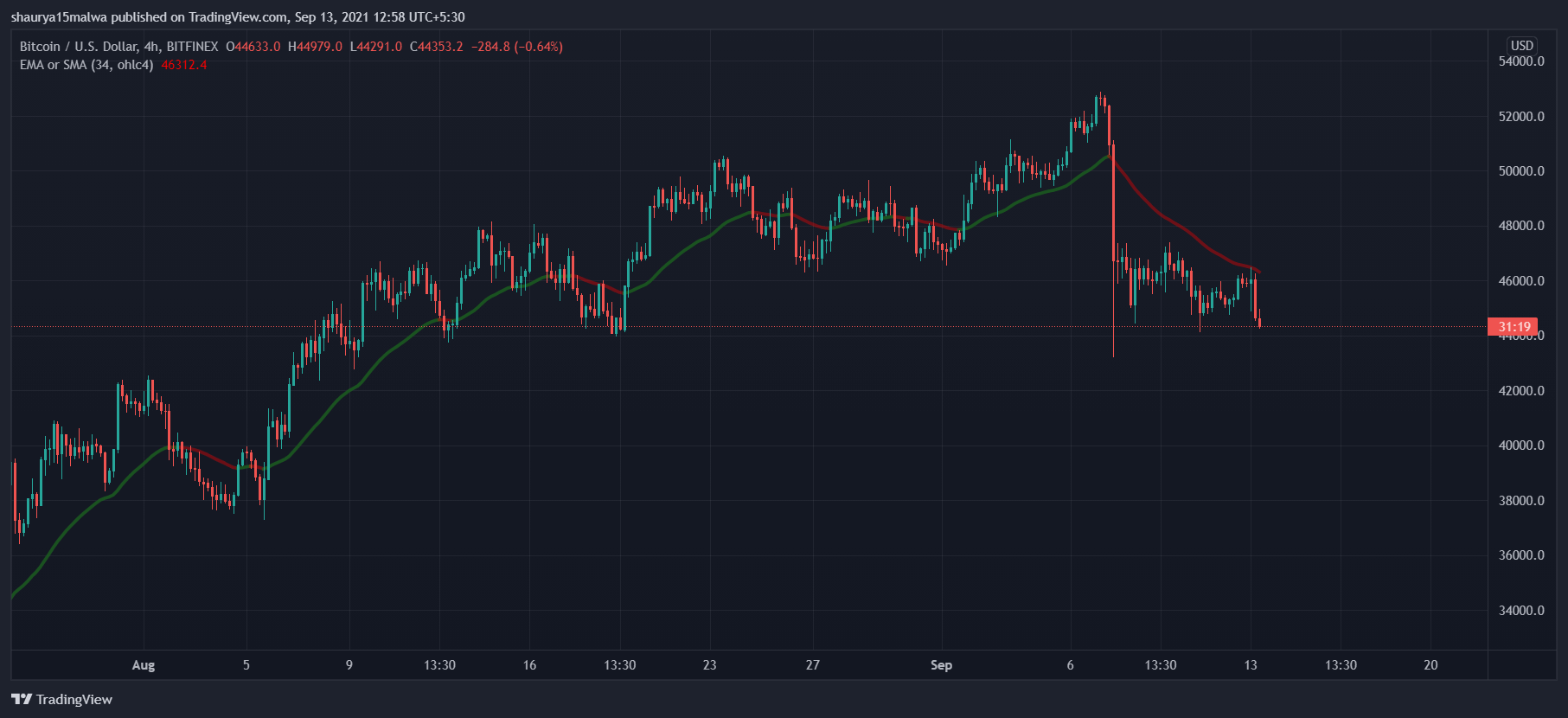

The overall trend seems to have slightly shifted as well. As the below image shows, Bitcoin broke below its $46,800 support to reach its current $44,200 support level. It has lost 13% of its value in the past week alone, and has the next ‘support’ level at $40,000 should prices fall further downward.

In terms of other cryptocurrencies, next in line with liquidations was Ethereum—with over $47 million worth of liquidations on ETH longs, accounting for $70 million in all. Solana, Cardano, Polkadot, and XRP followed ETH, with $26 million, $22 million, $12 million, and $10 million worth of liquidations respectively.

As such, Bybit took a bulk of all liquidations with $103 million, followed by Binance at $97 million, OKEx at $69 million, and FTX at $49 million.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Like what you see? Subscribe for updates.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Render

Render  Bonk

Bonk  Bittensor

Bittensor  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  dogwifhat

dogwifhat  Arbitrum

Arbitrum  MANTRA

MANTRA  Monero

Monero  Stacks

Stacks  OKB

OKB  Filecoin

Filecoin